Nitto Boseki (TSE:3110) Is Up 11.8% After Strong H1 Results and T-glass Optimism – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

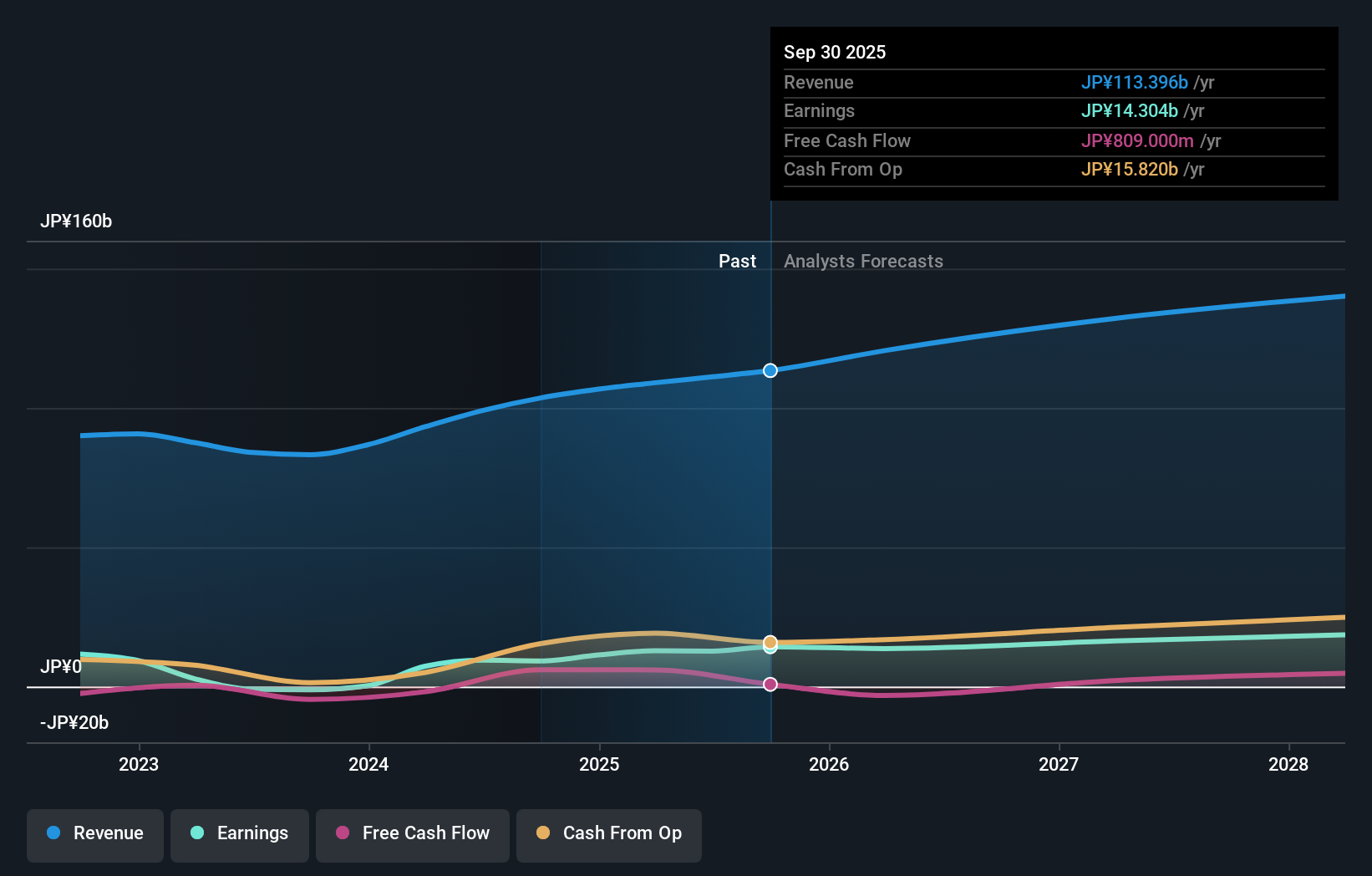

- Nitto Boseki recently reported an 8.2% increase in net sales and a 28.7% rise in operating profit for the first half of its fiscal year ending March 2026, along with an upward revision to its full-year earnings forecast.

- An analyst upgrade followed management’s positive outlook on its T-glass product, with anticipated price increases and shipment growth fueled by productivity gains.

- We’ll explore how T-glass shipment growth expectations help refresh Nitto Boseki’s investment narrative amid these strong results.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

What Is Nitto Boseki's Investment Narrative?

For anyone considering Nitto Boseki as a long-term holding, the key belief is in the company’s ability to drive sustainable growth through specialty products like T-glass amid leadership shifts and a changing industry. The recent board meeting’s planned asset transfer, which will bring extraordinary income later this year, may sharpen near-term financials and potentially offset any short-term volatility tied to operating margins. The company’s upgraded sales forecasts and analyst upgrades on the back of robust shipment and pricing strategies for T-glass have likely made this catalyst even more important right now, at least in the short run. However, these changes may also recalibrate the company’s risk profile, as high valuation multiples and price volatility have been persistent talking points before the news. The focus shifts to whether these strategic wins create lasting momentum or if short-term gains are already reflected in the current price.

On the other hand, pay close attention to potential risks from rapid price swings and high valuation. Nitto Boseki's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Nitto Boseki - why the stock might be worth 28% less than the current price!

Build Your Own Nitto Boseki Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nitto Boseki research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nitto Boseki research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nitto Boseki's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nitto Boseki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3110

Nitto Boseki

Manufactures, processes, and sells glass fiber products, chemical and pharmaceutical products, and textile products in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives