Nitto Boseki (TSE:3110) Valuation in Focus Following Upgraded Outlook and Strong First-Half Results

Reviewed by Simply Wall St

Nitto Boseki (TSE:3110) announced impressive first-half results along with a raised yearly outlook, underscoring the company’s operational momentum. Management highlighted growing demand and price strength for T-glass, which supported a positive shift in investor sentiment.

See our latest analysis for Nitto Boseki.

Nitto Boseki’s upgraded outlook and positive news on T-glass ignited major momentum, with the stock surging over 75% in the last three months and delivering a 55% total shareholder return across the past year. With such strong performance and renewed optimism, investors are clearly recognizing both the company’s recent wins and long-term growth story.

If you’re inspired by this kind of breakout, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

But after such a rapid share price rise and upbeat forecasts, is there still value left on the table for new investors? Or has the market already factored in Nitto Boseki’s promising future?

Price-to-Earnings of 28x: Is it justified?

With Nitto Boseki trading at a price-to-earnings (P/E) ratio of 28x, which is above both the peer average and the broader JP Building industry, it is priced at a premium relative to similar companies. The last close was ¥9,780, reflecting the market's willingness to pay up for recent growth and future potential.

The price-to-earnings ratio tells investors how many times over the company's earnings they are paying for each share. In industries with strong growth or high expectations, elevated P/E multiples can seem justified if future profits are set to accelerate.

Nitto Boseki's elevated P/E suggests the market is anticipating continued robust earnings growth. However, with its P/E standing at 28x versus the industry average of 14.8x, the stock is clearly valued at a significant premium to its sector peers. When compared against our estimated Fair Price-to-Earnings Ratio of 28.3x, the current valuation does not appear significantly out of line and could converge with the fair level if growth targets are met.

Explore the SWS fair ratio for Nitto Boseki

Result: Price-to-Earnings of 28x (OVERVALUED)

However, while momentum is strong, any slowdown in revenue growth or missing future earnings estimates could challenge the current valuation optimism.

Find out about the key risks to this Nitto Boseki narrative.

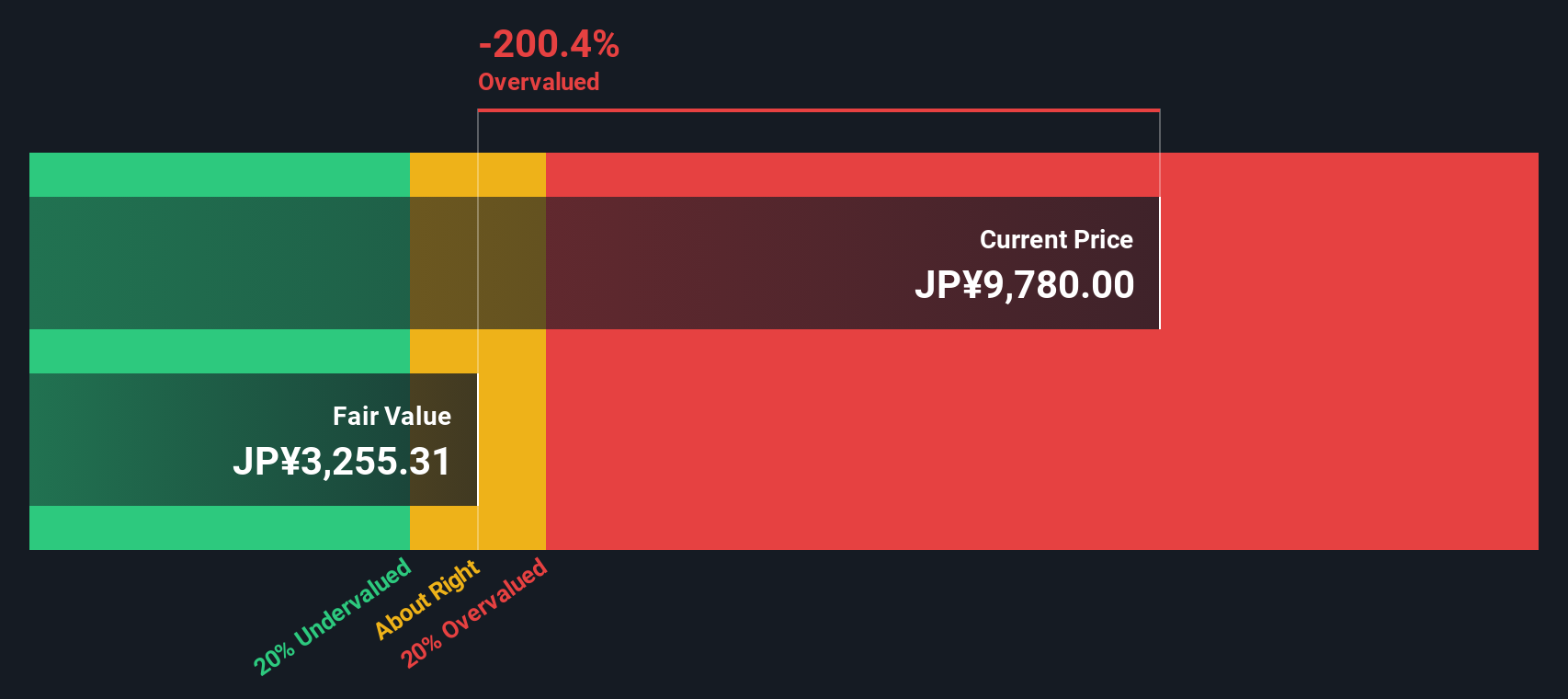

Another View: Discounted Cash Flow Says Overvalued

Taking a different approach, our DCF model estimates Nitto Boseki’s fair value at ¥5,750, which is well below its current share price. This method suggests the stock could be considerably overvalued and raises new questions about how much optimism is already priced in by the market.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nitto Boseki for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 863 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nitto Boseki Narrative

Keep in mind, if this perspective doesn’t match your own or you’d rather dive into the numbers yourself, you can shape the story in just a few minutes: Do it your way

A great starting point for your Nitto Boseki research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t just watch from the sidelines. Seize your next opportunity using powerful stock screens that bring fresh winners into focus every single day.

- Unlock income potential when you scan for impressive yields among these 17 dividend stocks with yields > 3% generating steady passive returns.

- Spot tomorrow’s game-changers by tracking these 25 AI penny stocks shaping the AI landscape and powering groundbreaking innovation.

- Capitalize on companies trading below their worth by targeting these 863 undervalued stocks based on cash flows with proven upside based on underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nitto Boseki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3110

Nitto Boseki

Manufactures, processes, and sells glass fiber products, chemical and pharmaceutical products, and textile products in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives