- Japan

- /

- Medical Equipment

- /

- TSE:7979

Discovering Three Undiscovered Gems In Japan With Solid Potential

Reviewed by Simply Wall St

Japan's stock markets have recently experienced significant volatility, driven by a rebounding yen and concerns over global growth. However, dovish comments from the Bank of Japan have helped stabilize the situation, providing an opportunity for investors to explore lesser-known opportunities in this dynamic market. In such an environment, identifying stocks with solid fundamentals and growth potential becomes crucial. Here are three undiscovered gems in Japan that stand out due to their resilience and promising outlooks.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nihon Parkerizing | 0.31% | 0.86% | 4.40% | ★★★★★★ |

| Soliton Systems K.K | 0.61% | 5.36% | 20.91% | ★★★★★★ |

| Totech | 16.86% | 5.13% | 11.52% | ★★★★★★ |

| Techno Smart | NA | 5.05% | -2.17% | ★★★★★★ |

| Imuraya Group | 17.62% | 1.55% | 27.83% | ★★★★★★ |

| Kondotec | 12.01% | 6.76% | 0.32% | ★★★★★☆ |

| Nikko | 32.39% | 4.11% | -8.57% | ★★★★★☆ |

| Dear LifeLtd | 93.05% | 20.12% | 18.05% | ★★★★★☆ |

| Kappa Create | 74.42% | -0.45% | 3.62% | ★★★★★☆ |

| GakkyushaLtd | 23.64% | 5.03% | 18.56% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

K&O Energy Group (TSE:1663)

Simply Wall St Value Rating: ★★★★★★

Overview: K&O Energy Group Inc. engages in the development, production, supply, and sale of natural gas and iodine in Japan with a market cap of ¥91.12 billion.

Operations: K&O Energy Group generates revenue primarily from the sale of natural gas and iodine in Japan. The company has a market capitalization of ¥91.12 billion.

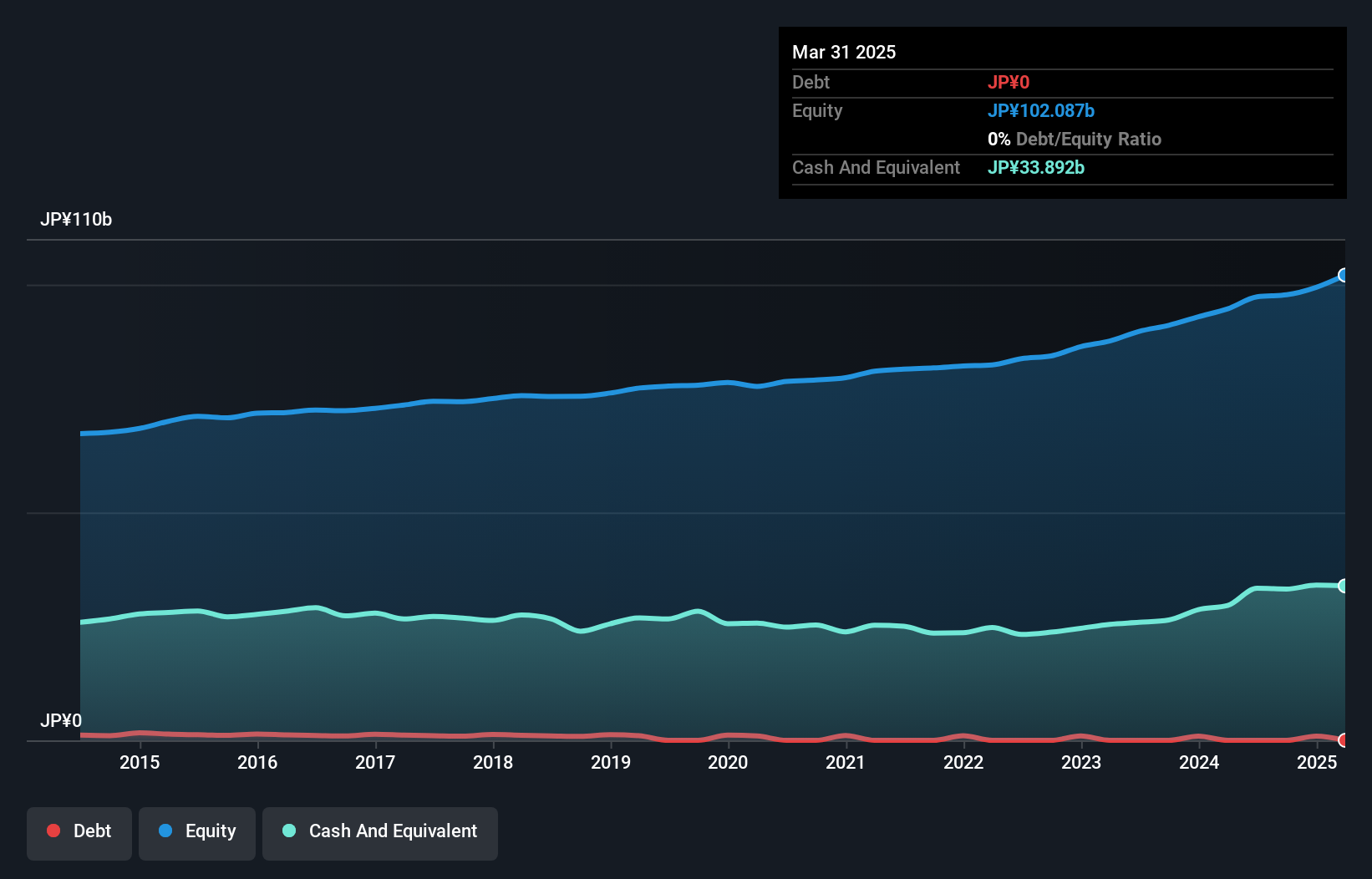

K&O Energy Group has demonstrated impressive earnings growth of 26.3% over the past year, significantly outpacing the Gas Utilities industry's -29%. The company operates debt-free, a notable improvement from its debt to equity ratio of 1.3% five years ago. Trading at 35.6% below its estimated fair value, K&O Energy seems undervalued with high-quality earnings reported consistently. However, earnings are forecasted to decline by an average of 10.5% annually over the next three years.

- Dive into the specifics of K&O Energy Group here with our thorough health report.

Examine K&O Energy Group's past performance report to understand how it has performed in the past.

Kyokuto Kaihatsu KogyoLtd (TSE:7226)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kyokuto Kaihatsu Kogyo Co., Ltd. manufactures and sells special purpose vehicles, environmental equipment and systems, and car parking systems in Japan with a market cap of ¥97.64 billion.

Operations: Kyokuto Kaihatsu Kogyo generates revenue primarily from the sale of special purpose vehicles, environmental equipment and systems, and car parking systems. The company's financial performance is influenced by its cost structure and operational efficiency.

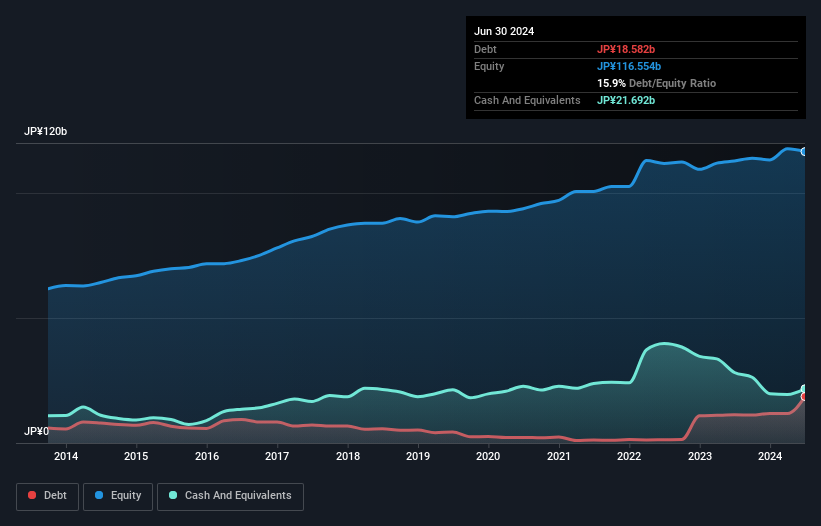

Kyokuto Kaihatsu Kogyo has shown promising earnings growth of 13.5% over the past year, outpacing the broader Machinery industry at 13.2%. However, its debt to equity ratio has risen from 4.9% to 15.9% in five years, indicating increased leverage. Despite this, the company remains profitable and doesn't face issues with interest coverage or cash runway concerns. Notably, earnings have decreased by an average of 3.9% annually over five years while maintaining high-quality earnings standards.

- Get an in-depth perspective on Kyokuto Kaihatsu KogyoLtd's performance by reading our health report here.

Gain insights into Kyokuto Kaihatsu KogyoLtd's past trends and performance with our Past report.

Shofu (TSE:7979)

Simply Wall St Value Rating: ★★★★★★

Overview: Shofu Inc. manufactures and sells dental materials and equipment worldwide, with a market cap of ¥83.91 billion.

Operations: Shofu generates revenue primarily from its Dental Related Business, which contributes ¥33.85 billion, and Nail-Related segment, adding ¥2.34 billion. The company also has a minor contribution of ¥93 million from other business activities.

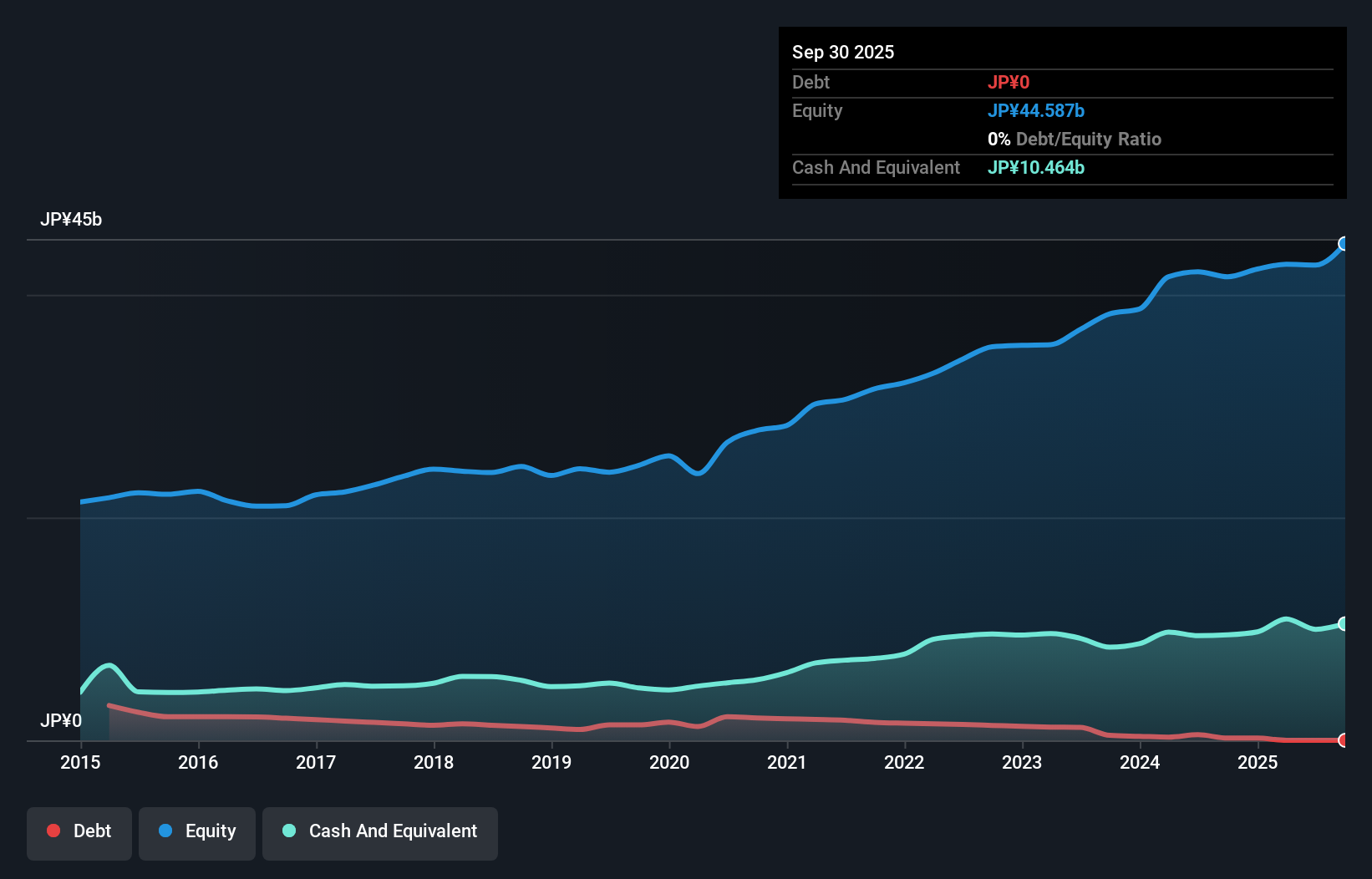

Shofu's recent performance highlights its potential as an undiscovered gem in Japan. Over the past year, earnings grew by 52.7%, significantly outpacing the Medical Equipment industry’s 3.2%. The company's debt to equity ratio has improved from 5.8% to 1.2% over five years, indicating better financial health. Additionally, Shofu revised its earnings guidance upwards for fiscal year ending March 2025, projecting net sales of ¥38.39 billion and operating income of ¥5.29 billion.

- Click here to discover the nuances of Shofu with our detailed analytical health report.

Understand Shofu's track record by examining our Past report.

Next Steps

- Delve into our full catalog of 718 Japanese Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7979

Flawless balance sheet with solid track record.