- Japan

- /

- Trade Distributors

- /

- TSE:8007

Top Three Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes approaching record highs and broad-based gains across sectors, investors are navigating a landscape of geopolitical tensions and economic uncertainties. In this environment, dividend stocks can offer potential stability and income, making them an attractive consideration for those looking to balance growth opportunities with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.25% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.57% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.32% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.81% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.37% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.83% | ★★★★★★ |

Click here to see the full list of 1943 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

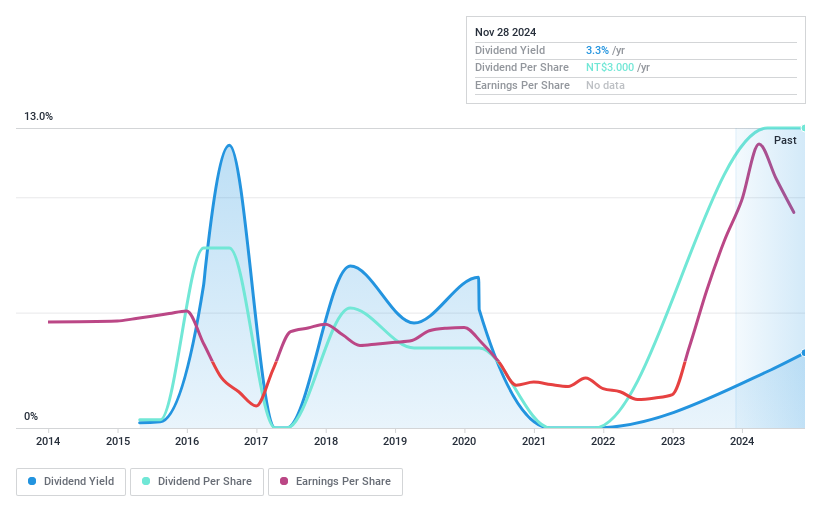

Richmond International Travel & ToursLtd (TPEX:2743)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Richmond International Travel & Tours Co., Ltd is a travel agency operating in Taiwan with a market cap of NT$3.39 billion.

Operations: Richmond International Travel & Tours Co., Ltd generates its revenue through its operations as a travel agency in Taiwan.

Dividend Yield: 3.2%

Richmond International Travel & Tours Ltd. has demonstrated a volatile dividend history over the past decade, though recent payments have increased. The company's dividends are well-covered by both earnings and cash flows, with a payout ratio of 33.6% and cash payout ratio of 19.3%. Despite trading below estimated fair value, its dividend yield of 3.18% lags behind top-tier payers in Taiwan's market. Recent earnings show growth but declining profit margins may impact future payouts.

- Dive into the specifics of Richmond International Travel & ToursLtd here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Richmond International Travel & ToursLtd is priced lower than what may be justified by its financials.

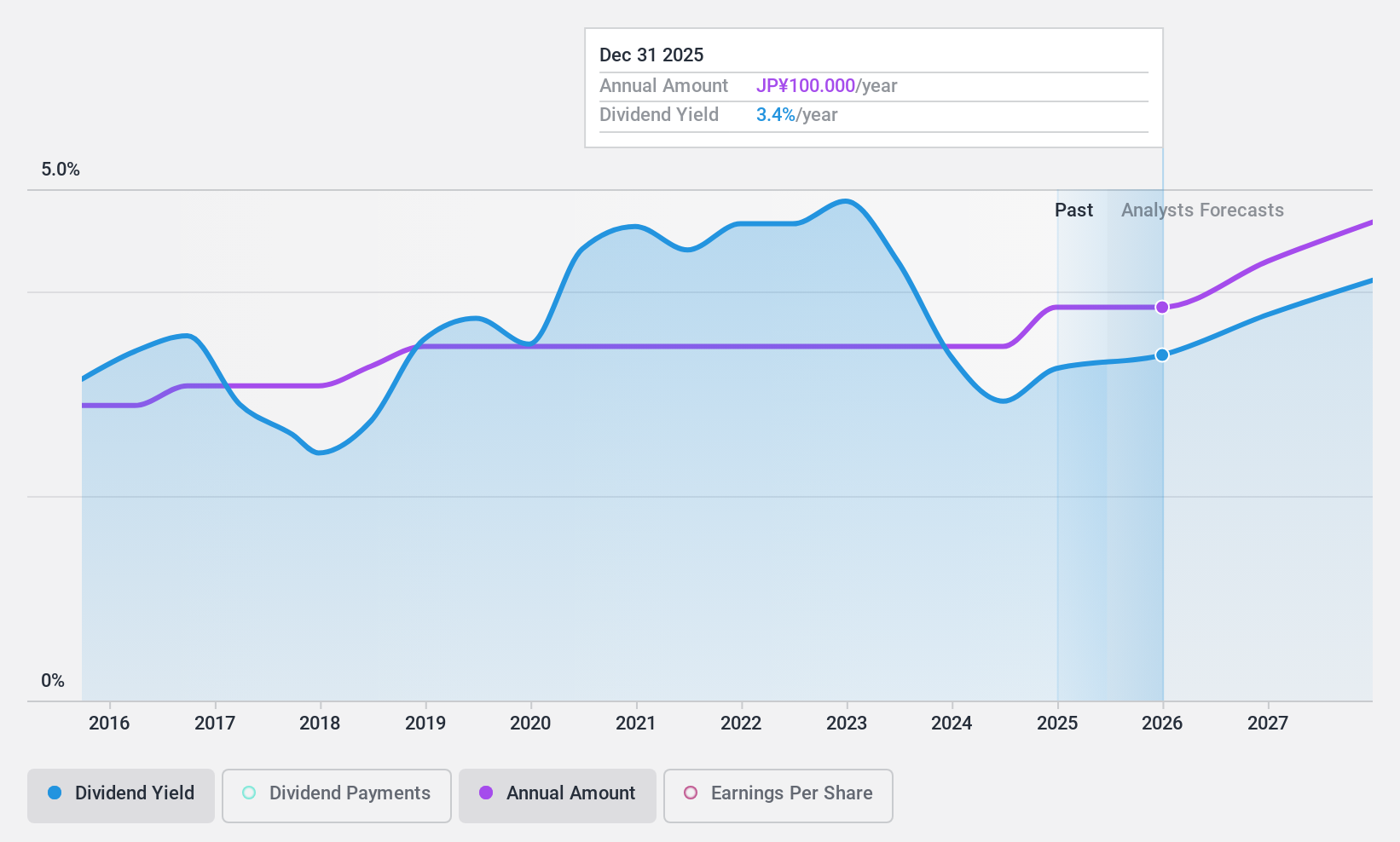

artience (TSE:4634)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Artience Co., Ltd. operates in the colorants and functional materials, polymers and coatings, printing and information, and packaging materials sectors across Japan, China, Europe, Africa, Asia, the Americas, and internationally with a market cap of ¥164.50 billion.

Operations: Artience Co., Ltd.'s revenue is derived from its Packaging Materials Related Business (¥89.02 billion), Polymers and Coatings Related Business (¥85.51 billion), Printing and Information Related Business (¥82.75 billion), and Colorants and Functional Materials Related Business (¥85.52 billion).

Dividend Yield: 3.2%

Artience Co., Ltd. offers a stable and reliable dividend, with payments growing consistently over the past 10 years. The dividend yield of 3.18% is well-covered by earnings (payout ratio: 33.2%) and cash flows (cash payout ratio: 42.1%), though it falls short compared to top-tier payers in Japan's market. Despite recent share price volatility, the stock trades at good value relative to peers, with strong earnings growth reported last year and positive guidance for fiscal year-end 2024.

- Unlock comprehensive insights into our analysis of artience stock in this dividend report.

- According our valuation report, there's an indication that artience's share price might be on the cheaper side.

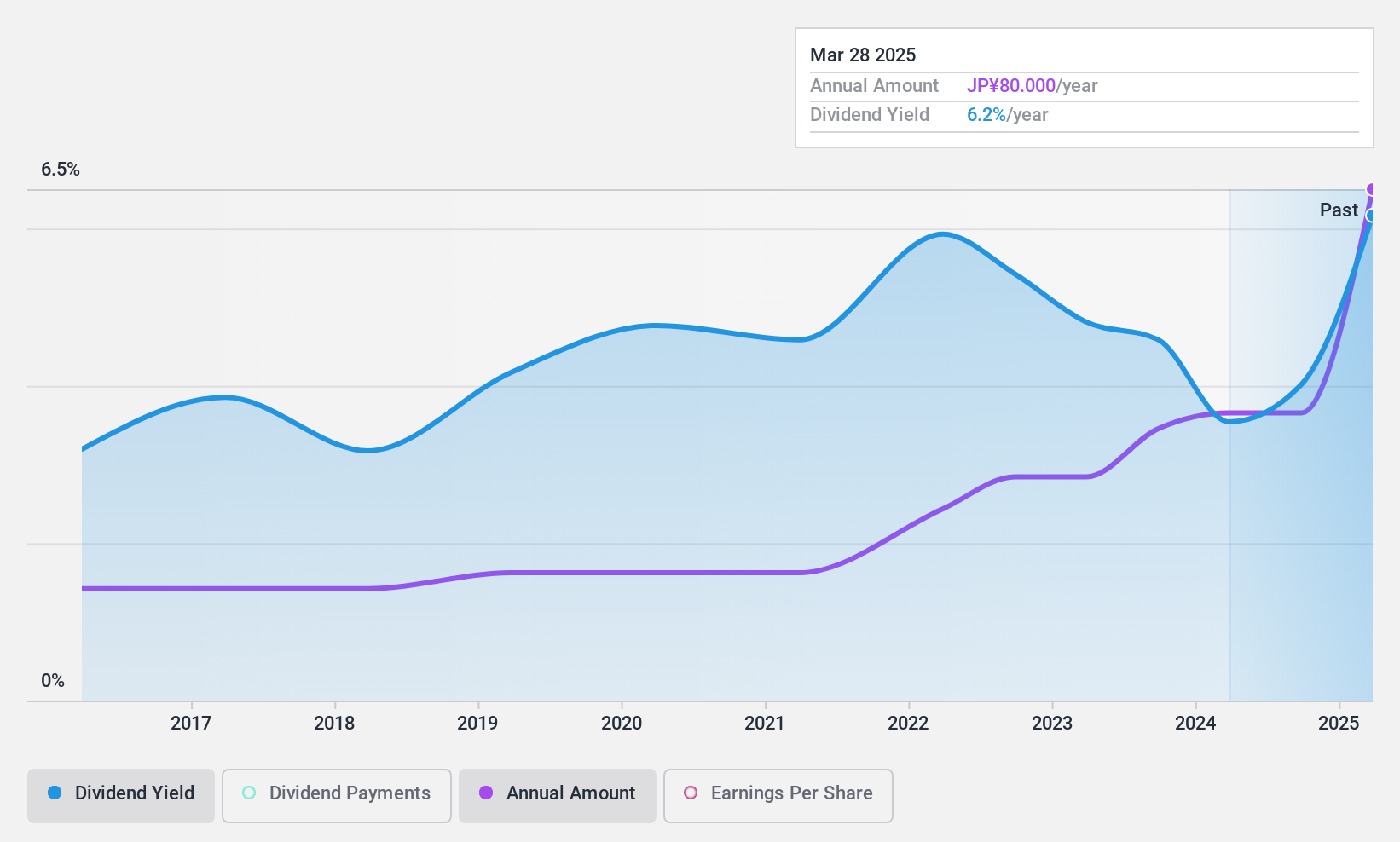

Takashima (TSE:8007)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Takashima & Co., Ltd. operates in Japan through its subsidiaries, focusing on the design, proposal, process, material sale, and distribution of construction and building products with a market cap of approximately ¥20.91 billion.

Operations: Takashima & Co., Ltd.'s revenue is derived from its activities in the design, proposal, processing, material sale, and distribution of construction and building products within Japan.

Dividend Yield: 6.6%

Takashima & Co., Ltd. offers a high dividend yield, ranking in the top 25% of Japanese payers, though its track record is unstable with recent decreases. The payout ratio is low at 9.5%, indicating dividends are well-covered by earnings and cash flows (cash payout ratio: 32.5%). Despite volatile past payments, dividends have grown over the last decade. Recent guidance projects net sales of ¥94 billion and operating profit of ¥2 billion for fiscal year-end March 2025.

- Delve into the full analysis dividend report here for a deeper understanding of Takashima.

- Our valuation report here indicates Takashima may be undervalued.

Next Steps

- Click here to access our complete index of 1943 Top Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takashima might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8007

Takashima

Engages in the design, proposal, process, material sale, and distribution of construction and building products in Japan.

Flawless balance sheet established dividend payer.