- Japan

- /

- Trade Distributors

- /

- TSE:8053

Sumitomo (TSE:8053): Evaluating Whether Recent Gains Signal Undervaluation or Full Pricing

Reviewed by Simply Wall St

See our latest analysis for Sumitomo.

Sumitomo's momentum has picked up with a 17.25% share price gain over the past 90 days and a year-to-date return of 37.11%. Looking longer term, total shareholder returns have been outstanding, reaching 46.54% over one year and a remarkable 367.2% over five years. This consistency signals that investors see both robust performance and lasting growth potential.

If Sumitomo’s steady climb has you rethinking your portfolio, now is a great time to discover fast growing stocks with high insider ownership

Yet with Sumitomo trading just below analyst price targets and recent gains piling up, the key question emerges: Is the stock still undervalued, or are markets already pricing in all the future growth?

Price-to-Earnings of 9.3x: Is it justified?

Sumitomo’s current share price of ¥4,718 looks attractive given its modest price-to-earnings (P/E) ratio of 9.3x, which stands out among industry peers and relative to typical benchmarks for robustly profitable companies.

The P/E ratio shows how much investors are willing to pay for each yen of earnings. A lower P/E can often suggest that the market is not fully pricing in future earnings growth or that investors are being cautious despite strong performance.

In Sumitomo's case, the 9.3x ratio is not only cheaper than the peer average (13x) but also trails the Japanese Trade Distributors industry average of 10.1x. Additionally, compared to what regression analyses suggest is a fair P/E ratio (19.9x), Sumitomo is trading at a noticeable discount. This provides a level the market could move toward if confidence in continued earnings delivery rises.

Explore the SWS fair ratio for Sumitomo

Result: Price-to-Earnings of 9.3x (UNDERVALUED)

However, slower annual revenue growth and only marginal net income gains could challenge Sumitomo’s momentum if these trends persist in the coming quarters.

Find out about the key risks to this Sumitomo narrative.

Another View: Discounted Cash Flow Model

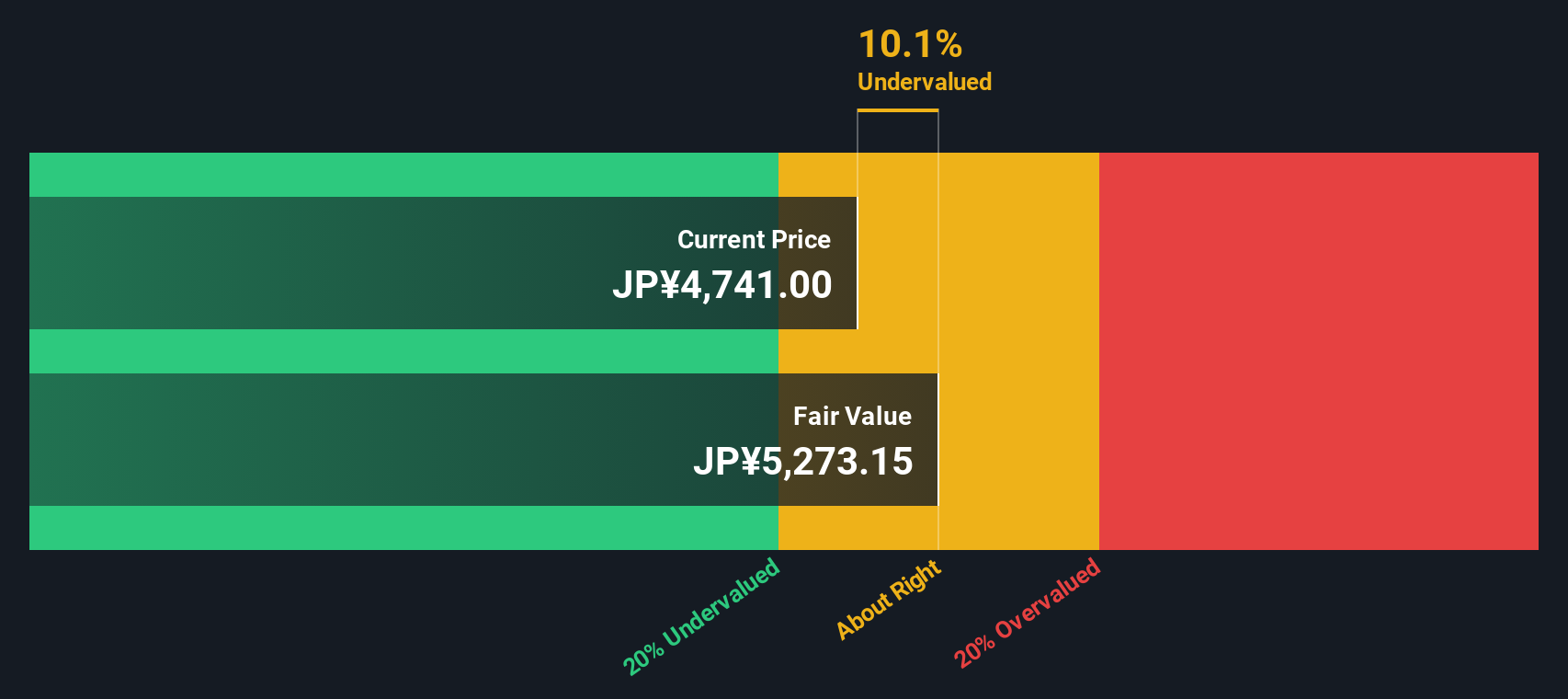

The SWS DCF model offers another lens on Sumitomo's current price. Based on the model, the stock trades at a significant 10.5% discount to its estimated fair value. This points to deeper undervaluation than suggested by price-to-earnings. Could the market be overlooking something, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sumitomo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sumitomo Narrative

If our analysis doesn’t match your personal outlook, or you’d rather dig into the numbers yourself, you can start building your own perspective in just a few minutes. So why not Do it your way.

A great starting point for your Sumitomo research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to uncover powerful trends and fresh opportunities that could give your portfolio the edge it needs for the months ahead.

- Unlock the potential of emerging technologies by checking out these 25 AI penny stocks, which are making waves in artificial intelligence across global markets.

- Start earning smarter by scouting these 16 dividend stocks with yields > 3% that pay generous yields and help grow your passive income.

- Capitalize on value by targeting these 876 undervalued stocks based on cash flows that are positioned to rebound as the market recognizes their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8053

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives