Stock Analysis

- Japan

- /

- Trade Distributors

- /

- TSE:8053

Exploring Three Japanese Dividend Stocks In May 2024

Reviewed by Kshitija Bhandaru

As of May 2024, the Japanese stock market has shown resilience with the Nikkei 225 and TOPIX indices experiencing gains amidst a broader global economic context marked by fluctuating markets and monetary policies. This backdrop sets an intriguing stage for investors considering dividend stocks in Japan, where stability and consistent returns become particularly appealing. In this environment, understanding what constitutes a robust dividend stock involves looking at factors such as company fundamentals, sector performance, and how well these companies can navigate current economic conditions.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Kanro (TSE:2216) | 3.26% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.57% | ★★★★★★ |

| Koei Tecmo Holdings (TSE:3635) | 3.80% | ★★★★★★ |

| Nippon Air conditioning Services (TSE:4658) | 3.37% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.01% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.34% | ★★★★★★ |

| Innotech (TSE:9880) | 3.88% | ★★★★★★ |

| Toyo Kanetsu K.K (TSE:6369) | 3.49% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.28% | ★★★★★★ |

| Star Micronics (TSE:7718) | 3.24% | ★★★★★★ |

Click here to see the full list of 305 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

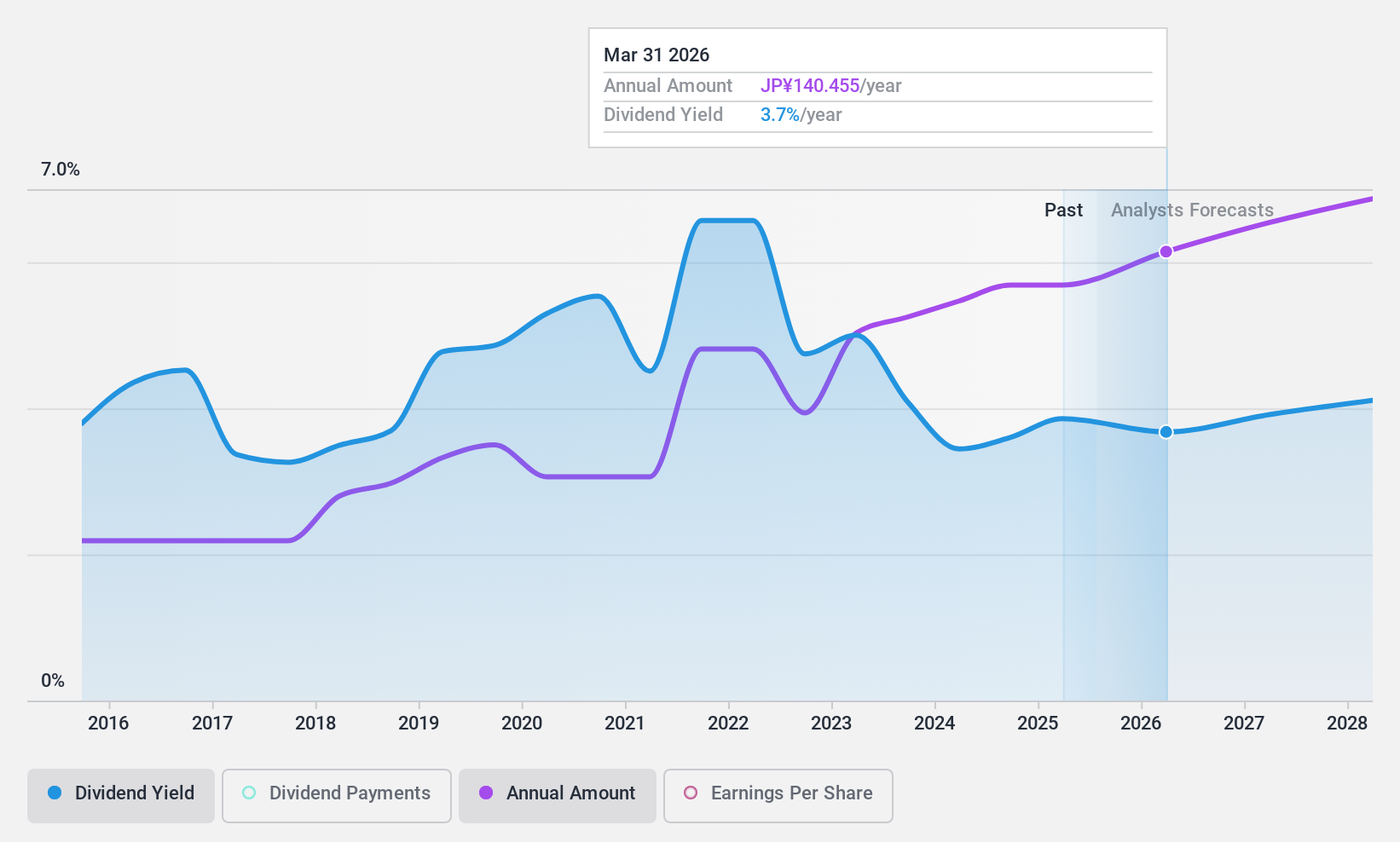

