Undiscovered Gems And 2 Other Small Caps With Potential On None

Reviewed by Simply Wall St

As global markets show resilience with major U.S. indexes approaching record highs, small-cap stocks have notably outperformed their larger counterparts, reflecting renewed investor interest in these often-overlooked segments. Amid this backdrop of broad-based gains and positive economic indicators such as low jobless claims and rising home sales, the search for undiscovered gems becomes particularly compelling as investors seek opportunities that align with current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| CTCI Advanced Systems | 30.56% | 24.10% | 29.97% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Jensen-Group (ENXTBR:JEN)

Simply Wall St Value Rating: ★★★★★★

Overview: Jensen-Group NV, along with its subsidiaries, specializes in designing, producing, and supplying single machines, systems, and turnkey solutions for the heavy-duty laundry industry with a market capitalization of €403.56 million.

Operations: Jensen-Group generates revenue primarily from the heavy-duty laundry segment, amounting to €420.74 million.

Jensen-Group, a smaller player in the machinery sector, has been making waves with its robust earnings growth of 48.8% over the past year, outpacing the industry average of 1.2%. The company appears well-positioned financially, with a net debt to equity ratio of just 1.2%, reflecting satisfactory leverage management. Furthermore, Jensen-Group trades at roughly 69% below its estimated fair value, suggesting potential undervaluation in the market. With revenue projected to grow by 7.45% annually and high-quality earnings reported consistently, this company seems poised for continued strength within its niche industry space.

- Click here and access our complete health analysis report to understand the dynamics of Jensen-Group.

Evaluate Jensen-Group's historical performance by accessing our past performance report.

Toyo Engineering (TSE:6330)

Simply Wall St Value Rating: ★★★★★☆

Overview: Toyo Engineering Corporation specializes in the engineering and construction of industrial facilities, with a market capitalization of ¥41.14 billion.

Operations: Toyo Engineering generates revenue primarily through its engineering and construction services for industrial facilities. The company focuses on optimizing cost structures to enhance profitability, reflected in its net profit margin trends.

