- Japan

- /

- Professional Services

- /

- TSE:2153

Top 3 Dividend Stocks On The Japanese Exchange For September 2024

Reviewed by Simply Wall St

Japan's stock markets have shown strong performance recently, with the Nikkei 225 Index gaining 3.1% and the broader TOPIX Index up 2.8%, buoyed by a weaker yen following the U.S. Federal Reserve's significant rate cut. Amid this favorable backdrop, investors may find dividend stocks particularly attractive for their potential to provide steady income and stability. When evaluating dividend stocks in such a dynamic market environment, it's crucial to consider factors like consistent payout history, solid financial health, and growth prospects that align with current economic trends.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Globeride (TSE:7990) | 4.34% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.16% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.83% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.95% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.87% | ★★★★★★ |

| Innotech (TSE:9880) | 4.82% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.51% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.21% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.57% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.42% | ★★★★★★ |

Click here to see the full list of 450 stocks from our Top Japanese Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Fuji Furukawa Engineering & ConstructionLtd (TSE:1775)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fuji Furukawa Engineering & Construction Co., Ltd. (TSE:1775) is a company engaged in engineering and construction services, with a market cap of ¥56.38 billion.

Operations: Fuji Furukawa Engineering & Construction Co., Ltd. (TSE:1775) generates revenue from its Electrical Equipment Construction Business, which contributes ¥68.75 billion, and its Air Conditioning Equipment Construction Business, which adds ¥33.68 billion.

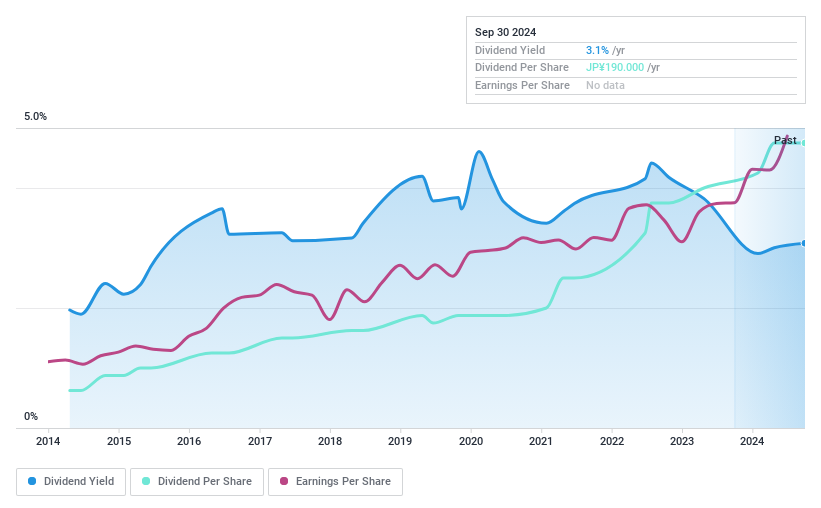

Dividend Yield: 3%

Fuji Furukawa Engineering & Construction Ltd. offers a stable and reliable dividend history, with payments consistently growing over the past 10 years. The current dividend yield stands at 3.03%, which is lower than the top quartile of Japanese dividend payers (3.76%). However, its dividends are well-covered by both earnings (payout ratio: 27.9%) and cash flows (cash payout ratio: 51%). Additionally, the stock trades at a discount of 13.2% below its estimated fair value.

- Get an in-depth perspective on Fuji Furukawa Engineering & ConstructionLtd's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Fuji Furukawa Engineering & ConstructionLtd is trading beyond its estimated value.

E J Holdings (TSE:2153)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: E J Holdings Inc., with a market cap of ¥28.38 billion, operates through its subsidiaries in the civil engineering consultant business both in Japan and internationally.

Operations: E J Holdings Inc. generates revenue primarily from its General Construction Consulting Business, which amounts to ¥37.21 billion.

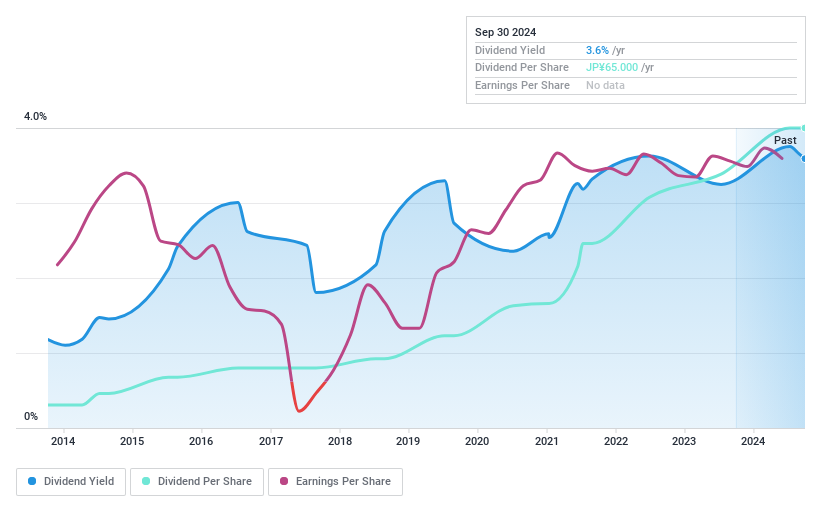

Dividend Yield: 3.6%

E J Holdings Inc. has demonstrated a consistent and growing dividend history over the past decade, with recent increases to JPY 55.00 per share for the year ended May 31, 2024. However, the company expects a decrease to JPY 40.00 per share for the fiscal year ending May 31, 2025. Despite this, dividends remain well-covered by earnings (payout ratio: 28.4%) and cash flows (cash payout ratio: 37.2%). The current yield is slightly below top-tier dividend payers in Japan at 3.59%.

- Take a closer look at E J Holdings' potential here in our dividend report.

- Our valuation report unveils the possibility E J Holdings' shares may be trading at a discount.

Sumitomo Rubber Industries (TSE:5110)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumitomo Rubber Industries, Ltd., with a market cap of ¥422.42 billion, operates globally in the production and sale of tires, sports equipment, and various industrial products.

Operations: Sumitomo Rubber Industries, Ltd. generates revenue from tires (¥1.03 billion), sports equipment (¥130.22 million), and industrial and other products (¥43.12 million).

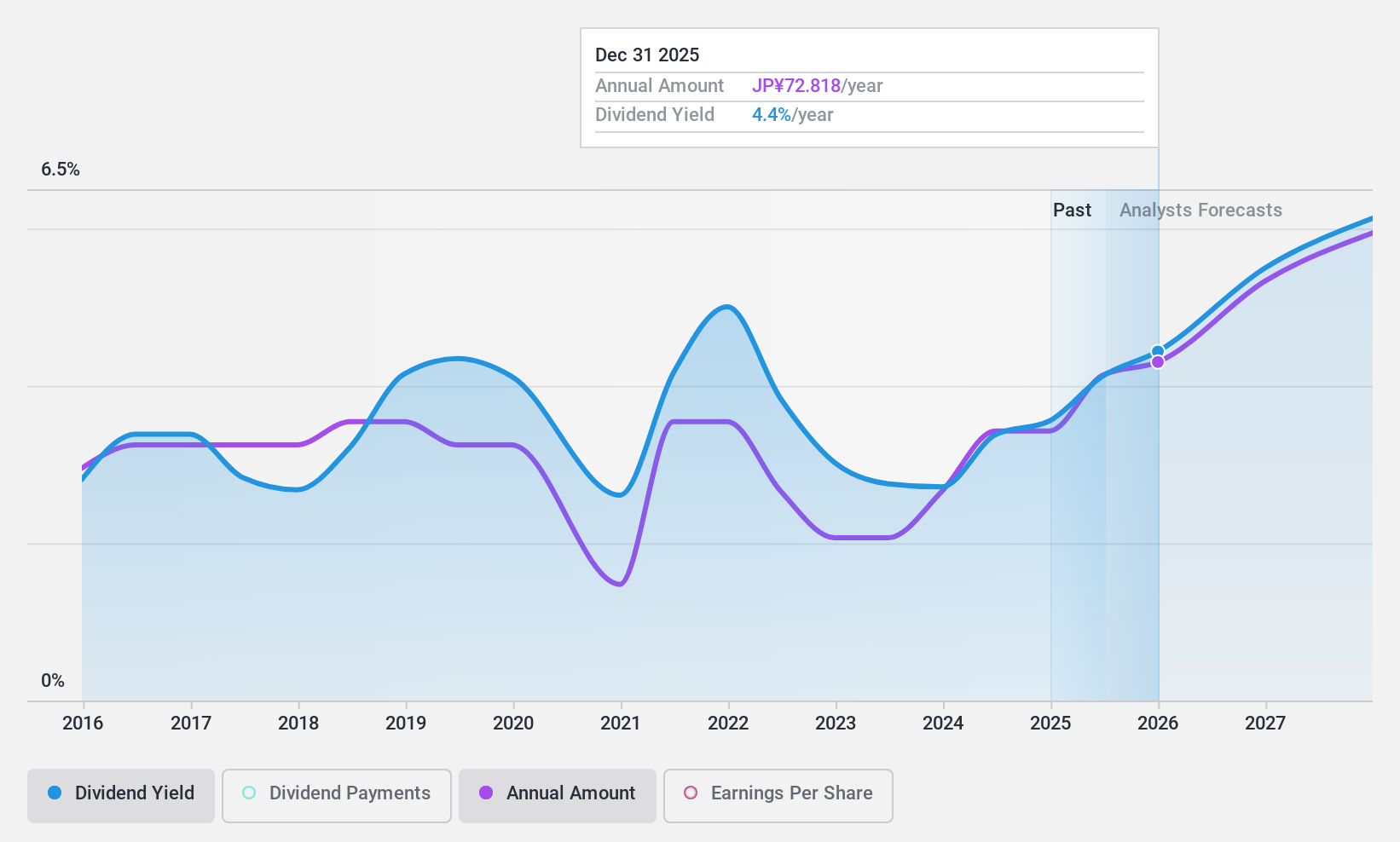

Dividend Yield: 3.6%

Sumitomo Rubber Industries offers a mixed dividend profile. Despite a recent increase in dividends to JPY 29 per share for Q2 2024, the company's dividend history has been volatile over the past decade. Dividends are well-covered by earnings (payout ratio: 31.9%) and cash flows (cash payout ratio: 14.8%). The stock trades at a good value compared to peers and industry, but its current yield of 3.61% is slightly below top-tier Japanese dividend payers.

- Dive into the specifics of Sumitomo Rubber Industries here with our thorough dividend report.

- The valuation report we've compiled suggests that Sumitomo Rubber Industries' current price could be quite moderate.

Seize The Opportunity

- Click here to access our complete index of 450 Top Japanese Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if E J Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2153

E J Holdings

Through its subsidiaries, engages in the civil engineering consultant business in Japan and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives