- Japan

- /

- Construction

- /

- TSE:1939

Undiscovered Gems In Japan Yondenko And Two Other Small Caps With Strong Potential

Reviewed by Simply Wall St

In recent weeks, Japan's stock markets have faced significant challenges, with the Nikkei 225 Index and TOPIX Index experiencing substantial declines. Despite this turbulence, certain small-cap stocks in Japan present intriguing opportunities for investors seeking to uncover hidden gems. Identifying a promising stock often involves looking beyond short-term market fluctuations to focus on robust fundamentals and growth potential. In the context of current market conditions, Yondenko and two other small-cap companies stand out as strong candidates for consideration.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Business Brain Showa-Ota | 0.05% | 7.50% | 59.43% | ★★★★★★ |

| Tokyo Tekko | 10.81% | 7.30% | 7.30% | ★★★★★★ |

| Central Forest Group | NA | 5.16% | 12.45% | ★★★★★★ |

| Techno Smart | NA | 5.05% | -2.17% | ★★★★★★ |

| Imuraya Group | 17.62% | 1.55% | 27.83% | ★★★★★★ |

| NPR-Riken | 13.26% | 6.00% | 32.17% | ★★★★★☆ |

| Techno Ryowa | 0.25% | 0.34% | 0.12% | ★★★★★☆ |

| YagiLtd | 30.82% | -9.63% | -6.89% | ★★★★☆☆ |

| Yukiguni Maitake | 158.67% | -5.22% | -32.27% | ★★★★☆☆ |

| FDK | 89.57% | -0.88% | 25.34% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Yondenko (TSE:1939)

Simply Wall St Value Rating: ★★★★★★

Overview: Yondenko Corporation operates in Japan, focusing on electrical and electrical power transmission and distribution facilities construction, with a market cap of ¥56.83 billion.

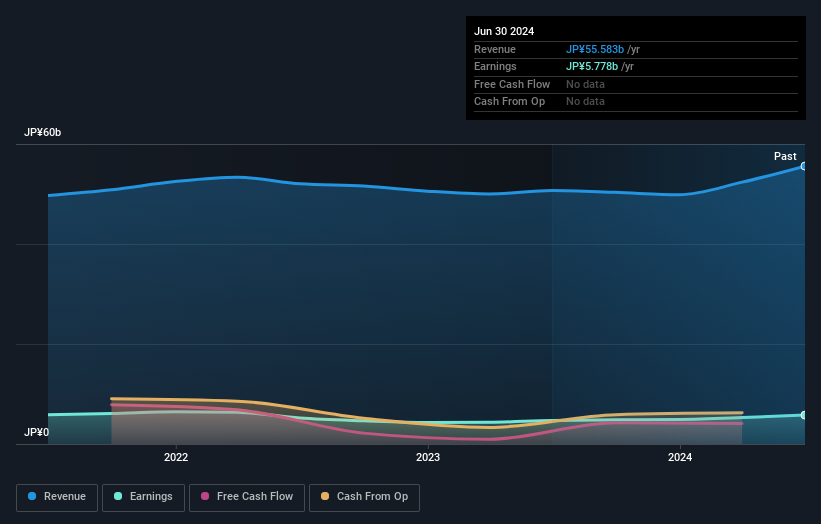

Operations: Yondenko Corporation generates revenue primarily from electrical and power transmission and distribution facilities construction in Japan. With a market cap of ¥56.83 billion, the company's financial performance is driven by its core construction activities.

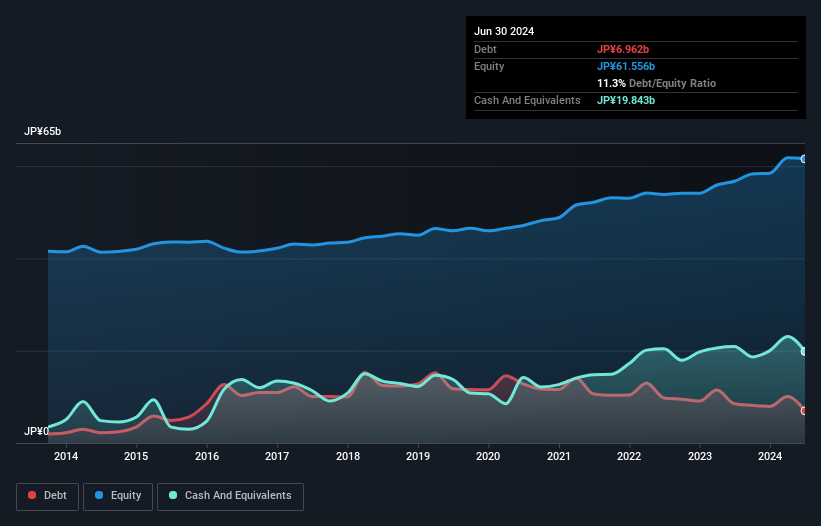

Yondenko, a small cap construction company in Japan, has shown significant improvement over the past five years. Their debt to equity ratio decreased from 25.6% to 11.3%, and they have more cash than total debt. The company's earnings growth of 23.6% last year outpaced the industry average of 23.4%. Recently, Yondenko raised its dividend forecast for Q2 and FY2025 to JPY 75 per share and announced amendments to increase authorized shares from 40 million to 120 million effective October 1, 2024.

- Navigate through the intricacies of Yondenko with our comprehensive health report here.

Gain insights into Yondenko's past trends and performance with our Past report.

Senshu Ikeda Holdings (TSE:8714)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Senshu Ikeda Holdings, Inc. offers banking products and services to small and medium-sized enterprises, as well as individuals in Japan and internationally, with a market cap of ¥103.47 billion.

Operations: Senshu Ikeda Holdings generates revenue primarily from its banking products and services targeted at small and medium-sized enterprises and individuals. The company's financial performance is reflected in its market cap of ¥103.47 billion.

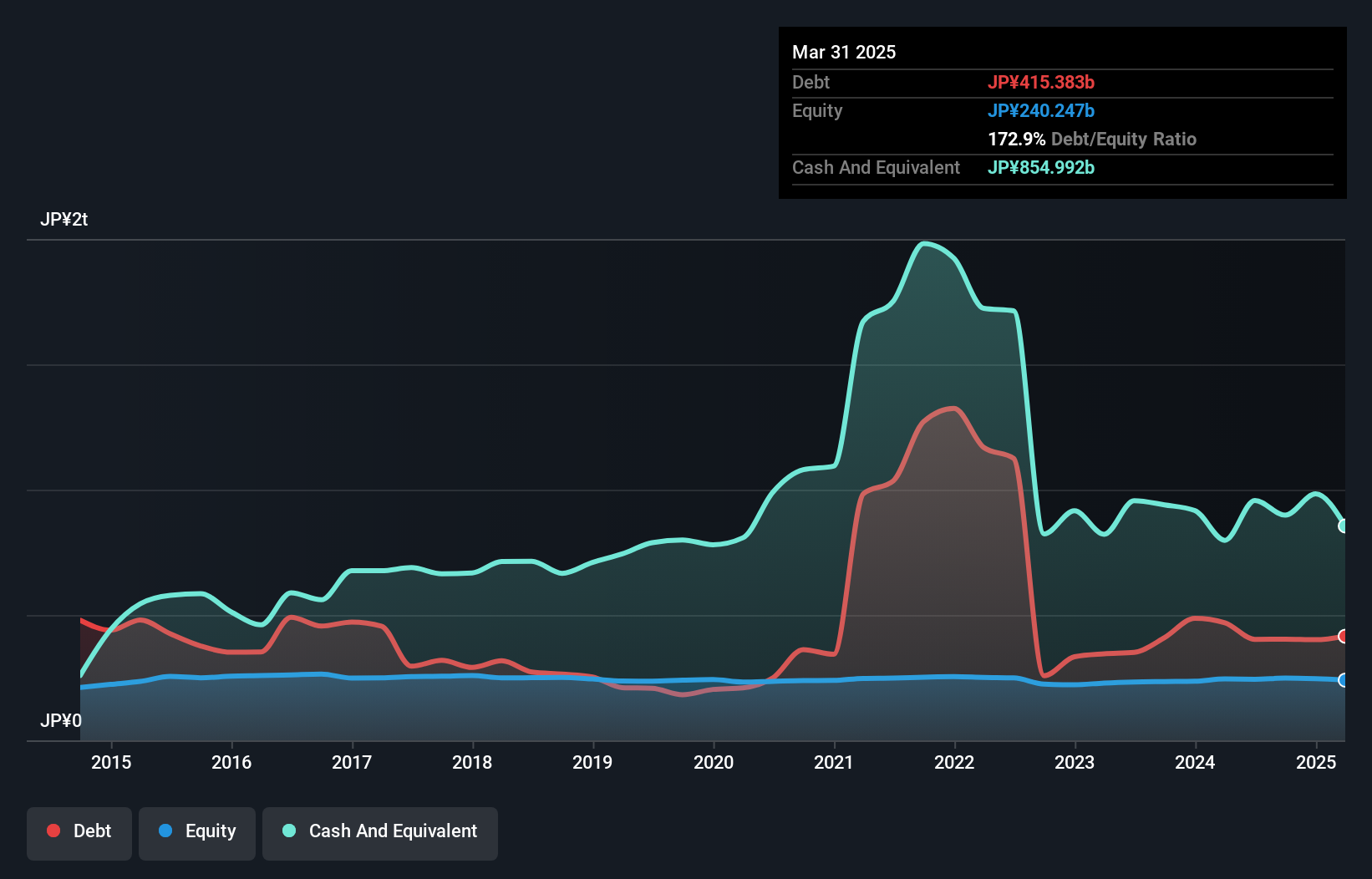

Senshu Ikeda Holdings, with total assets of ¥6,446.4B and equity of ¥243.7B, has shown impressive earnings growth of 30.3% over the past year, surpassing the industry average of 13.3%. Total deposits stand at ¥5,734.9B while loans are at ¥4,654.5B with a net interest margin of 0.8%. Despite having an appropriate non-performing loan ratio (1.1%), its allowance for bad loans remains insufficient at 1.1%.

- Click here to discover the nuances of Senshu Ikeda Holdings with our detailed analytical health report.

Understand Senshu Ikeda Holdings' track record by examining our Past report.

Sankyo FrontierLtd (TSE:9639)

Simply Wall St Value Rating: ★★★★★★

Overview: Sankyo Frontier Co., Ltd. produces, sells, and rents modular buildings, self-storage units, and multistory parking devices in Japan and internationally with a market cap of ¥46.34 billion.

Operations: Sankyo Frontier Co., Ltd. generates revenue through the production, sale, and rental of modular buildings, self-storage units, and multistory parking devices. The company has a market cap of ¥46.34 billion.

Sankyo Frontier Ltd. has demonstrated impressive earnings growth of 21.9% over the past year, outpacing the Real Estate industry average of 14%. The company’s debt to equity ratio has improved significantly from 36.3% to 7.4% in five years, indicating better financial health. With a price-to-earnings ratio of 8.8x, it remains attractively valued compared to the JP market's average of 13.2x, making it an intriguing prospect for investors seeking value in Japan's market.

Next Steps

- Investigate our full lineup of 725 Japanese Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1939

Yondenko

Engages in the electrical, and electrical power transmission and distribution facilities construction activities in Japan.

Flawless balance sheet with solid track record and pays a dividend.