As global markets continue to experience a wave of gains, with major indices like the Dow Jones Industrial Average and S&P 500 reaching record highs, investors are keenly navigating the landscape influenced by domestic policy shifts and geopolitical developments. Amidst this backdrop, dividend stocks offering yields up to 5.4% present a compelling opportunity for those seeking income generation alongside potential capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.56% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.28% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.89% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.60% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.42% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.47% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.47% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.92% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.70% | ★★★★★☆ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Emirates Integrated Telecommunications Company PJSC (DFM:DU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emirates Integrated Telecommunications Company PJSC offers carrier, data hub, internet exchange facilities, and satellite services mainly in the United Arab Emirates with a market cap of AED34.22 billion.

Operations: Emirates Integrated Telecommunications Company PJSC's revenue is primarily derived from its Mobile segment at AED7.32 billion, followed by Fixed services at AED3.91 billion and Wholesale operations contributing AED1.83 billion.

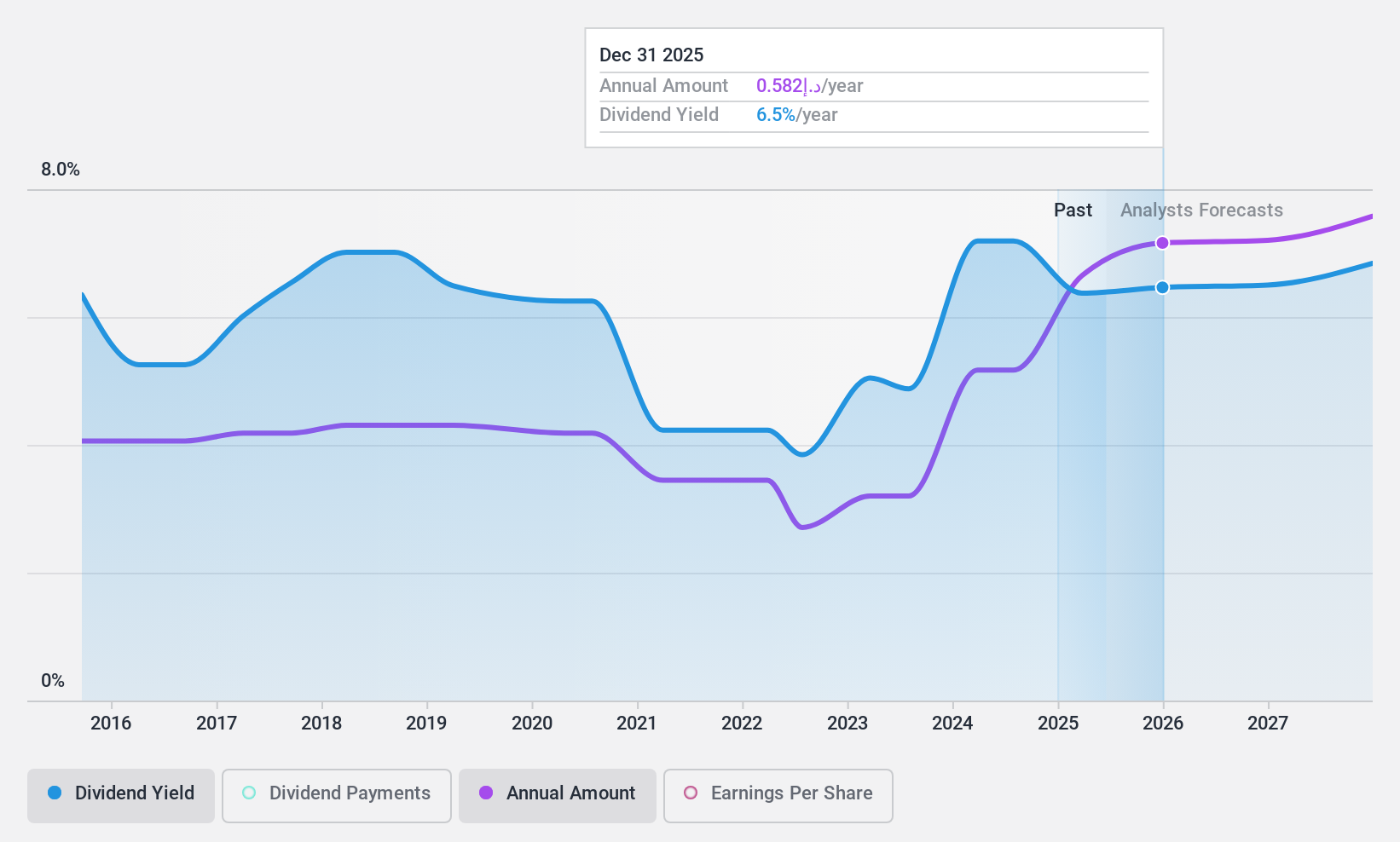

Dividend Yield: 5.4%

Emirates Integrated Telecommunications Company PJSC's earnings grew by 47.6% over the past year, with Q3 2024 net income reaching AED 719.09 million, up from AED 503.76 million a year ago. The dividend payout ratio is sustainable at 80.8% of earnings and 69.6% of cash flows, though the dividend yield (5.43%) lags behind top-tier payers in the AE market (6.13%). While dividends have grown over ten years, they remain volatile and unreliable historically due to fluctuations exceeding 20%.

- Click to explore a detailed breakdown of our findings in Emirates Integrated Telecommunications Company PJSC's dividend report.

- The analysis detailed in our Emirates Integrated Telecommunications Company PJSC valuation report hints at an deflated share price compared to its estimated value.

Hour Glass (SGX:AGS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Hour Glass Limited is an investment holding company involved in the retailing and distribution of watches, jewelry, and other luxury products across several countries including Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam with a market cap of SGD991.53 million.

Operations: The company's revenue primarily comes from its retailing and distribution of watches, jewelry, and other luxury products, amounting to SGD1.11 billion.

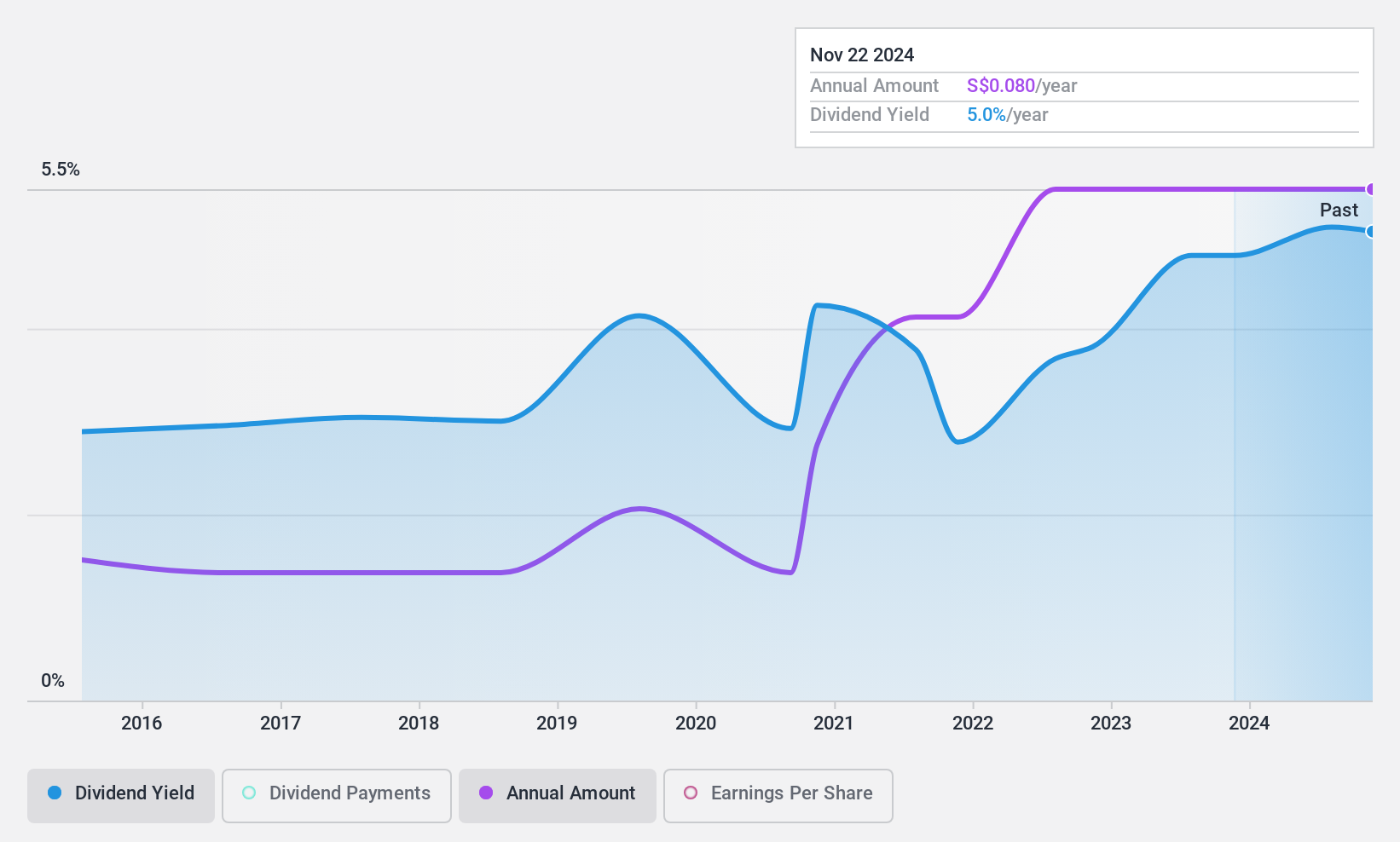

Dividend Yield: 5.2%

The Hour Glass Limited declared an interim dividend of 2.00 cents per share, payable on December 4, 2024. Despite a decline in half-year earnings to SGD 61.42 million from SGD 77.01 million, dividends remain covered by earnings (payout ratio: 37%) and cash flows (cash payout ratio: 46.5%). However, the dividend yield is lower than top-tier payers in Singapore and has been historically volatile with unreliable growth over the past decade.

- Dive into the specifics of Hour Glass here with our thorough dividend report.

- Our expertly prepared valuation report Hour Glass implies its share price may be lower than expected.

Seibu Electric & Machinery (TSE:6144)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Seibu Electric & Machinery Co., Ltd. is a Japanese company that manufactures and sells mechatronics, with a market cap of ¥27.73 billion.

Operations: Seibu Electric & Machinery Co., Ltd.'s revenue is primarily derived from its Precision Machinery Business at ¥13.76 billion, Conveyor Machine Business at ¥10.91 billion, and Industrial Machinery Business at ¥6.64 billion.

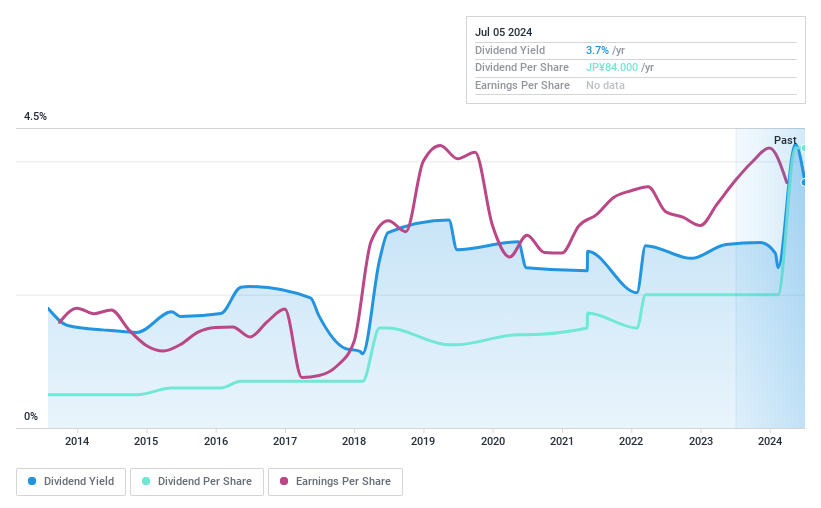

Dividend Yield: 4.6%

Seibu Electric & Machinery offers a dividend yield of 4.58%, ranking in the top 25% of Japanese dividend payers. The company has maintained stable and growing dividends over the past decade with a low payout ratio of 18.1%, ensuring coverage by earnings. However, despite high-quality earnings, dividends are not backed by free cash flows, raising concerns about sustainability without sufficient free cash flow support.

- Click here to discover the nuances of Seibu Electric & Machinery with our detailed analytical dividend report.

- According our valuation report, there's an indication that Seibu Electric & Machinery's share price might be on the expensive side.

Next Steps

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1961 more companies for you to explore.Click here to unveil our expertly curated list of 1964 Top Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emirates Integrated Telecommunications Company PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:DU

Emirates Integrated Telecommunications Company PJSC

Provides carrier, data hub, internet exchange facilities, and satellite service primarily in the United Arab Emirates.

Outstanding track record with excellent balance sheet and pays a dividend.