Sojitz (TSE:2768)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sojitz Corporation is a global general trading company involved in a diverse range of business activities, with a market capitalization of approximately ¥939.52 billion.

Operations: Sojitz Corporation generates its revenue from several key segments, including Chemicals (¥559.92 billion), Automotive (¥403.73 billion), Retail & Consumer Service (¥428.96 billion), Infrastructure & Healthcare (¥169.62 billion), Metals, Mineral Resources & Recycling (¥484.22 billion), Consumer Industry & Agriculture Business (¥267.83 billion), and Aerospace & Transportation Projects (¥45.85 billion).

Dividend Yield: 3.5%

Sojitz has displayed mixed results in its dividend performance over the past decade, with volatile payments that have seen significant annual fluctuations. Despite this instability, the company's dividends are well-covered by both earnings and cash flows, with a payout ratio of 29.9% and a cash payout ratio of 40.2%. Additionally, Sojitz trades at a favorable price-to-earnings ratio of 9.3x compared to the Japanese market average of 14.4x. Recent activities include an aggressive share buyback program completed in April 2024, enhancing shareholder value through capital efficiency measures linked to its Medium-term Management Plan.

- Get an in-depth perspective on Sojitz's performance by reading our dividend report here.

- Our valuation report here indicates Sojitz may be undervalued.

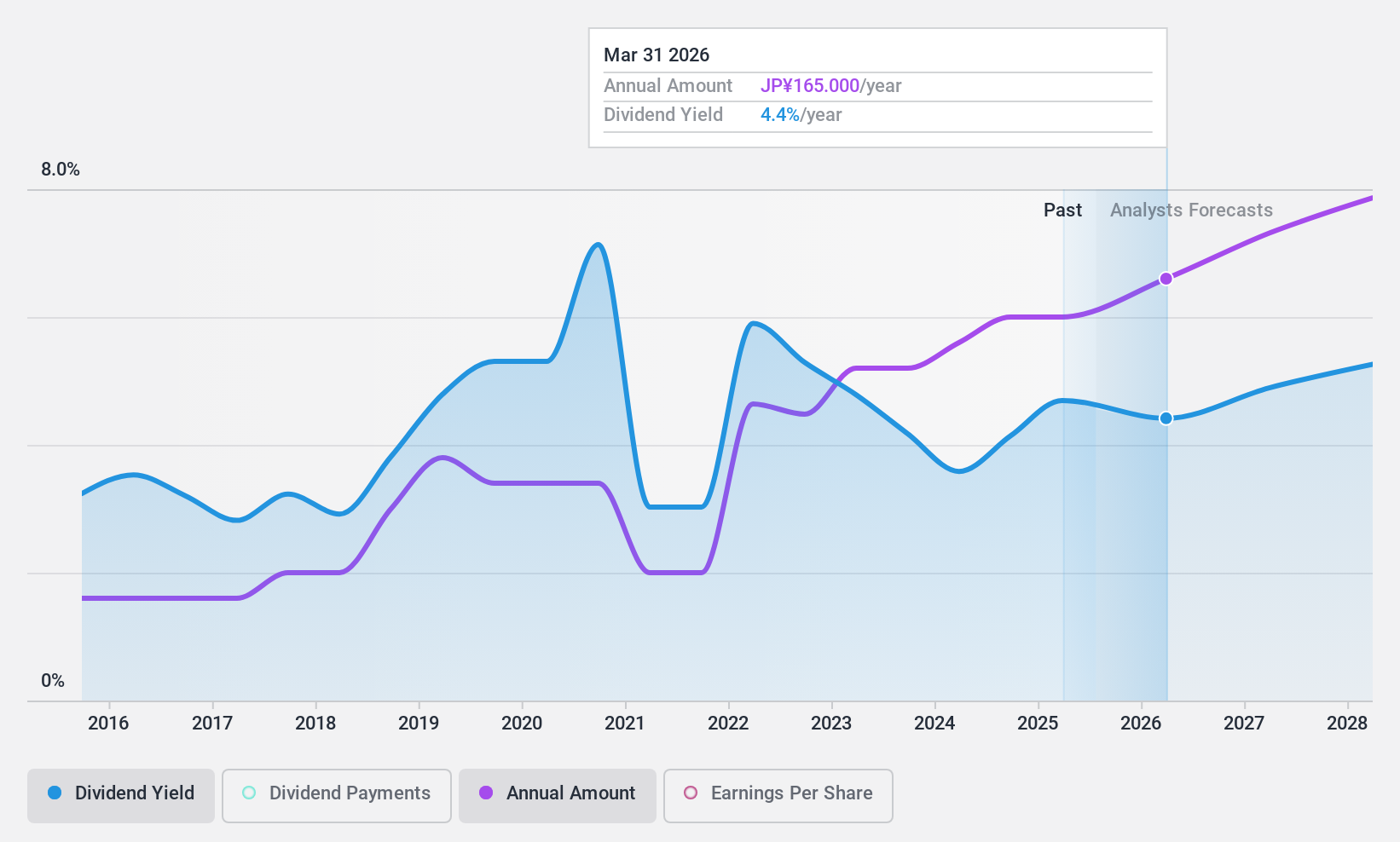

Sumitomo (TSE:8053)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumitomo Corporation operates globally as a diversified trading company, with a market capitalization of approximately ¥5.25 trillion.

Operations: Sumitomo Corporation's revenue streams include Metal Products at ¥1.74 billion, Mineral Resources, Energy, Chemical & Electronics at ¥1.59 billion, Transportation & Construction Systems at ¥1.38 billion, Living Related & Real Estate at ¥1.20 billion, Infrastructure at ¥0.51 billion, and Media & Digital at ¥0.49 billion.

Dividend Yield: 3%

Sumitomo has experienced volatility in its dividend payments over the past decade, with a recent buyback announcement on May 2, 2024, to repurchase ¥50 billion worth of shares. Despite the unstable dividend history, dividends are sufficiently covered by earnings and cash flows with a payout ratio of 39.6% and a cash payout ratio of 30.8%. However, its dividend yield of 3.02% is slightly below the top quartile in Japan's market at 3.23%, and profit margins have decreased from last year's figures.

- Dive into the specifics of Sumitomo here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Sumitomo is trading beyond its estimated value.

