Hirogin Holdings (TSE:7337): Assessing Valuation After Launching Share Buyback Program

Reviewed by Simply Wall St

Hirogin Holdings (TSE:7337) has kicked off its share buyback program, purchasing over 720,000 shares on the Tokyo Stock Exchange following board approval. The move is intended to optimize the capital structure and increase shareholder returns.

See our latest analysis for Hirogin Holdings.

Momentum has been strong for Hirogin Holdings this year, with a 25.5% year-to-date share price return and an impressive 26.7% total shareholder return over the past twelve months. The recent buyback announcement appears to have reinforced investor confidence. This builds on solid long-term gains and suggests that positive sentiment around growth and capital returns could persist if management continues to deliver.

If you’re keen to spot other compelling trends in the market, this could be the perfect moment to widen your lens and discover fast growing stocks with high insider ownership

But with shares now trading close to analyst price targets, investors may wonder whether Hirogin Holdings is still undervalued after recent gains or if markets are already factoring in the company’s future growth prospects, leaving little room for upside.

Price-to-Earnings of 11.9x: Is it justified?

Hirogin Holdings currently trades at a price-to-earnings (P/E) ratio of 11.9x, just above the industry and peer averages and slightly below the broader Japanese market. This suggests the stock is valued on the higher side relative to its closest competitors, but not excessively so.

The P/E ratio represents how much investors are paying for each yen of earnings. For banks, this is a crucial metric because it reflects expectations around future profitability and risk in a sector where growth is typically steady rather than explosive. In Hirogin Holdings’ case, the higher-than-average multiple may indicate that the market expects its recent earnings momentum to continue, but it could also suggest limited upside from current levels if future profit growth does not exceed expectations.

Notably, Hirogin Holdings' P/E ratio of 11.9x stands above the JP Banks industry average of 11.6x and the peer group average of 11.8x. This points to a premium that may be difficult to justify unless management can deliver sustained profit expansion. However, this multiple is still below the broader Japanese market P/E of 14.3x, offering some relative value. When compared to the estimated Fair Price-to-Earnings Ratio of 13.6x, the stock appears undervalued on a normalized basis. This could imply room for the valuation to move higher if the company's growth trajectory remains consistent.

Explore the SWS fair ratio for Hirogin Holdings

Result: Price-to-Earnings of 11.9x (ABOUT RIGHT)

However, stronger regulatory headwinds or a slowdown in net income growth could quickly challenge optimistic expectations and put pressure on Hirogin Holdings' premium valuation.

Find out about the key risks to this Hirogin Holdings narrative.

Another View: What Does the SWS DCF Model Suggest?

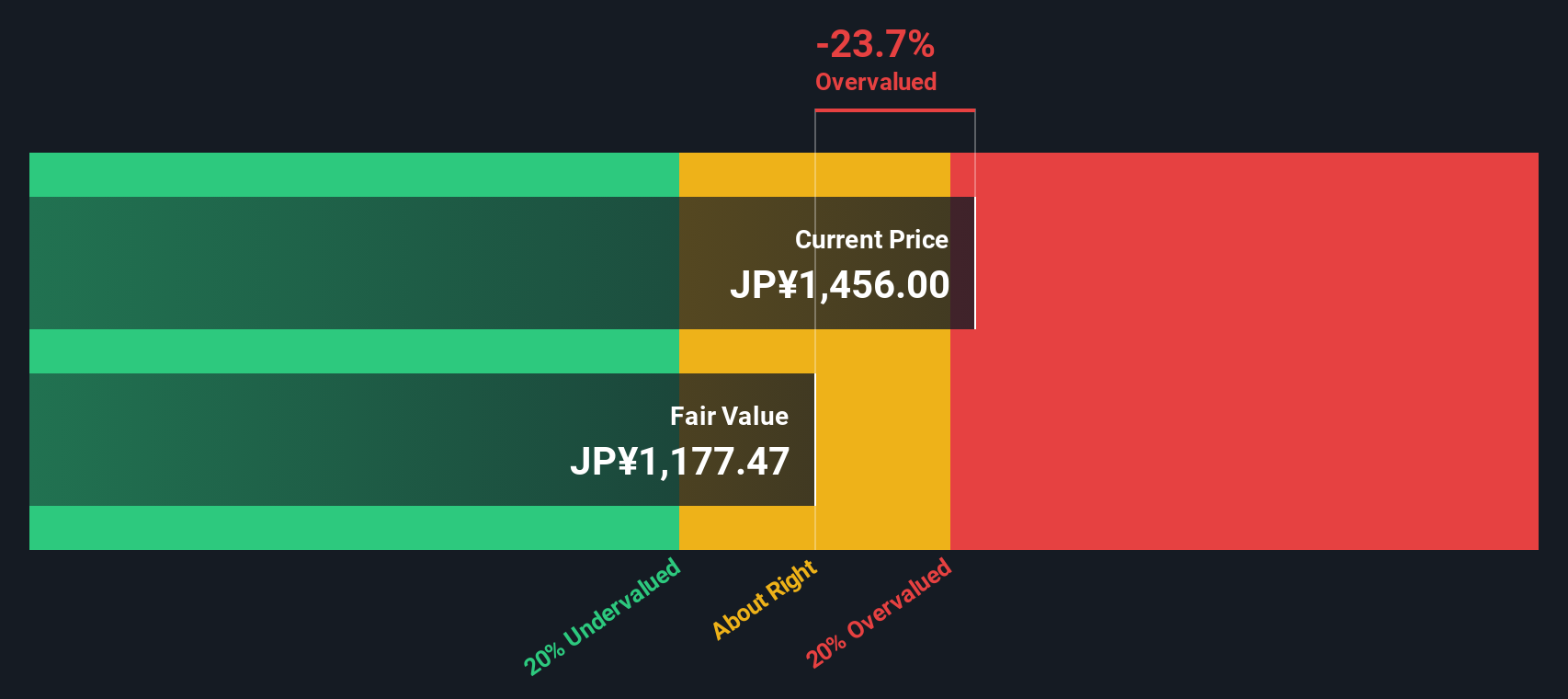

Taking a different approach, our SWS DCF model indicates Hirogin Holdings may be overvalued. Shares are trading at ¥1,461.5 compared to an estimated fair value of ¥1,177.46. This perspective challenges the earnings-based optimism and raises concerns about how much future growth is already priced in. Which approach should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hirogin Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 860 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hirogin Holdings Narrative

If you have your own insights or wish to dig deeper into the numbers, you can put your story together in just minutes. Do it your way

A great starting point for your Hirogin Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more standout investment ideas?

Don’t let great opportunities slip past your radar. Use the Simply Wall Street Screener to target unique growth themes, untapped bargains, or market shifts that most investors are missing out on.

- Capitalize on emerging trends in healthcare with AI by analyzing these 32 healthcare AI stocks to find companies making breakthroughs at the intersection of health and technology.

- Grow your portfolio’s income stream by reviewing these 17 dividend stocks with yields > 3% offering yields above 3% for steady and reliable returns.

- Position yourself ahead of tomorrow’s market movers by searching these 28 quantum computing stocks for companies advancing quantum computing and reshaping how industries operate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hirogin Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7337

Hirogin Holdings

Operates as a bank holding company for The Hiroshima Bank, Ltd.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives