- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7609

3 Top Japanese Dividend Stocks Yielding 3.5%

Reviewed by Simply Wall St

Japan’s stock markets have recently shown strong performance, with the Nikkei 225 Index rising 5.6% and the broader TOPIX Index up 3.7%, driven by optimism surrounding China’s stimulus announcements and dovish commentary from the Bank of Japan. This positive market environment provides a favorable backdrop for investors seeking reliable dividend stocks. In this context, identifying top Japanese dividend stocks yielding around 3.5% can be an attractive strategy for those looking to benefit from stable income streams amid a robust market outlook.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Globeride (TSE:7990) | 4.29% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.15% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.74% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.95% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.79% | ★★★★★★ |

| Kondotec (TSE:7438) | 3.74% | ★★★★★★ |

| Innotech (TSE:9880) | 4.81% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.19% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.44% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.43% | ★★★★★★ |

Click here to see the full list of 435 stocks from our Top Japanese Dividend Stocks screener.

We'll examine a selection from our screener results.

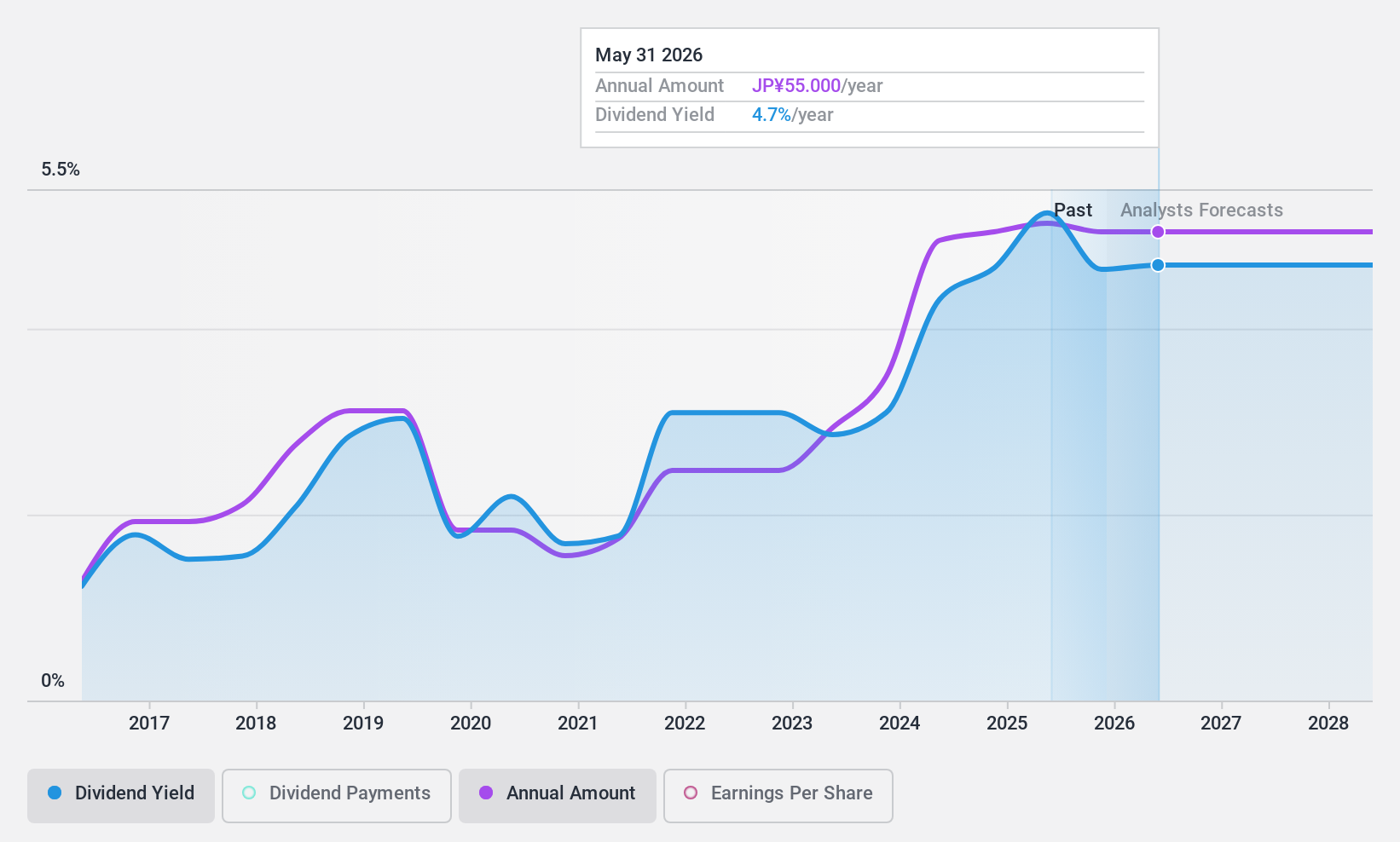

Cosel (TSE:6905)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cosel Co., Ltd. manufactures and sells electrical components and EMI filters in Japan and internationally, with a market cap of ¥48.82 billion.

Operations: Cosel Co., Ltd.'s revenue segments primarily include the manufacturing and sale of electrical components and EMI filters.

Dividend Yield: 4.5%

Cosel's dividend yield of 4.55% places it in the top 25% of dividend payers in Japan. Despite a volatile dividend history over the past decade, current payments are well-covered by earnings and cash flows with payout ratios of 48.7% and 51.4%, respectively. However, recent shareholder dilution from a ¥11.58 billion private placement may affect future stability and reliability of dividends despite an overall positive earnings growth forecast at 12.35% per year.

- Navigate through the intricacies of Cosel with our comprehensive dividend report here.

- Our expertly prepared valuation report Cosel implies its share price may be too high.

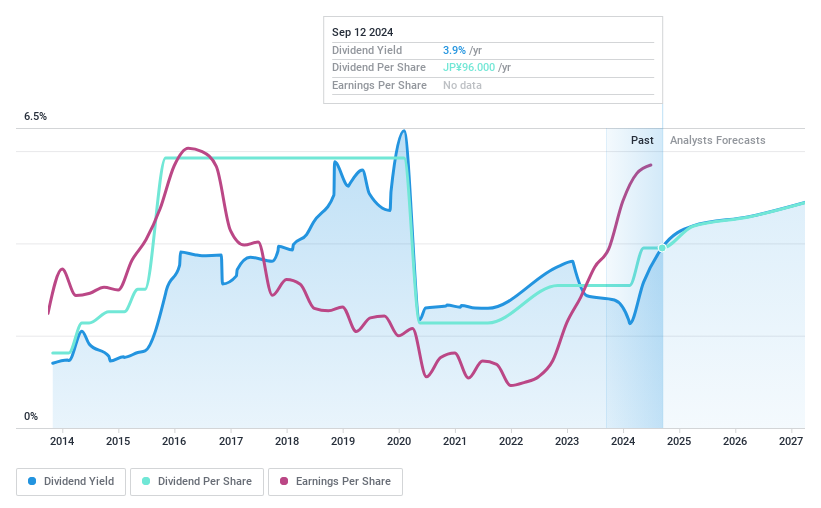

Subaru (TSE:7270)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Subaru Corporation manufactures and sells automobiles and aerospace products across Japan, Asia, North America, Europe, and other international markets with a market cap of ¥1.97 trillion.

Operations: Subaru Corporation's revenue segments include ¥4.60 billion from cars and ¥111.45 million from aerospace products.

Dividend Yield: 3.6%

Subaru's dividend payments have been volatile over the past decade, but they are well-covered by earnings and cash flows with low payout ratios of 16.4% and 18.6%, respectively. Recent buybacks totaling ¥59.99 billion for 2.79% of shares could support shareholder value, though earnings are forecast to decline by an average of 2.8% annually over the next three years. The company's recent strategic alliance with FPT Software aims to drive innovation and digital transformation efforts.

- Click here and access our complete dividend analysis report to understand the dynamics of Subaru.

- Our valuation report unveils the possibility Subaru's shares may be trading at a discount.

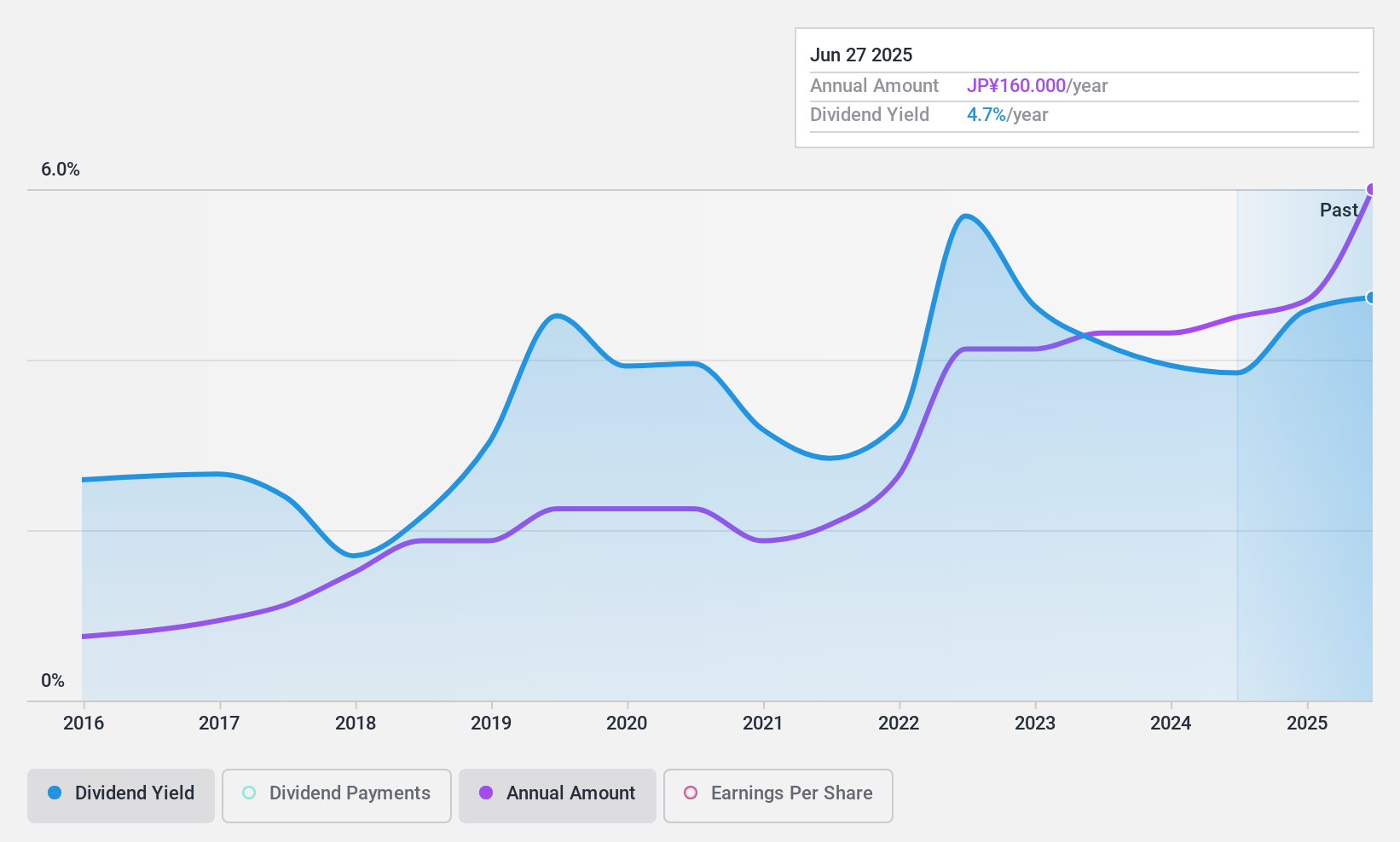

Daitron (TSE:7609)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Daitron Co., Ltd. is an electronic engineering trading company that imports, exports, and sells electronic components and assembly goods in Japan and internationally, with a market cap of ¥32.11 billion.

Operations: Daitron Co., Ltd. generates revenue from three main segments: Overseas Operation (¥20.24 billion), Domestic Sales Business (¥69.86 billion), and Domestic Manufacturing Business (¥11.25 billion).

Dividend Yield: 4.3%

Daitron's dividend yield of 4.32% ranks in the top 25% of Japanese dividend payers, with payments well-covered by earnings and cash flows, reflected in payout ratios of 39.2% and 20.7%, respectively. Despite this, the company's dividends have been volatile over the past decade, lacking reliability and stability. Trading at a significant discount to its estimated fair value suggests good relative value compared to peers and industry standards.

- Click here to discover the nuances of Daitron with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Daitron is trading behind its estimated value.

Key Takeaways

- Gain an insight into the universe of 435 Top Japanese Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7609

Daitron

An electronic engineering trading company, primarily imports, exports, and sells electronic components and assembly goods in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.