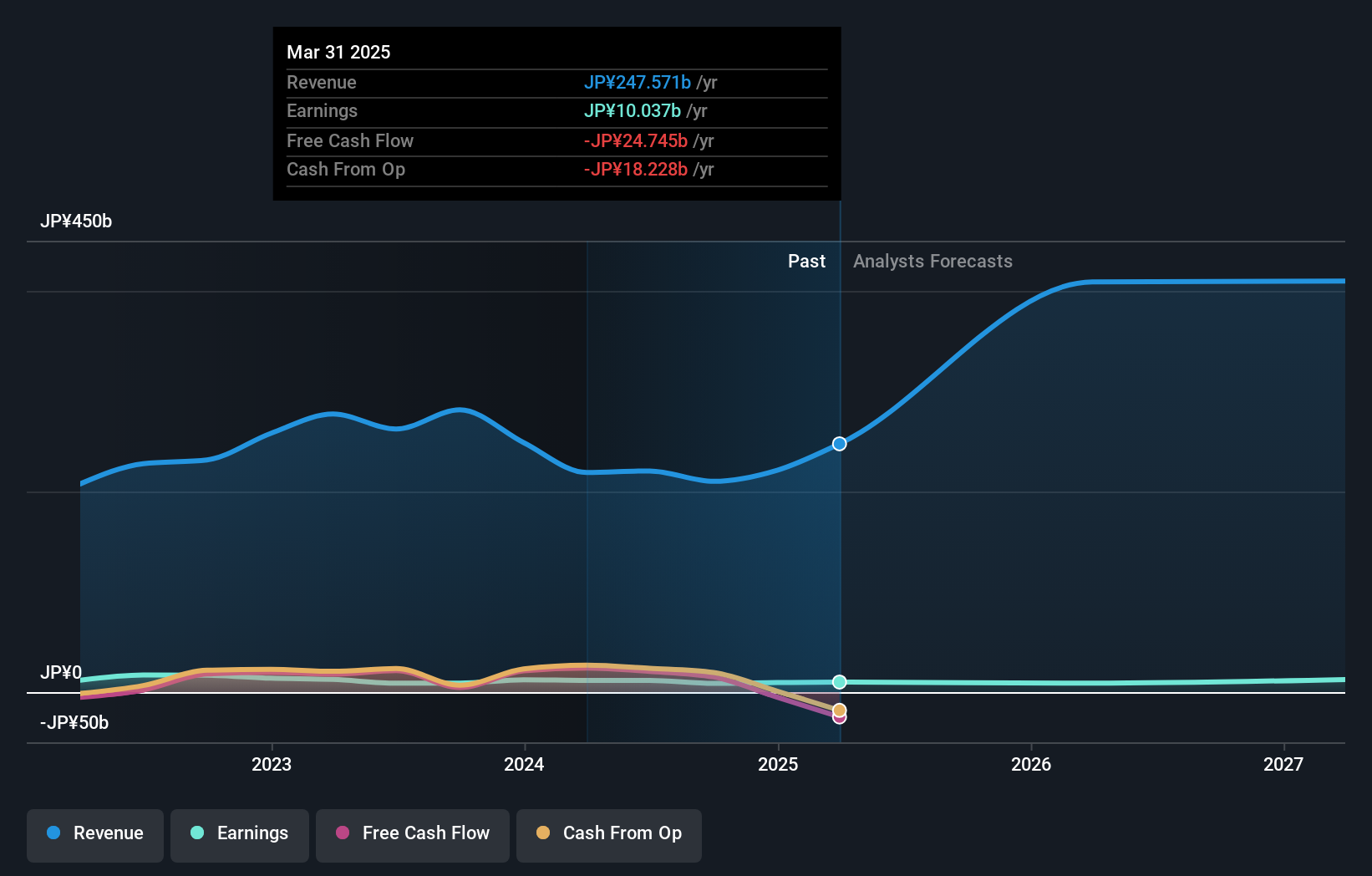

Toyo Engineering, a smaller player in the construction industry, has caught attention with its impressive earnings growth of 232% over the past year, outpacing the industry's 19%. Despite this surge, a ¥5.1 billion one-off gain significantly impacted recent financial results through September 2024. The company trades at nearly 31% below estimated fair value and boasts a reduced debt-to-equity ratio from 76.5% to 74.2% over five years. However, earnings are forecasted to decline by an average of 19% annually for the next three years, highlighting potential challenges ahead despite current profitability and sufficient interest coverage.

- Dive into the specifics of Toyo Engineering here with our thorough health report.

Examine Toyo Engineering's past performance report to understand how it has performed in the past.

Hosiden (TSE:6804)

Simply Wall St Value Rating: ★★★★★★

Overview: Hosiden Corporation develops, manufactures, and sells electronic components in Japan and internationally with a market cap of ¥118.08 billion.

Operations: The primary revenue streams for Hosiden are Mechanical Parts and Audio Parts, generating ¥174.75 billion and ¥21.72 billion respectively. Display Parts contribute a smaller portion with ¥2.61 billion in revenue, while Composite Parts add another ¥11.09 billion to the total income.

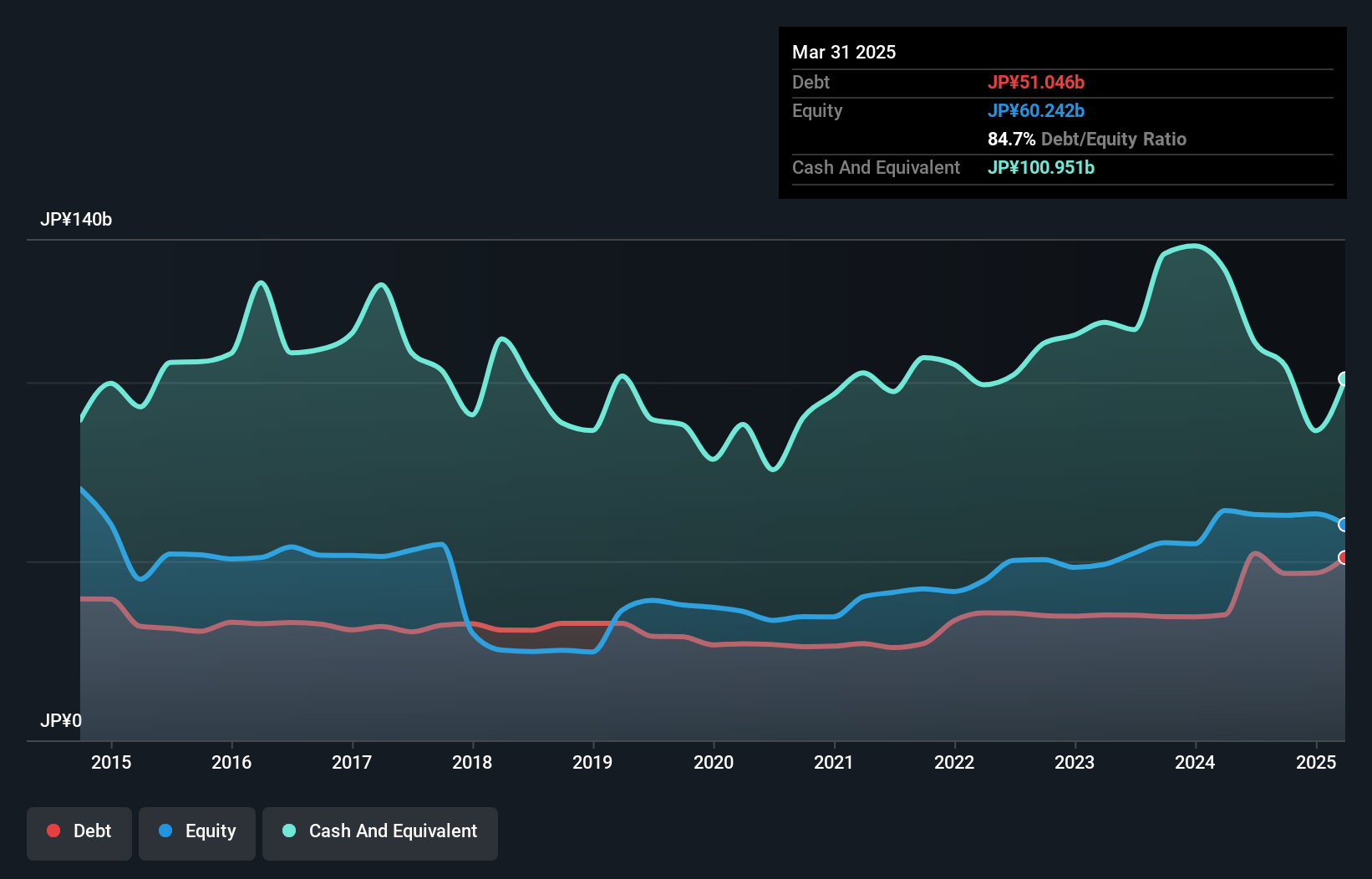

Hosiden, an intriguing player in the electronics sector, is trading at a significant discount of 55% below its estimated fair value. Despite a challenging year with earnings growth at -3%, it still surpasses industry averages. The company boasts high-quality past earnings and maintains profitability, ensuring no concerns about cash runway. Over five years, its debt-to-equity ratio impressively dropped from 13% to 0.8%, highlighting financial prudence. With more cash than total debt and interest payments well-covered by profits, Hosiden seems well-positioned for potential revenue growth forecasted at nearly 20% annually.

- Click here to discover the nuances of Hosiden with our detailed analytical health report.

Gain insights into Hosiden's past trends and performance with our Past report.

Where To Now?

- Investigate our full lineup of 4634 Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:JEN

Jensen-Group

Designs, produces, and supplies single machines, systems, and turnkey solutions for the heavy-duty laundry industry.

Flawless balance sheet with solid track record.