A Look at Hyakujushi Bank (TSE:8386) Valuation Following Buyback, Upgraded Earnings, and Dividend Forecasts

Reviewed by Simply Wall St

Hyakujushi Bank (TSE:8386) is drawing attention after unveiling a share repurchase program, revising its earnings and dividend forecasts upward, and reporting impressive interim financial results, all in one busy announcement cycle.

See our latest analysis for Hyakujushi Bank.

Momentum around Hyakujushi Bank has surged in recent months, as upbeat financials and shareholder-focused moves have caught investors’ attention. Following these announcements, the share price posted a 13.7% return over the past month and has now climbed 75.8% year-to-date. Even more notable is the one-year total shareholder return of 122%, which highlights strong gains for those who have held steady over both the short and long term.

If you’re curious where else such energy is bubbling up, now’s a smart moment to broaden your search and discover fast growing stocks with high insider ownership

With such rapid gains fueled by strong results and shareholder-friendly moves, the key question now is whether Hyakujushi Bank represents a fresh buying opportunity or if the market is already pricing in its future growth potential.

Price-to-Earnings of 11.6x: Is it justified?

Based on its price-to-earnings (P/E) ratio of 11.6x, Hyakujushi Bank appears attractively priced against peers, trading below the broader Japanese market average and slightly under the peer group average.

The P/E ratio measures how much investors are willing to pay for a company’s earnings. For banks like Hyakujushi, this multiple is widely used to compare how the market values its profit-generating ability relative to others in the sector.

With a P/E below the market average (14.3x) and its peer group (12.3x), Hyakujushi’s current valuation suggests the market is not overpaying for its recent earnings growth. Despite its strong momentum and record results, the stock is priced in line with the industry average of 11.6x, reflecting sector norms and underscoring neither a clear discount nor premium.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 11.6x (ABOUT RIGHT)

However, downside risks remain, including potential macroeconomic headwinds or unexpected regulatory changes that could temper Hyakujushi Bank’s robust momentum.

Find out about the key risks to this Hyakujushi Bank narrative.

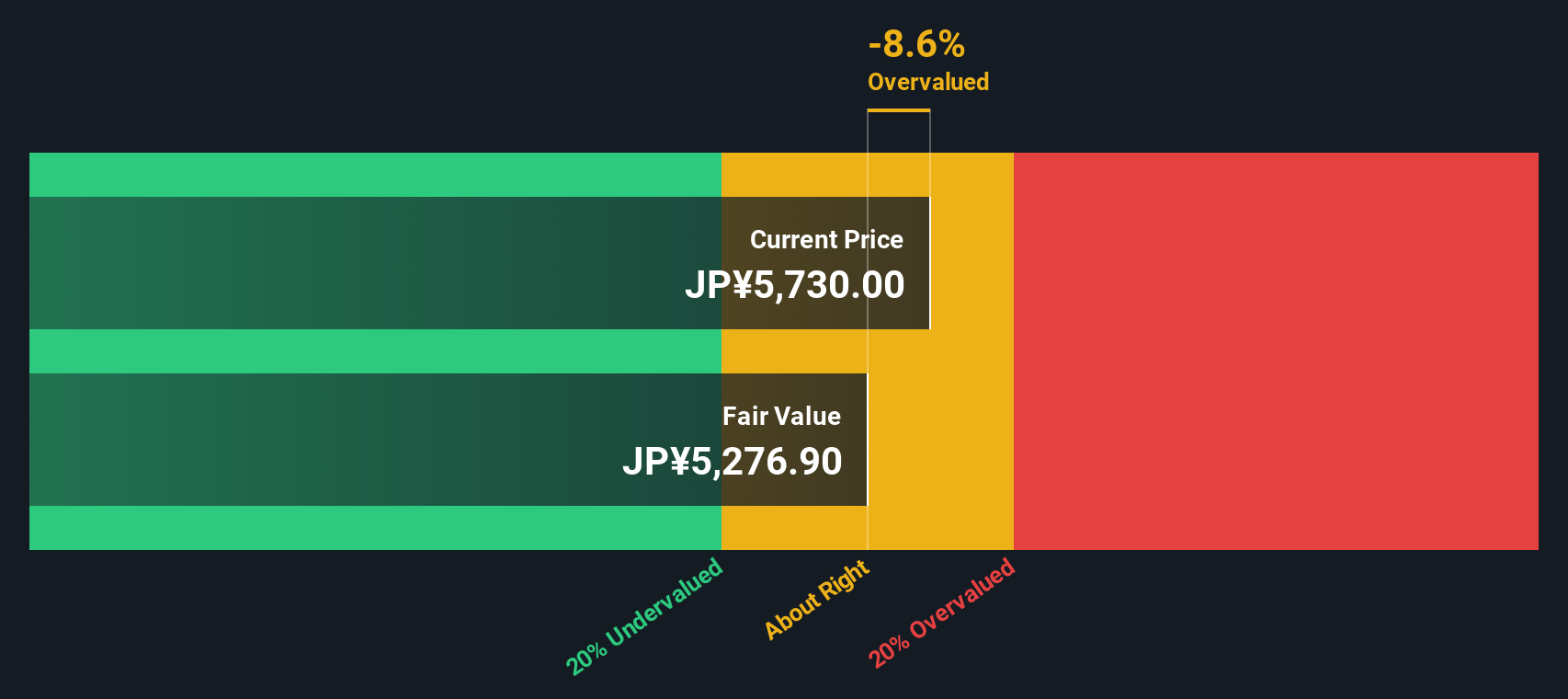

Another View: SWS DCF Model Paints a Different Picture

While Hyakujushi Bank’s earnings multiple looks reasonable, our DCF model offers a different perspective. According to our analysis, shares are trading around 7% above the estimate of intrinsic fair value, which may suggest investors are getting ahead of themselves. Could this disconnect indicate that caution is needed?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hyakujushi Bank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hyakujushi Bank Narrative

If you want a different perspective or prefer to dive into your own research, it’s easy to build your own story in just a few minutes. Do it your way

A great starting point for your Hyakujushi Bank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Don’t let great opportunities pass you by while others act. Expand your watchlist with unique stocks chosen for strong upside, innovation, or steady returns.

- Target reliable income streams and boost your yield with these 16 dividend stocks with yields > 3%, designed to highlight companies offering consistently high payouts.

- Capitalize on the future of healthcare by grabbing a spot in these 32 healthcare AI stocks, where pioneering firms merge medical advancement with AI breakthroughs.

- Uncover massive potential before the crowd by jumping into these 3590 penny stocks with strong financials, which could deliver outsized growth with solid financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hyakujushi Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8386

Solid track record with excellent balance sheet.

Market Insights

Community Narratives