A Look at Hino Motors (TSE:7205) Valuation After Upgraded Profit Outlook and Leadership Change

Reviewed by Simply Wall St

Hino Motors (TSE:7205) just revised its full-year earnings guidance, signaling much higher operating income and profit for 2026. The company also named Daimler executive Satyakam Arya as its next President.

See our latest analysis for Hino Motors.

Hino Motors shares have responded strongly to the news, climbing with a 13% seven-day share price return. This hints at renewed optimism after the company’s upgraded profit guidance and the leadership shakeup. However, after a tough stretch, the year-to-date share price return remains down more than 25%, and five-year total shareholder return is still deep in negative territory. This reflects lingering challenges despite the recent momentum.

If you want to see what else is stirring in the auto space, now's a great time to discover See the full list for free.

But with shares still well below their five-year highs and new leadership in place, the big question for investors is whether Hino Motors is trading at a bargain now or if future growth is already reflected in the current price.

Price-to-Earnings of 9.6x: Is it justified?

Hino Motors currently trades at a price-to-earnings (P/E) ratio of just 9.6x, which makes the shares look attractively priced relative to market expectations and the last close of ¥408.

The P/E ratio measures how much investors are willing to pay today for a yen of earnings. It is a quick gauge of whether the market sees upside or risk in a company’s profit outlook. For an established manufacturer like Hino, a low P/E can mean two things: opportunity if the market is too pessimistic, or a warning sign of ongoing challenges.

Compared to the broader Japanese Machinery industry average of 13.2x, and a peer average of 12.8x, Hino’s earnings multiple is meaningfully lower. More telling is that the estimated “fair” P/E for the stock, based on historical and projected growth, is 23.2x. That is well above the current level and suggests significant market skepticism remains embedded in the price. The company may have room to close this gap if new leadership can deliver improved profitability.

Explore the SWS fair ratio for Hino Motors

Result: Price-to-Earnings of 9.6x (UNDERVALUED)

However, continued weak long-term returns and lingering skepticism about profitability remain real risks that could weigh on Hino's recovery story.

Find out about the key risks to this Hino Motors narrative.

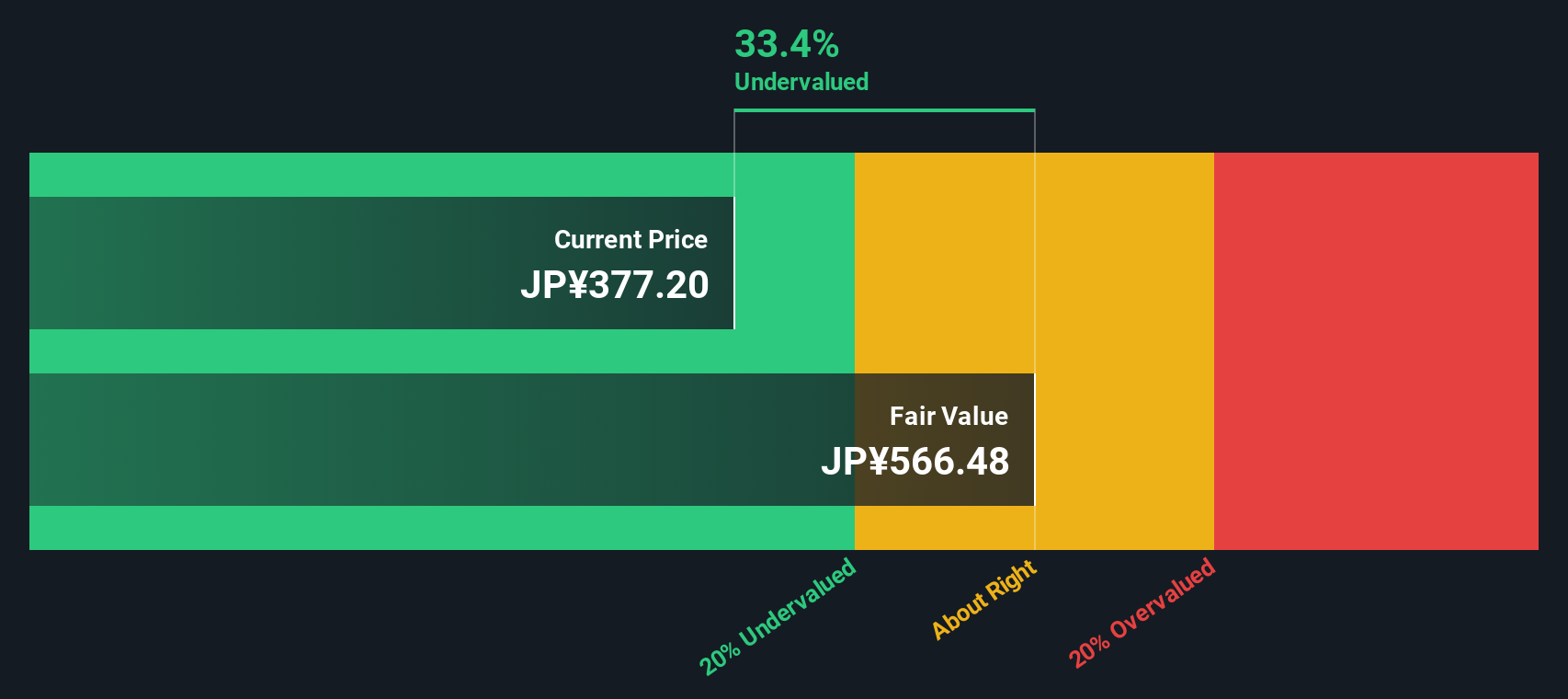

Another View: Discounted Cash Flow Perspective

Taking a different approach, the SWS DCF model suggests that Hino Motors is trading at a 28.5% discount to its estimated fair value. The calculated fair price is ¥570.27 compared to the current ¥408 share price. This method points to even greater undervaluation than what the earnings ratio alone implies. Is this deeper discount a sign of a genuine value opportunity, or is the market pricing in risks not captured by the models?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hino Motors for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 863 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hino Motors Narrative

If you want to look at the numbers from your own perspective or dig deeper into the story, building your own take takes less than three minutes. Do it your way

A great starting point for your Hino Motors research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Don’t let your next big winner pass you by. Simply Wall Street’s powerful screener can help you spot unique opportunities others might overlook.

- Secure your portfolio with steady income by checking out these 16 dividend stocks with yields > 3% offering yields above 3% and strong financial fundamentals.

- Catch early movers reshaping tomorrow’s economy when you browse these 24 AI penny stocks driving advances in artificial intelligence and automation.

- Position yourself ahead of Wall Street by reviewing these 863 undervalued stocks based on cash flows that the market may have missed, all based on solid cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hino Motors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7205

Hino Motors

Manufactures and sells commercial vehicles under the Hino brand worldwide.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives