Daikin Industries (TSE:6367) Valuation in Focus After Revised 2026 Forecast and Dividend Cut

Reviewed by Simply Wall St

Daikin Industries Ltd (TSE:6367) drew investor focus after updating its consolidated earnings guidance for the year ending March 2026. The company also separately announced a lower interim dividend than the previous year. These developments could shift expectations around its near-term performance.

See our latest analysis for Daikin IndustriesLtd.

Following these updates, Daikin IndustriesLtd’s share price has rebounded briskly, notching a 12.8% gain over the past week and a 15.1% climb in the last month, suggesting renewed optimism despite a more cautious interim dividend. Still, its total shareholder return for the past year, at 10.5%, reflects a performance underpinned by recent momentum but tempered by weaker multi-year results.

If Daikin’s latest moves have you watching the broader industrials space, there’s a world of opportunity to discover. Check out See the full list for free. for more stocks making headlines.

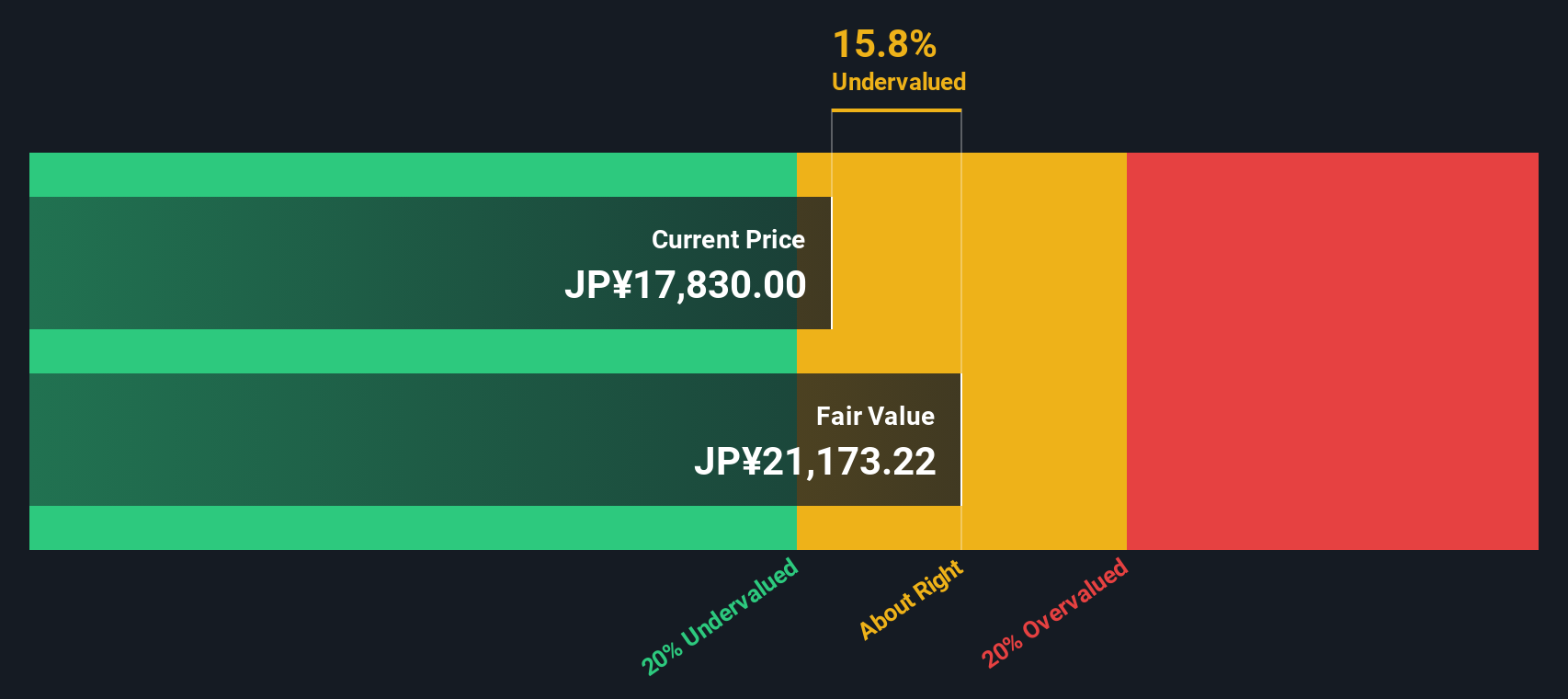

With Daikin Industries Ltd’s fundamentals and cautious dividend guidance now in sharper focus, the question is whether its recent rally signals untapped value or if the market has already priced in the company’s future growth prospects.

Price-to-Earnings of 21.6x: Is it justified?

Daikin Industries Ltd is trading at a price-to-earnings ratio of 21.6x, which puts its valuation in the spotlight compared to sector peers and its own growth profile.

The price-to-earnings ratio tells investors how much they are paying for each yen of the company’s earnings. It is one of the most closely watched multiples for capital goods companies. For Daikin, this ratio reflects the market's expectations for steady profit growth and shows how investors price in its future earnings potential.

Currently, Daikin’s 21.6x ratio is well above the JP Building industry average of 14.6x. This suggests the market values its prospects more highly than its typical competitor. However, when compared to its peer group’s average of 53.4x and its estimated fair price-to-earnings level of 23.9x, Daikin’s valuation appears reasonable and could serve as a benchmark if investor sentiment shifts toward fair value.

Explore the SWS fair ratio for Daikin IndustriesLtd

Result: Price-to-Earnings of 21.6x (ABOUT RIGHT)

However, slower revenue growth and past multi-year underperformance could limit further upside if sentiment turns or results disappoint in future quarters.

Find out about the key risks to this Daikin IndustriesLtd narrative.

Another View: What Does the SWS DCF Model Say?

While the market weighs Daikin’s earnings multiple, the SWS DCF model takes a different angle, estimating fair value at ¥20,711. At the current price of ¥20,190, Daikin trades about 2.5% below this level, which hints at modest undervaluation. But does this small gap reveal real opportunity, or is the market just about right?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Daikin IndustriesLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 858 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Daikin IndustriesLtd Narrative

If you see the story differently or prefer to dive into your own analysis, you can craft a personalized perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Daikin IndustriesLtd.

Looking for more investment ideas?

Level up your portfolio and stay ahead of the curve by checking out these dynamic opportunities below. Don’t wait until everyone else is already in.

- Capitalize on the next wave of artificial intelligence by reviewing these 25 AI penny stocks, which are poised to benefit as the technology transforms business and society.

- Boost your income stream and find stability with these 15 dividend stocks with yields > 3%, offering attractive yields and resilient fundamentals even when markets get volatile.

- Unearth value-priced companies with strong future potential by searching for these 858 undervalued stocks based on cash flows before the mainstream catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6367

Daikin IndustriesLtd

Manufactures, distributes, and sells air-conditioning and refrigeration equipment, and chemical products in Japan, the Americas, China, Asia, Europe, Europe, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives