Nanto Bank (TSE:8367) Stock Split and Benefits Update: What Does It Mean for Valuation?

Reviewed by Simply Wall St

Nanto Bank (TSE:8367) has announced a five-for-one stock split, along with updates to its shareholder benefit program. The move is intended to boost share liquidity and make the stock more appealing to a wider range of investors.

See our latest analysis for Nanto Bank.

Nanto Bank’s latest moves come after a stellar run for shareholders, with a total shareholder return of nearly 79% over the past year and a remarkable 232% over five years. The stock has climbed more than 60% year to date, and recent double-digit growth in profit and ordinary income appears to be fueling renewed interest despite some recent volatility in the share price.

If this momentum has you looking for more opportunities beyond traditional banks, consider broadening your search and discover fast growing stocks with high insider ownership

With shares surging and Nanto Bank posting double-digit profit growth, the question now arises: does the current price still reflect compelling value, or has the market already priced in its future prospects?

Price-to-Earnings of 12.4x: Is it justified?

With Nanto Bank trading at a price-to-earnings (P/E) ratio of 12.4x based on its recent close of ¥5,180, the stock appears more expensive than many of its domestic banking peers.

The price-to-earnings ratio reflects how much investors are willing to pay per unit of current earnings, a key metric when evaluating banks where profitability relative to equity is a core marker. For Nanto Bank, a relatively high P/E can suggest the market expects above-average returns or earnings growth ahead.

However, the data reveals that Nanto Bank’s P/E multiple of 12.4x is above both the Japanese banks industry average of 11.5x and the broader peer group average of 10.8x. This means the market is assigning a premium valuation even though recent earnings growth has lagged behind the sector and some profit margin compression has occurred. If a fair P/E benchmark were available, it would help gauge how much room there is for the multiple to adjust.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 12.4x (OVERVALUED)

However, risks remain, including profit margin compression and potential market corrections, which could quickly reverse recent momentum in Nanto Bank’s shares.

Find out about the key risks to this Nanto Bank narrative.

Another View: Is Nanto Bank Actually Undervalued?

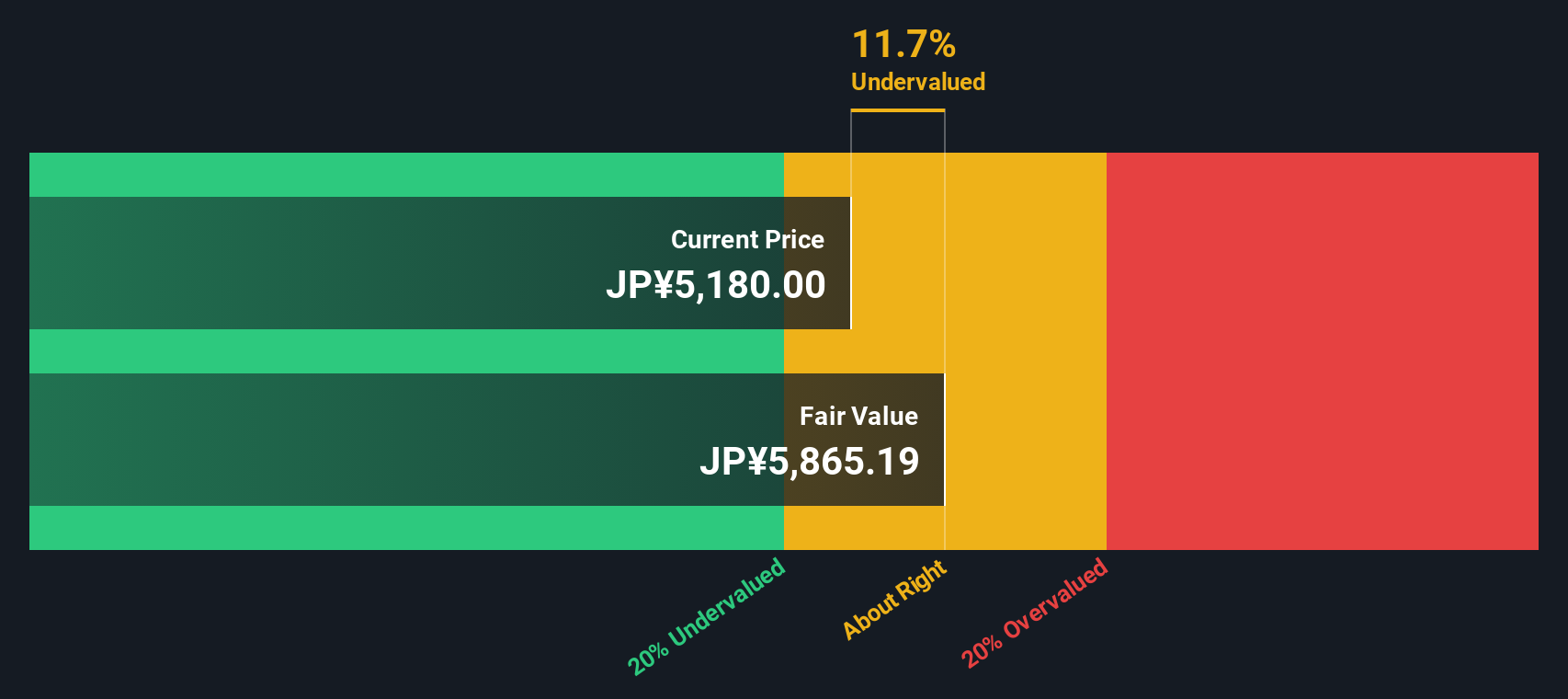

While the current price-to-earnings ratio suggests Nanto Bank might be overvalued versus peers, our SWS DCF model presents a different perspective. According to discounted cash flow analysis, shares are trading at an 11.7% discount to estimated fair value. Could investors be overlooking longer-term value drivers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nanto Bank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 864 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nanto Bank Narrative

If you would rather investigate further or have a different viewpoint, you can explore the data and build your own story about Nanto Bank in just a few minutes. Do it your way

A great starting point for your Nanto Bank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for opportunity to knock. Actively seek out stocks with strong potential using the Simply Wall Street Screener and get ahead of the market.

- Unlock major yield potential by reviewing these 16 dividend stocks with yields > 3%, which showcases companies consistently delivering dividends above 3%.

- Target tomorrow’s tech leaders by checking out these 24 AI penny stocks, focused on pioneering artificial intelligence across innovative industries.

- Spot promising new players breaking through market barriers among these 3576 penny stocks with strong financials, featuring companies with solid financials and growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanto Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8367

Nanto Bank

Provides banking, securities, leasing, and credit guarantee services in Japan.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives