- Japan

- /

- Auto Components

- /

- TSE:6473

3 Dividend Stocks To Consider With Yields Up To 8.5%

Reviewed by Simply Wall St

As global markets navigate a busy earnings season and mixed economic signals, major indexes like the S&P 500 and Nasdaq Composite have experienced volatility, with growth stocks generally lagging behind their value counterparts. Amidst these fluctuations, investors may find stability in dividend stocks, which can offer consistent income streams even when market conditions are uncertain. A good dividend stock typically combines a reliable payout history with strong financial health, making it an attractive option for those seeking income in today's unpredictable market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.69% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.19% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.12% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.48% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.93% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.57% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.83% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 2033 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

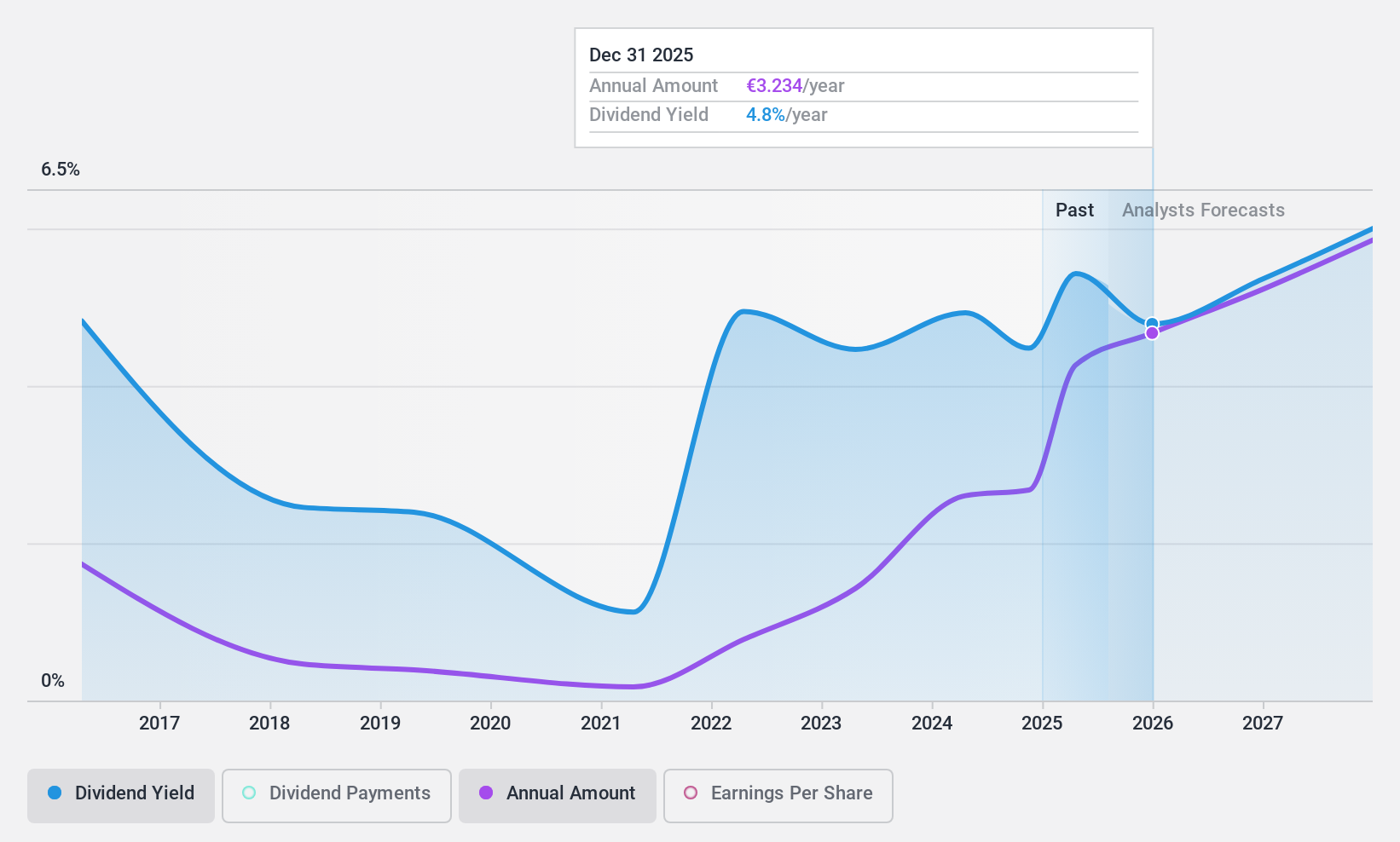

UniCredit (BIT:UCG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UniCredit S.p.A. is a commercial banking institution operating in Italy, Germany, Central Europe, and Eastern Europe with a market capitalization of €64.87 billion.

Operations: UniCredit S.p.A. generates revenue from its operations in Italy (€10.76 billion), Germany (€5.15 billion), Central Europe (€4.30 billion), Eastern Europe (€2.92 billion), and Russia (€1.28 billion).

Dividend Yield: 4.3%

UniCredit's dividend payments have been volatile and unreliable over the past decade, though they have grown overall. The current payout ratio of 30.6% suggests dividends are well covered by earnings, with future coverage expected to remain strong at 45.1%. Despite trading below estimated fair value and offering good relative value compared to peers, its dividend yield of 4.28% is lower than top-tier Italian payers. Recent M&A activities involving Commerzbank could impact financial stability considerations.

- Click to explore a detailed breakdown of our findings in UniCredit's dividend report.

- According our valuation report, there's an indication that UniCredit's share price might be on the cheaper side.

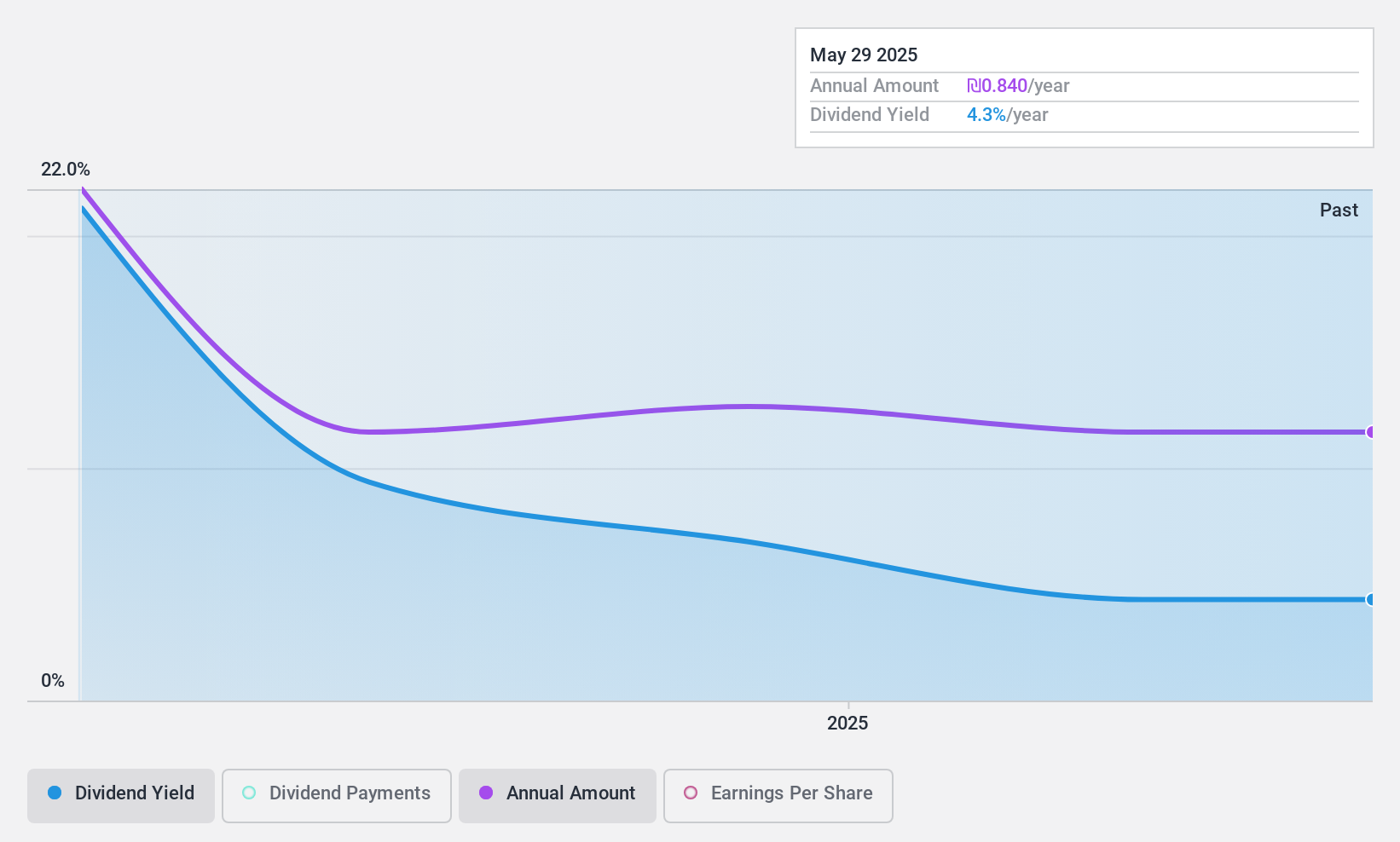

Meitav Trade Investments (TASE:MTRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Meitav Trade Investments Ltd offers financial investment services and has a market cap of ₪387.99 million.

Operations: Meitav Trade Investments Ltd generates revenue through its provision of financial investment services.

Dividend Yield: 8.6%

Meitav Trade Investments offers a dividend yield of 8.59%, placing it in the top 25% of Israeli dividend payers. The dividends are well covered by earnings, with a payout ratio of 29.1%, and cash flows, indicated by a cash payout ratio of 55%. However, the company's track record for dividends is unstable as they have only recently begun payments. Trading at 61.7% below estimated fair value suggests potential investment appeal despite uncertainties in dividend reliability.

- Click here and access our complete dividend analysis report to understand the dynamics of Meitav Trade Investments.

- In light of our recent valuation report, it seems possible that Meitav Trade Investments is trading behind its estimated value.

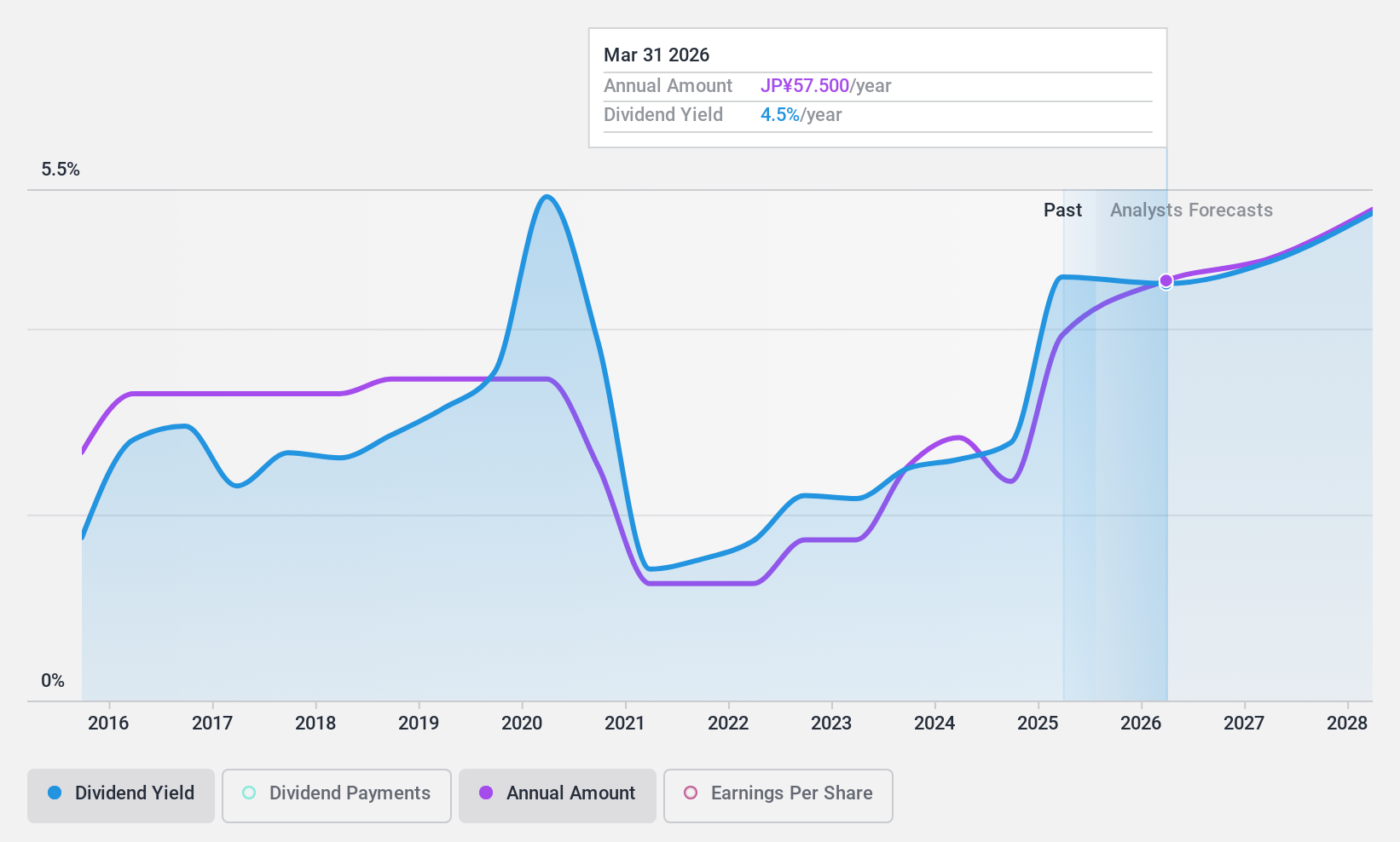

JTEKT (TSE:6473)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JTEKT Corporation manufactures and sells steering systems, driveline components, bearings, machine tools, electronic control devices, and home accessory equipment with a market cap of approximately ¥362.72 billion.

Operations: JTEKT Corporation's revenue is primarily derived from its Automotive segment at ¥1.35 billion, followed by Industrial and Bearings at ¥371.92 million, and Machine Tools at ¥217.34 million.

Dividend Yield: 4.7%

JTEKT's dividend yield of 4.73% ranks in the top 25% of Japanese payers but suffers from volatility and unreliable growth over the past decade. While the payout ratio appears reasonable at 66%, dividends are not well supported by free cash flows, evidenced by a high cash payout ratio of 463.6%. Recent board discussions indicate potential revisions to financial forecasts and dividends, highlighting ongoing uncertainties despite trading significantly below estimated fair value.

- Dive into the specifics of JTEKT here with our thorough dividend report.

- Our valuation report here indicates JTEKT may be overvalued.

Next Steps

- Investigate our full lineup of 2033 Top Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6473

JTEKT

Manufactures and sells steering systems, driveline components, bearings, machine tools, electronic control devices, home accessory equipment, etc.

Flawless balance sheet with reasonable growth potential and pays a dividend.