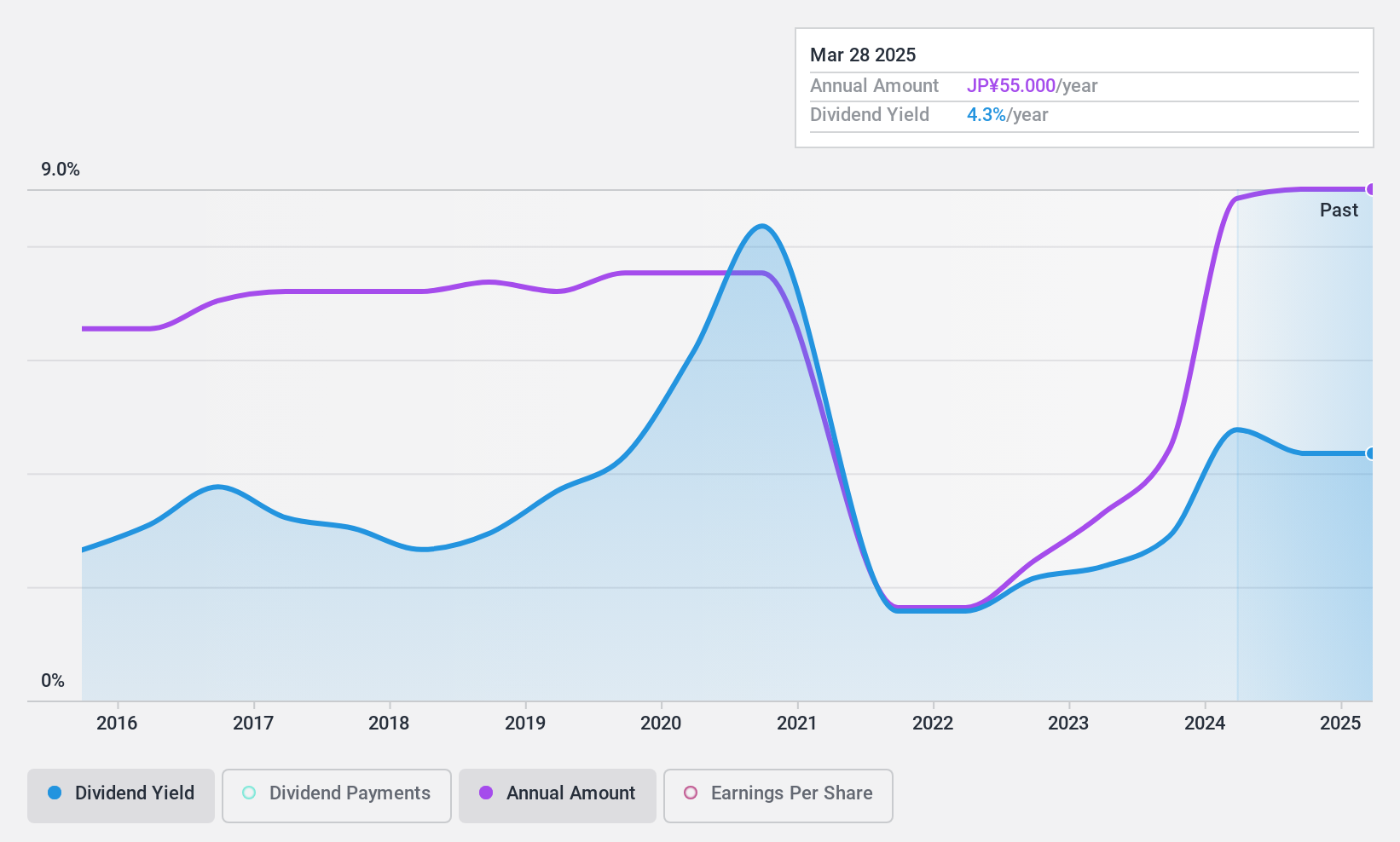

AOKI Holdings (TSE:8214)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: AOKI Holdings Inc., operating in Japan, is involved in diverse sectors including fashion, anniversary and bridal services, entertainment, and real estate rental, with a market capitalization of approximately ¥104.52 billion.

Operations: AOKI Holdings Inc. generates revenue primarily through its fashion business (¥96.89 billion), entertainment (¥75.15 billion), anniversary and bridal services (¥9.60 billion), and real estate leasing (¥5.61 billion).

Dividend Yield: 4.3%

AOKI Holdings recently raised its fiscal year guidance, expecting net sales of JPY 187.70 billion and a profit of JPY 7.55 billion. Dividend projections increased to JPY 37 per share from an earlier JPY 27, reflecting improved profitability. Despite a history of volatile dividends, current payments are supported by a cash payout ratio of 61% and an earnings coverage at 28.8%. However, the dividend track record over the past decade has been unstable, suggesting caution for those seeking consistent returns.

- Click here and access our complete dividend analysis report to understand the dynamics of AOKI Holdings.

- Our expertly prepared valuation report AOKI Holdings implies its share price may be too high.

Next Steps

- Dive into all 305 of the Top Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Sumitomo is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8053

Adequate balance sheet average dividend payer.