Is Ebara’s (TSE:6361) Share Buyback a Sign of Strategic Optimism or Excess Capital?

Reviewed by Sasha Jovanovic

- Ebara Corporation announced that it repurchased 1,286,900 of its common shares, following Board approval to buy back up to 9,090,909 shares as part of a capital structure optimization plan.

- This move often signals management’s confidence in the company’s outlook and can lead to an increased focus on shareholder value.

- We'll explore how the share buyback announcement informs Ebara's investment narrative and highlights management’s perspective on capital allocation.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Ebara's Investment Narrative?

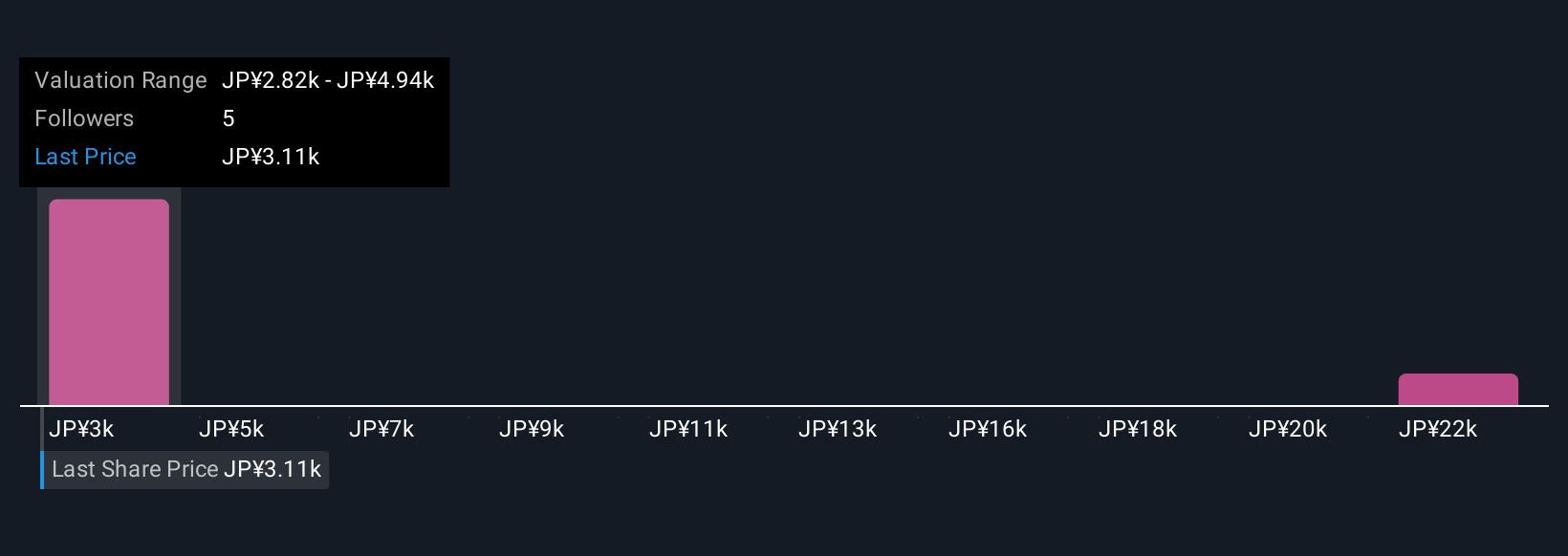

Being a shareholder in Ebara means believing in its ability to continually refine its financial structure while embracing sectors like semiconductors for long-term growth. The recent share repurchase could give a short-term psychological boost to the stock and does reinforce signals of management confidence, but it doesn’t eliminate more pressing near-term catalysts or risks. Ebara’s profit guidance was recently updated due to revenue declines in Building Service & Industrial Business and a shifting profit mix, and its dividends have also been lowered year-on-year. While participation in collaborations such as the JOINT3 consortium may support future relevance, the immediate impacts of the buyback program likely won’t materially change slower forecast revenue growth or concerns about valuation, given the price's premium to analyst targets and high earnings multiples. With a share price that’s recently outpaced both industry and market returns, continued volatility and pressure on profitability remain front of mind for investors. On the flip side, that steep valuation is something investors need to keep an eye on.

Ebara's shares are on the way up, but they could be overextended by 9%. Uncover the fair value now.Exploring Other Perspectives

Explore 3 other fair value estimates on Ebara - why the stock might be worth 15% less than the current price!

Build Your Own Ebara Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ebara research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ebara research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ebara's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ebara might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6361

Ebara

Manufactures and sells pumps, compressors, turbines, and chillers in Europe, the Middle East, Africa, Asia, Japan, Oceania, North America, and Central and South America.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives