- Japan

- /

- Auto Components

- /

- TSE:5191

Sumitomo Riko (TSE:5191) Margin Gain Challenges Cautious Narrative Despite Profit Decline Forecast

Reviewed by Simply Wall St

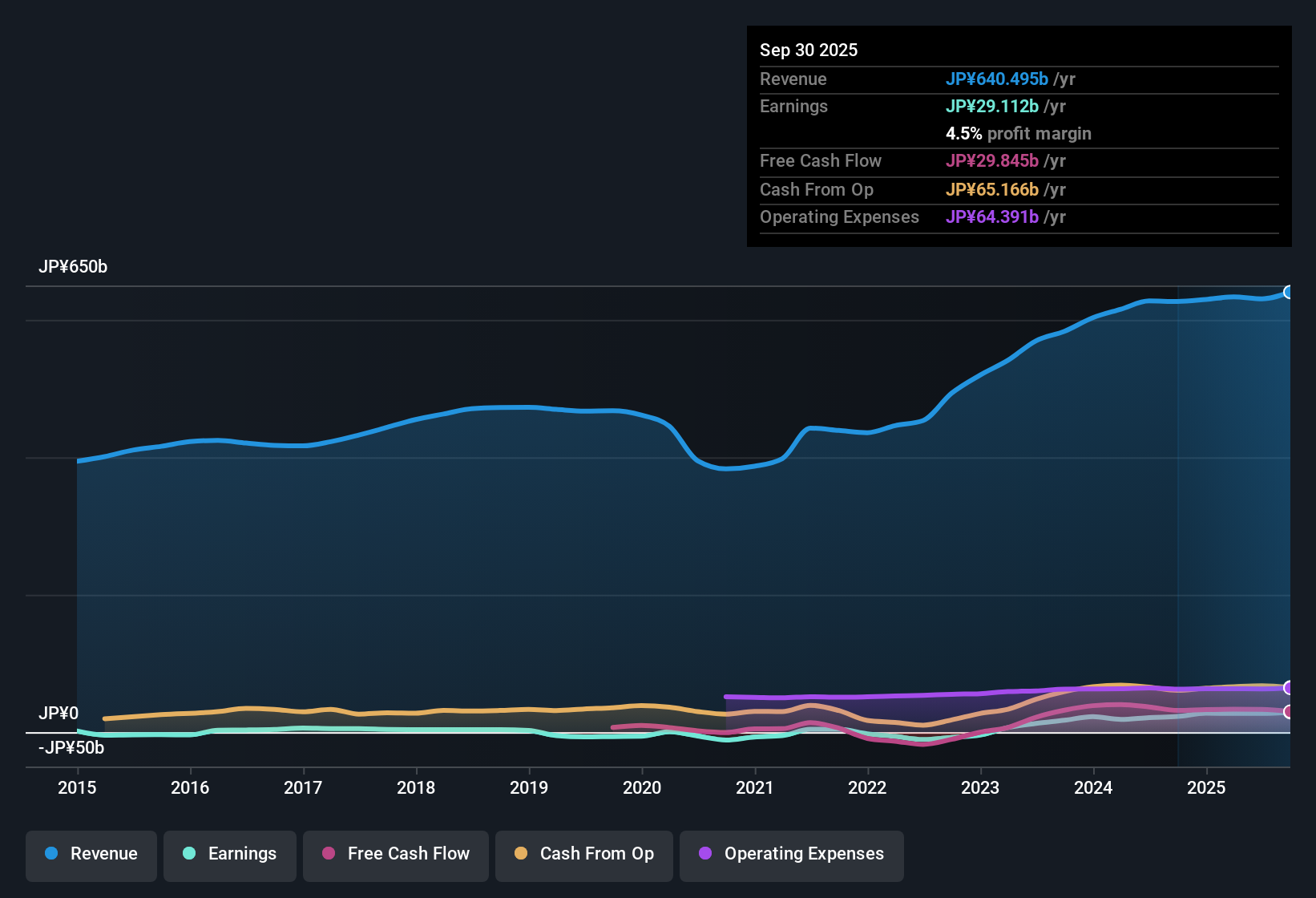

Sumitomo Riko (TSE:5191) posted net profit margins of 4.5%, up from 3.6% a year ago, capping off a notable period of profitability with five-year average annual earnings growth of 60.1%. That pace has moderated, with earnings up 27.4% over the past year but forecast to decline by an average of 5.5% annually for the next three years. Revenue is expected to lag the broader Japanese market’s growth. Shares currently trade at ¥2,617 with a price-to-earnings ratio of 9.3x, below both industry and peer averages. The discounted cash flow fair value sits at ¥1,160.75, suggesting the valuation may warrant closer scrutiny as investors weigh profit momentum against near-term headwinds.

See our full analysis for Sumitomo Riko.Up next, we will see how these headline results compare against the most widely followed market narratives and whether the numbers reinforce or challenge those expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Buck Market Weakness

- Net profit margins stand at 4.5%, maintaining a resilient level in the face of softer earnings growth, even as competitors in the auto components sector navigate choppy conditions and volatility.

- Stability continues to characterize Sumitomo Riko’s performance. This supports the narrative that positions the company as a "steady ship," considered a reliable pick when sector peers experience more dramatic swings.

- Margin preservation, coupled with high quality earnings, highlights operational reliability during a period of sector-wide supply chain adjustments.

- Absence of negative surprises in business updates further amplifies the conviction that Sumitomo Riko appeals to risk-averse investors prioritizing predictability.

Pace of Growth Slows Sharply

- Average annual earnings growth of 60.1% over the past five years now gives way to expectations for 5.5% per year declines in earnings over the next three years, with revenue growth also set to trail the Japanese market at just 1.4% per year versus the market’s 4.5% average.

- The shift from rapid expansion to forecast contraction highlights investor caution. Claims of “quiet outperformance” are coming under scrutiny as the company enters a period with few growth catalysts on the horizon.

- What is surprising is that despite the strong long-term trajectory, the near-term sentiment is shaped more by declining guidance and sector uncertainty than historical gains.

- Retail investors’ measured optimism faces a test, as modest growth projections may lead to the company being overlooked unless new developments emerge.

Valuation Discount Raises Questions

- Shares trade at a 9.3x price-to-earnings ratio, well below the sector average of 11.6x and peers at 21.7x. However, the current share price of ¥2,617 sits notably above the DCF fair value estimate of ¥1,160.75, suggesting the market may be pricing in more optimism than fundamentals support.

- This valuation gap stands out in the prevailing view of Sumitomo Riko as a “safe but unexciting” holding. Investors must weigh an attractive relative price against a fair value backdrop that implies muted upside unless operational momentum returns.

- The material discount to both industry and peer averages is counteracted by the market’s apparent willingness to pay a premium to DCF fair value in search of stability.

- Modest sector growth and lack of speculative enthusiasm mean there is little evidence for a valuation-driven surge unless significant positive catalysts arrive.

To see recent valuation shifts and compare how Sumitomo Riko stacks up with other companies, check the full calculation and see the story unfold in your watchlist: Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sumitomo Riko for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 834 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Sumitomo Riko's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Sumitomo Riko’s rapid earnings growth has reversed to forecast declines. Revenue is expected to underperform the market, and valuation concerns have come to the fore.

If uncertain fair value or weak upside keeps you cautious, target better prospects by searching for these 834 undervalued stocks based on cash flows that the market may be missing right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5191

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives