Daihatsu Infinearth (TSE:6023) Margin Gains Surpass Expectations, Challenging Growth Concerns

Reviewed by Simply Wall St

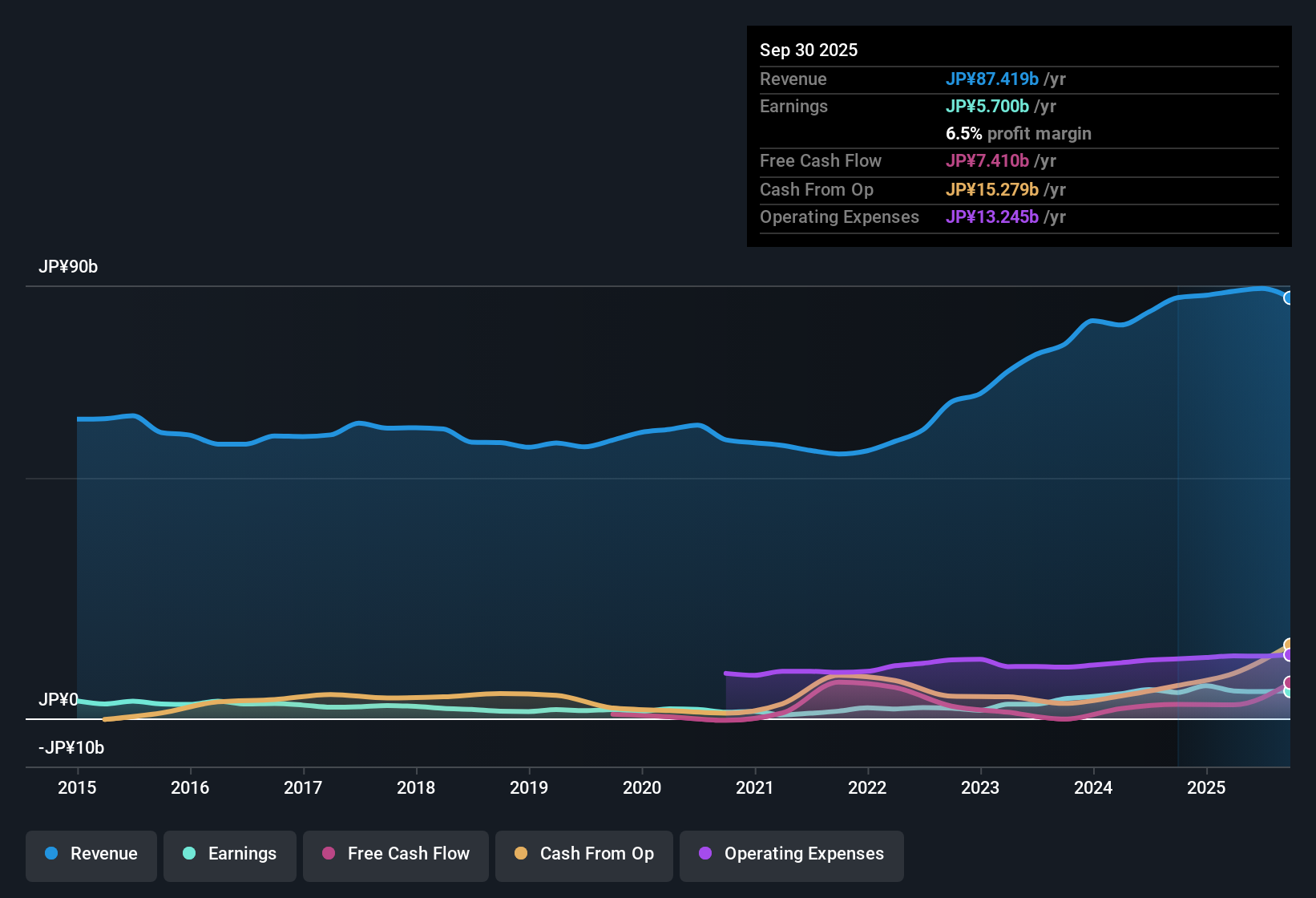

Daihatsu Infinearth Mfg.Co.Ltd (TSE:6023) posted revenue growth forecasts of 3% per year, coming in behind the broader Japanese market’s 4.5% expectation. Net profit margins improved to 6.5% from 6.2%, and earnings increased 5.8% over the past year. This marks a step down from the company’s 35% five-year CAGR, but still shows solid profit expansion over time. With a Price-To-Earnings Ratio of 13.7x versus a peer average of 15.9x, a current share price of ¥3,075 below a fair value estimate, and perceived high-quality earnings, the results may interest value-focused investors despite recent share price instability.

See our full analysis for Daihatsu Infinearth Mfg.Co.Ltd.The next section puts these figures in context by comparing them to the most widely held market narratives, revealing where sentiment matches the numbers and where surprises may be brewing.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Gains Outpace Revenue Slowdown

- Net profit margins have edged up to 6.5%, slightly higher than the previous 6.2%, helping partially offset revenue growth forecasts of 3% annually that trail the broader Japanese market’s 4.5% projection.

- While recent margin improvement is a positive, the prevailing market view notes that forward-looking estimates for annual earnings growth stand at just 1%, well below the country's average of 7.9%.

- This contrast means higher margins offer some resilience, but the company's overall growth momentum is decelerating compared to both its own past performance and peers.

- Investors weighing stability versus growth potential may see the margin gains as a cushion, though not enough to fully offset the slower top-line trajectory.

Valuation Undercuts Peer Averages

- With a Price-To-Earnings Ratio of 13.7x, Daihatsu Infinearth trades below the average of its peers (15.9x), and the current share price (¥3,075) sits at a discount to its DCF fair value of ¥3,529.81.

- The prevailing market view points out that this valuation discount could make the stock appealing to value-oriented investors, particularly when paired with perceptions of high-quality earnings.

- The discount to fair value enhances value appeal, but share price instability over the past three months introduces a risk that may deter some who are seeking near-term price confidence.

- Persistent undervaluation may offer upside if the market re-rates the company, but only if earnings growth resumes at a stronger pace than currently expected.

Dividend and Profit Growth Rewards

- Recognized for both attractive dividend yield and growing profit or revenue, the company is flagged as delivering tangible rewards even as headline earnings growth shows signs of tapering.

- The prevailing market view suggests that, for investors seeking a blend of yield and steady (if moderating) profit expansion, Daihatsu Infinearth remains a potentially compelling pick.

- The combination of good value, a history of profit growth, and income potential can help shore up long-term optimism, even in a slow-growth phase.

- However, the single flagged risk of share price instability underscores the need for patience and close monitoring for any reversal of these positive trends.

Steady profit gains, a value-oriented valuation, and a meaningful dividend make Daihatsu Infinearth an interesting prospect for long-term investors willing to ride out slower growth and some near-term volatility.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Daihatsu Infinearth Mfg.Co.Ltd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Daihatsu Infinearth’s decelerating earnings growth and slower revenue outlook highlight a challenge in maintaining consistent momentum compared to peers and its own track record.

If you want to focus on names with consistent earnings strength and steady upward trends, check out stable growth stocks screener (2094 results) to find companies with proven stability across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6023

Daihatsu Infinearth Mfg.Co.Ltd

Manufactures and sells marine engines, land engines, and industrial instruments in Japan, China, the Rest of Asia, Central America, South America, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives