Is Daikin’s (TSE:6367) Lower Dividend a Sign of Shifting Priorities in Growth Strategy?

Reviewed by Sasha Jovanovic

- Daikin Industries Ltd. recently announced a revision of its full-year consolidated earnings guidance for the fiscal year ending March 31, 2026, projecting net sales of ¥4.84 trillion, operating profit of ¥435 billion, and earnings per share of ¥956.28, while also declaring a lower interim dividend of ¥165.00 per share for the second quarter compared to the prior year.

- This combination of updated financial projections and a reduced dividend payment can influence how shareholders evaluate the company’s approach to balancing growth ambitions with shareholder returns.

- With the reduced interim dividend as a key development, we’ll consider how these guidance changes impact Daikin Industries’ investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Daikin IndustriesLtd's Investment Narrative?

Being a Daikin Industries shareholder fundamentally rests on believing in the company's ability to sustain moderate, steady growth in a competitive global climate sector, while effectively managing profitability and shareholder rewards. The recent downward revision of the interim dividend and an upward adjustment to earnings guidance both sharpen focus on management’s balancing act: driving profit, investing in expansion, and delivering income to shareholders. While the upgraded forecasts suggest confidence in business fundamentals, the dividend cut introduces short term uncertainty for those prioritizing yield. Previously, the most important short term catalysts included continued margin improvement and stable profit growth, with risks clustered around cost pressures and execution in overseas markets. The announcement arguably shifts the spotlight to the company’s capital allocation discipline, though share price reactions in the days following suggest the overall impact may be less material than the headline numbers imply. However, short term shifts in dividend policy reveal more about changing risk appetite than about the company’s long term prospects.

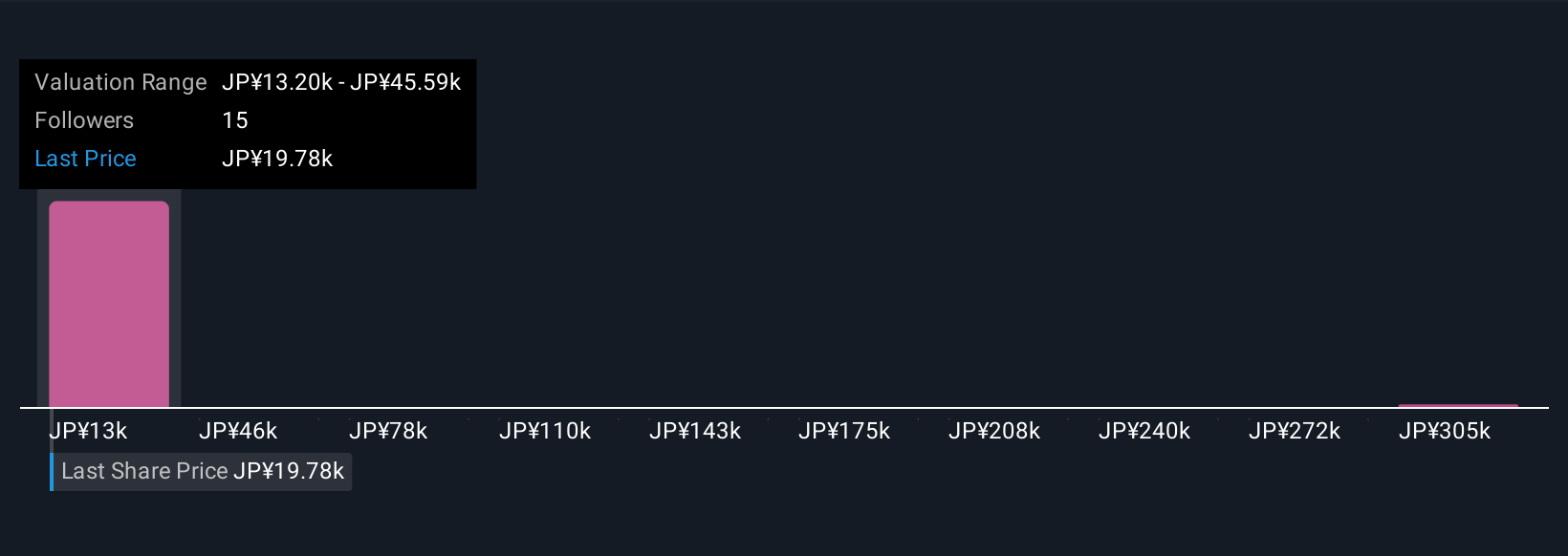

Daikin IndustriesLtd's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 6 other fair value estimates on Daikin IndustriesLtd - why the stock might be worth 33% less than the current price!

Build Your Own Daikin IndustriesLtd Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Daikin IndustriesLtd research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Daikin IndustriesLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Daikin IndustriesLtd's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6367

Daikin IndustriesLtd

Manufactures, distributes, and sells air-conditioning and refrigeration equipment, and chemical products in Japan, the Americas, China, Asia, Europe, Europe, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives