- Japan

- /

- Auto Components

- /

- TSE:3569

Seiren (TSE:3569): Evaluating Valuation After Strong Recent Share Price Momentum

Reviewed by Simply Wall St

SeirenLtd (TSE:3569) has been on the radar for many investors lately after a stretch of price moves that, while lacking headline-grabbing announcements, may still be signaling something worth a second look. Sometimes, it is these subtle shifts rather than bold events that get seasoned investors curious. After all, not every meaningful opportunity comes with a flashing sign. The latest activity has raised the question of whether the market is quietly realigning its expectations for SeirenLtd's future.

Looking at the bigger picture, SeirenLtd’s shares have climbed 21% over the past year, with even stronger momentum building this past quarter. The stock jumped 36% in the past 3 months, far outpacing its performance earlier in the year. There has not been a major event driving this acceleration, but when a company's price starts moving ahead of clear catalysts, it is often a sign that investors are re-evaluating its prospects based on factors like underlying earnings growth or shifts in industry outlook.

The real question now is whether SeirenLtd’s stock is a bargain for value-focused buyers, or if recent gains have already baked in any upside on the horizon. Has the opportunity passed, or is there more room to run?

Price-to-Earnings of 12.7x: Is it justified?

Based on the current price-to-earnings (P/E) ratio, SeirenLtd is trading at 12.7 times its earnings. This figure is higher than the average P/E for the JP Auto Components industry, which sits at 11.3x, and above what is estimated to be a fair P/E for the company itself at 10.2x.

The price-to-earnings ratio compares a company's current share price to its per-share earnings. For investors in the auto components sector, it serves as a standard measure for assessing whether a stock is priced reasonably, especially relative to its peers and historical averages.

SeirenLtd appears expensive when judged by these earnings metrics. This could mean the stock’s recent run is factoring in expectations for continued outperformance or future growth that has not yet fully materialized in the company’s numbers. Investors should consider if this premium is warranted by underlying fundamentals or signals an overheated short-term market sentiment.

Result: Fair Value of ¥3,649.6 (OVERVALUED)

See our latest analysis for SeirenLtd.However, slowing revenue growth or a shift in industry sentiment could quickly challenge the stock’s recent momentum and its current valuation premium.

Find out about the key risks to this SeirenLtd narrative.Another View: What Does Our DCF Model Say?

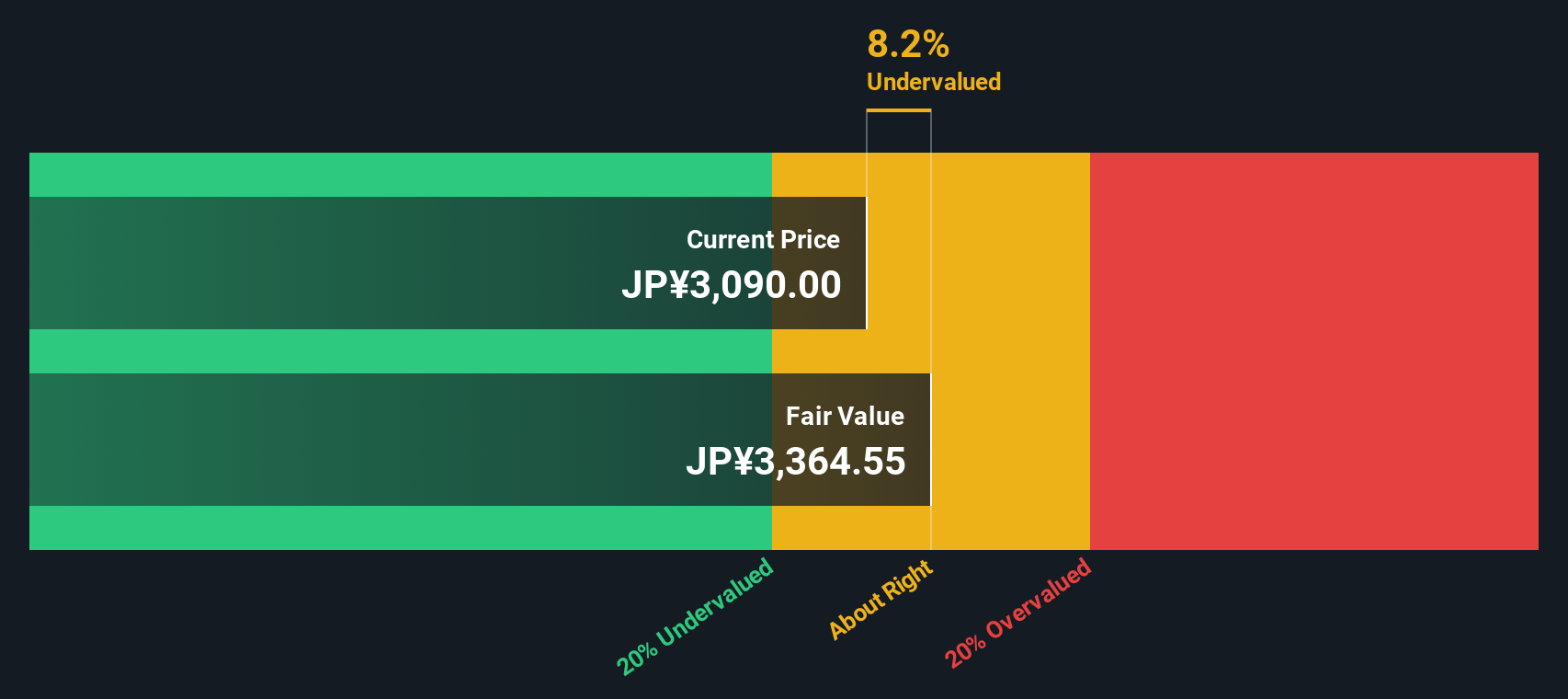

Taking a step back from earnings multiples, the SWS DCF model offers a fresh perspective and suggests SeirenLtd is actually undervalued. This challenges the earlier impression given by standard metrics. Could this difference reveal a hidden opportunity or signal more clouds ahead?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own SeirenLtd Narrative

If you see things differently, or would rather dig into the numbers firsthand, you can easily put together your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding SeirenLtd.

Looking for more investment ideas?

Don’t limit yourself to just one opportunity. The market offers a variety of standout options. If you want to move ahead, consider these ideas:

- Tap into technology’s next wave by spotting early-stage companies poised for growth with penny stocks with strong financials.

- Secure reliable income streams by finding companies offering generous yields above 3% through dividend stocks with yields > 3%.

- Stay ahead of Wall Street by tracking stocks that are undervalued based on strong cash flow fundamentals using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3569

SeirenLtd

Manufactures and markets textile products, industrial machines, and electronic parts in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives