- South Korea

- /

- Banks

- /

- KOSE:A138930

3 Asian Dividend Stocks Offering Yields Up To 5.7%

Reviewed by Simply Wall St

As global markets navigate through a period of volatility, with concerns over elevated valuations and geopolitical tensions, investors are increasingly turning their attention to Asia's dividend stocks as a potential source of steady income. In this environment, selecting stocks that offer robust yields and financial stability can be an effective strategy for those seeking to balance risk and reward.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.25% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.73% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.96% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.81% | ★★★★★★ |

| NCD (TSE:4783) | 4.67% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.88% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.65% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.37% | ★★★★★★ |

Click here to see the full list of 1019 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

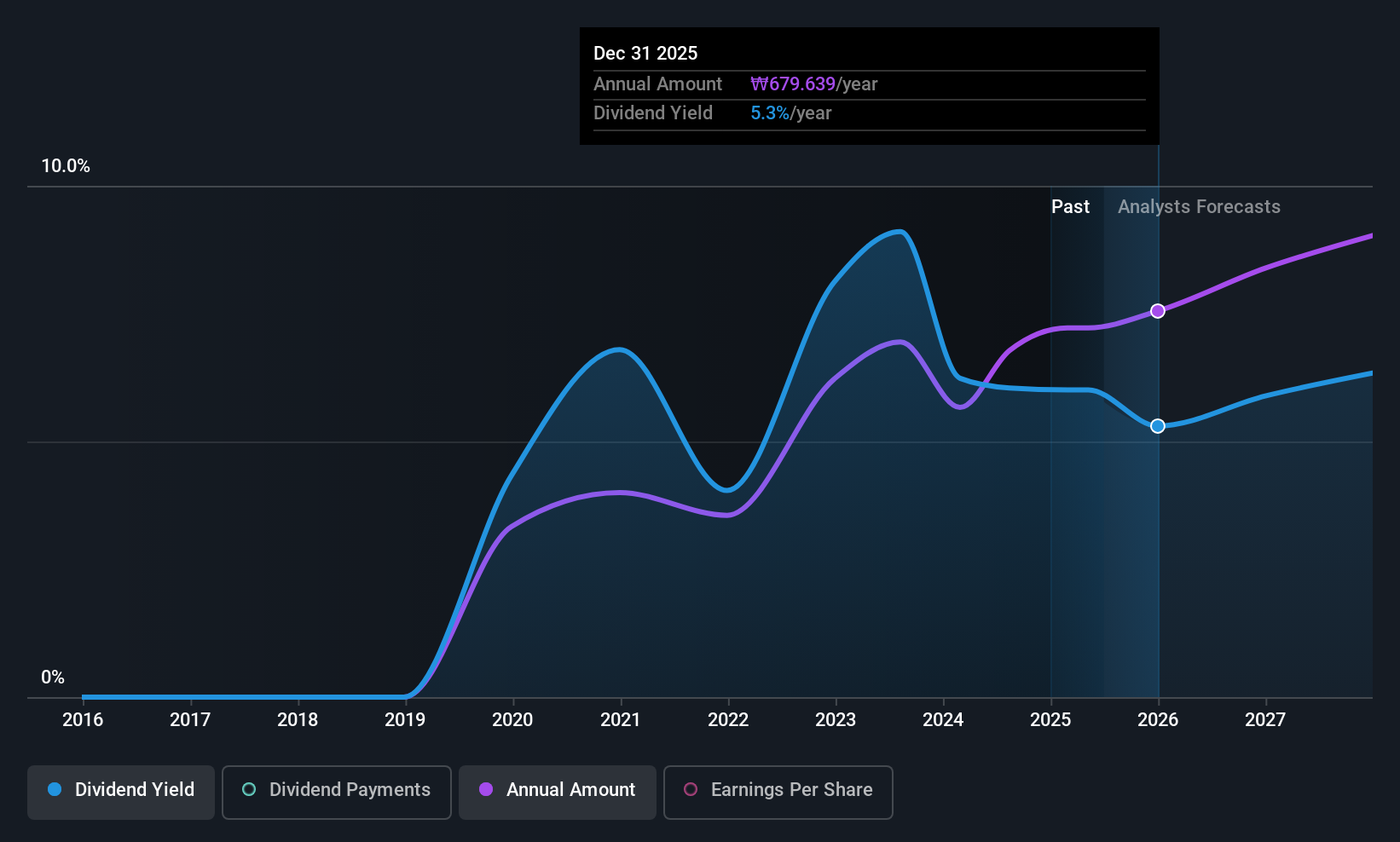

BNK Financial Group (KOSE:A138930)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BNK Financial Group Inc., along with its subsidiaries, offers a range of financial products and services both in South Korea and internationally, with a market cap of ₩4.85 trillion.

Operations: BNK Financial Group Inc. generates revenue through its diverse financial products and services offered domestically and internationally.

Dividend Yield: 4.2%

BNK Financial Group's dividend yield of 4.21% ranks in the top 25% among KR market payers, supported by a low payout ratio of 30.4%, indicating sustainability. Despite a volatile and unreliable six-year dividend history, recent earnings growth of 35.8% suggests potential stability improvements. The stock trades at a significant discount to its estimated fair value, enhancing its attractiveness for value-focused investors. A recent share buyback further underscores management's confidence in the company's financial health.

- Navigate through the intricacies of BNK Financial Group with our comprehensive dividend report here.

- The valuation report we've compiled suggests that BNK Financial Group's current price could be quite moderate.

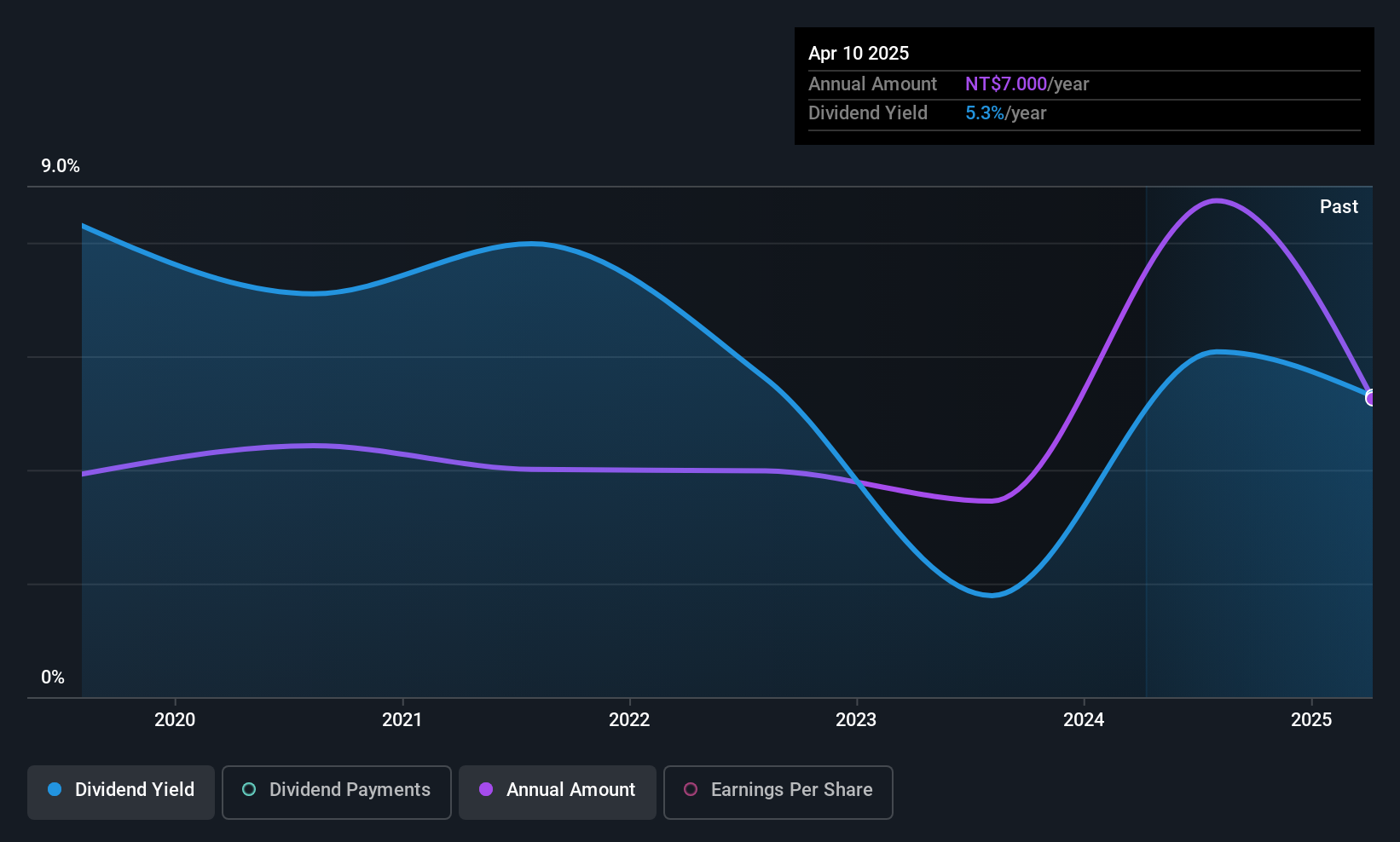

Shiny Brands Group (TPEX:6703)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shiny Brands Group Co., Ltd. focuses on the research, development, and production of skin care products both in Taiwan and internationally, with a market cap of NT$3.37 billion.

Operations: Shiny Brands Group Co., Ltd. generates its revenue primarily from Beauty Care Products and Biotechnology Health Food, amounting to NT$3.30 billion.

Dividend Yield: 5.8%

Shiny Brands Group's dividend yield of 5.76% is among the top 25% in Taiwan, yet its seven-year payment history has been volatile and unreliable. Despite a high payout ratio of 86.2%, dividends are covered by both earnings and cash flows, with a cash payout ratio at 56.5%. Recent financials show declining sales and net income, alongside its removal from the S&P Global BMI Index in September, raising concerns about future stability.

- Click here to discover the nuances of Shiny Brands Group with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Shiny Brands Group is priced lower than what may be justified by its financials.

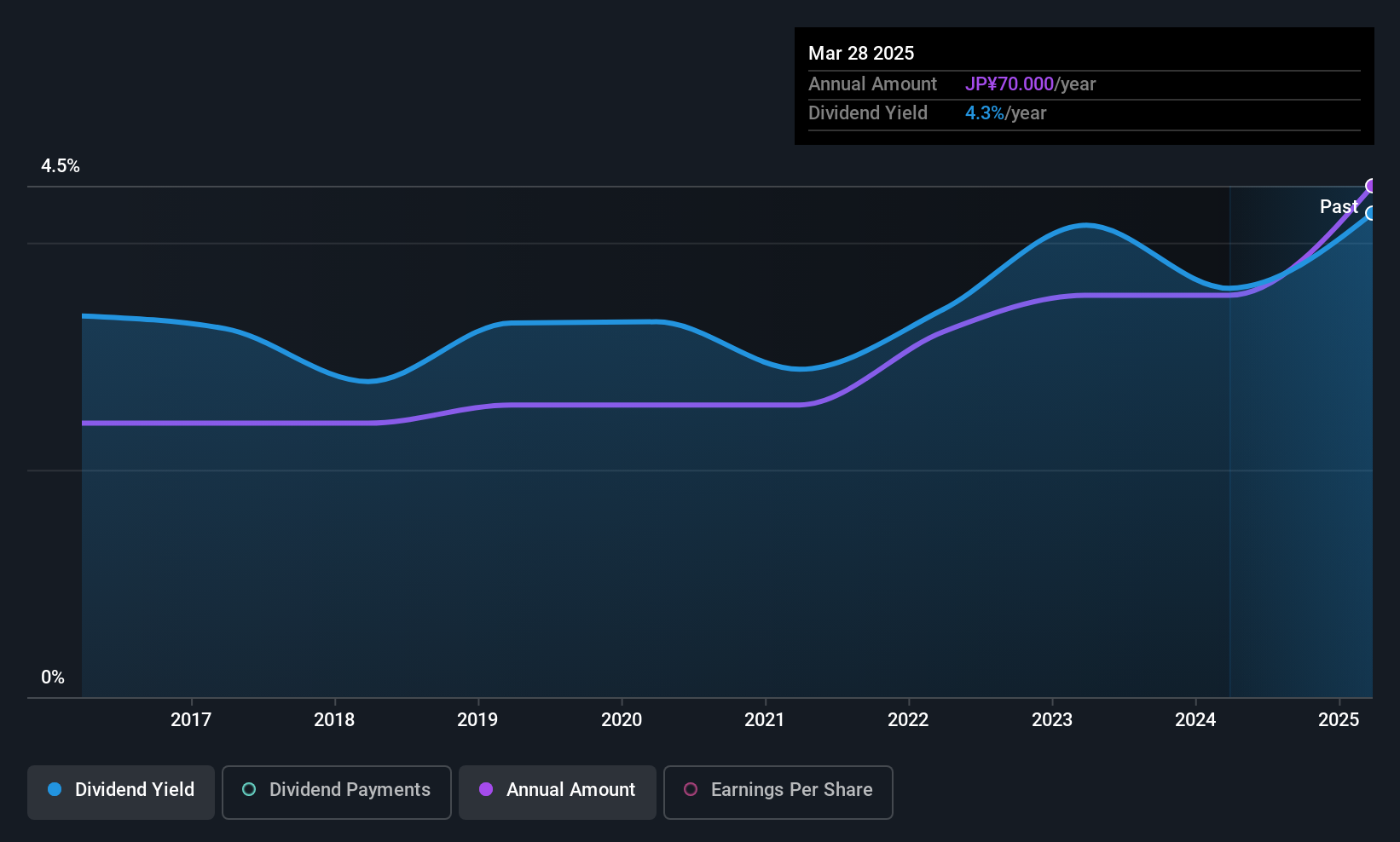

UEKI (TSE:1867)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UEKI Corporation operates as a general construction company in Japan with a market cap of ¥17.47 billion.

Operations: UEKI Corporation's revenue primarily comes from its operations as a general construction company in Japan.

Dividend Yield: 3.3%

UEKI Corporation's dividends have grown steadily over the past decade, with stable and reliable payments. The dividend yield of 3.33% is below the top quartile in Japan but remains attractive due to its sustainability, supported by a low payout ratio of 25.3% from earnings and 38.3% from cash flows. Trading at a significant discount to estimated fair value, UEKI offers potential for capital appreciation alongside its consistent dividend history.

- Click to explore a detailed breakdown of our findings in UEKI's dividend report.

- According our valuation report, there's an indication that UEKI's share price might be on the cheaper side.

Taking Advantage

- Click here to access our complete index of 1019 Top Asian Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BNK Financial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A138930

BNK Financial Group

Provides various financial products and services in South Korea and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives