- Japan

- /

- Construction

- /

- TSE:1959

A Look at Kraftia (TSE:1959) Valuation After Upgraded Earnings Guidance and Higher Dividend

Reviewed by Simply Wall St

Kraftia (TSE:1959) gave investors plenty to talk about this week. The company released updated earnings guidance for the coming year and announced a hike to its interim dividend. Both are relevant signals for shareholders.

See our latest analysis for Kraftia.

Kraftia’s momentum has been hard to ignore, with the share price climbing 50.3% so far this year and its one-year total shareholder return at 40.3%. Fresh earnings guidance and a dividend boost have added to recent enthusiasm. This builds on a robust three-year total return of 146%, suggesting long-term confidence is holding strong.

If you’re looking to broaden your search after Kraftia’s recent moves, consider discovering fast growing stocks with high insider ownership.

With shares surging and new guidance out, is Kraftia’s current valuation reflecting all its future potential? Alternatively, could today’s momentum mean there is still room for investors to benefit from further gains?

Price-to-Earnings of 17.6x: Is it justified?

Kraftia trades at a price-to-earnings (P/E) ratio of 17.6x, slightly higher than the peer average of 17x. This suggests investors are paying a modest premium for Kraftia’s recent performance and prospects compared to similar companies.

The price-to-earnings multiple measures how much the market is willing to pay for each unit of Kraftia's earnings. For industrial firms like Kraftia, this is a common gauge of whether future growth and profitability justify the current share price.

In Kraftia’s case, the current valuation signals that investors expect continued earnings growth. The company’s 10% forecast profit growth outpaces the broad Japanese market, but lags the industry’s recent significant growth. The fair price-to-earnings ratio, estimated at 17.9x, indicates that Kraftia’s valuation is close to a reasonable level the market could shift toward if positive trends persist.

The stock is notably more expensive than the industry’s 12.4x average, which means the market is banking on Kraftia outperforming its sector. However, the fair multiple analysis suggests room for upward adjustment if the company delivers on its growth outlook.

Explore the SWS fair ratio for Kraftia

Result: Price-to-Earnings of 17.6x (ABOUT RIGHT)

However, slower revenue growth or failure to meet earnings forecasts could quickly dampen momentum and challenge today’s optimistic outlook for Kraftia.

Find out about the key risks to this Kraftia narrative.

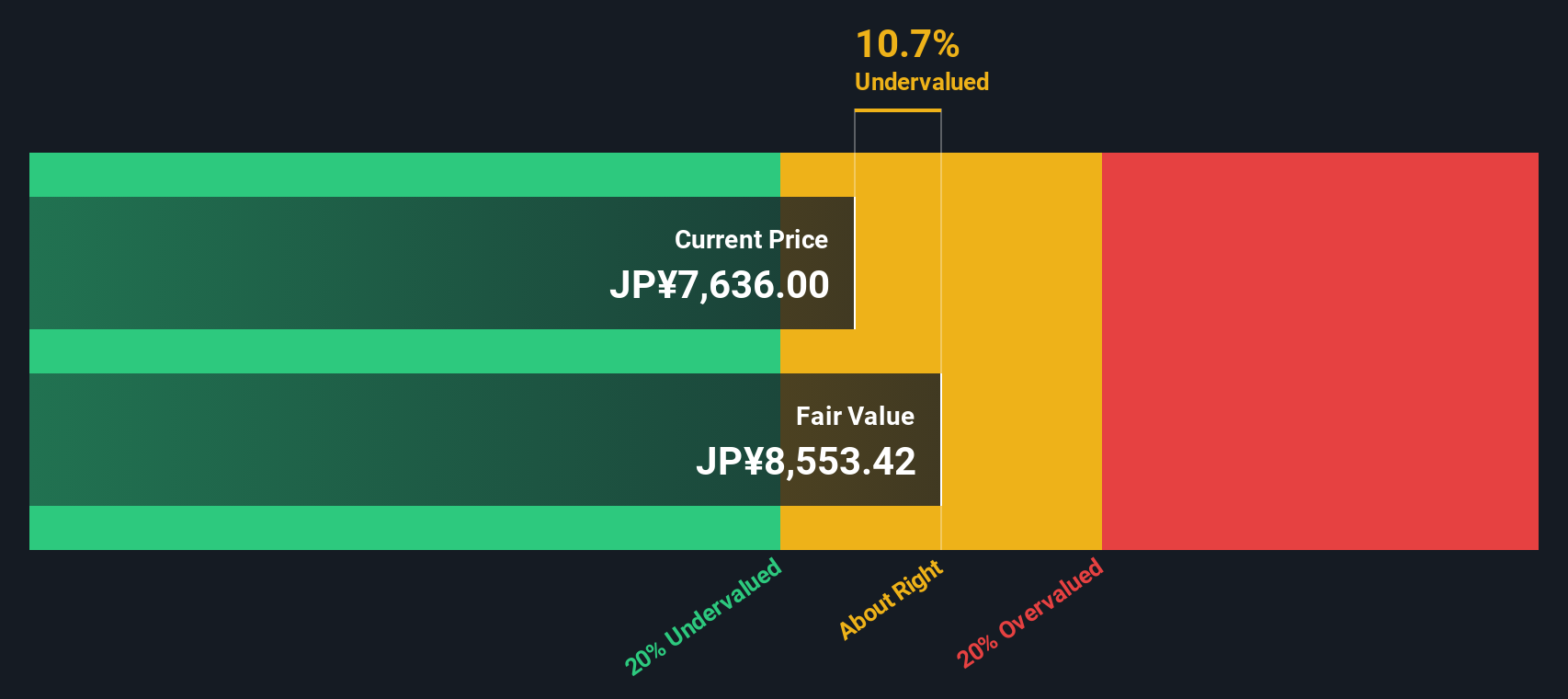

Another View: DCF Signals Undervaluation

Looking at things differently, our DCF model values Kraftia shares at ¥8,553.42, about 10.7% above the current price. This approach suggests the market might be underestimating Kraftia’s future cash flows. This potential hidden value could offer a margin of safety for investors.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kraftia for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 849 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kraftia Narrative

If you see things differently or trust your own research, you can craft your own narrative for Kraftia in just a few minutes: Do it your way.

A great starting point for your Kraftia research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Want an edge finding tomorrow’s winners? Strengthen your portfolio by spotting trends before the crowd and capitalizing on opportunities you might be overlooking.

- Boost your income strategy by targeting market leaders that offer above-average yields when you scan these 17 dividend stocks with yields > 3%.

- Unlock growth potential in emerging fields by tapping into innovation with these 32 healthcare AI stocks at your fingertips.

- Capitalize on evolving technologies and cutting-edge breakthroughs by analyzing these 25 AI penny stocks that are poised to shape the digital world.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraftia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1959

Kraftia

Engages in design, construction, and installation of power infrastructure construction business in Japan.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives