- Japan

- /

- Auto Components

- /

- TSE:3116

Toyota Boshoku (TSE:3116): Evaluating Valuation After New Earnings Guidance and Dividend Confirmation

Reviewed by Simply Wall St

Toyota Boshoku (TSE:3116) just released its earnings guidance for the year ending March 2026, providing projections for revenue, profits, and earnings per share. The company also confirmed an interim dividend for shareholders.

See our latest analysis for Toyota Boshoku.

Toyota Boshoku’s latest guidance and dividend confirmation have caught investors’ attention, as seen in its strong momentum this year. The share price is up nearly 15% since January, with a one-year total shareholder return of over 20%. Long-term holders have fared even better, with an 85% total return over five years.

If you’re interested in what else is accelerating in the auto space, why not see the full lineup of opportunities with our See the full list for free.

As Toyota Boshoku shares continue their run with solid financial guidance and a shareholder-friendly dividend, the key question remains: Is the stock still trading at an attractive valuation, or is anticipated growth already reflected in the price?

Price-to-Earnings of 20.1x: Is it justified?

Toyota Boshoku is currently trading at a price-to-earnings (P/E) ratio of 20.1x, which is nearly double the industry average. This suggests that investors are willing to pay a premium for the company's future earnings potential compared to other auto components companies in Japan.

The P/E ratio is an important valuation tool, especially for cyclical sectors like auto components. It measures how much investors are paying for each yen of earnings. A higher ratio often means expectations for future growth, but it can also signal over-optimism.

At 20.1x, the company stands out as expensive versus the Japanese auto components sector average of just 10.9x and a peer group average of 11.2x. However, relative to its estimated fair P/E ratio of 20.3x, the current multiple looks justifiable. This indicates that, despite looking expensive compared to competitors, the current valuation aligns with what might be considered fair for the company’s outlook.

Explore the SWS fair ratio for Toyota Boshoku

Result: Price-to-Earnings of 20.1x (ABOUT RIGHT)

However, slowing revenue growth and potential pressure on profit margins could challenge the current valuation if earnings momentum falters in upcoming quarters.

Find out about the key risks to this Toyota Boshoku narrative.

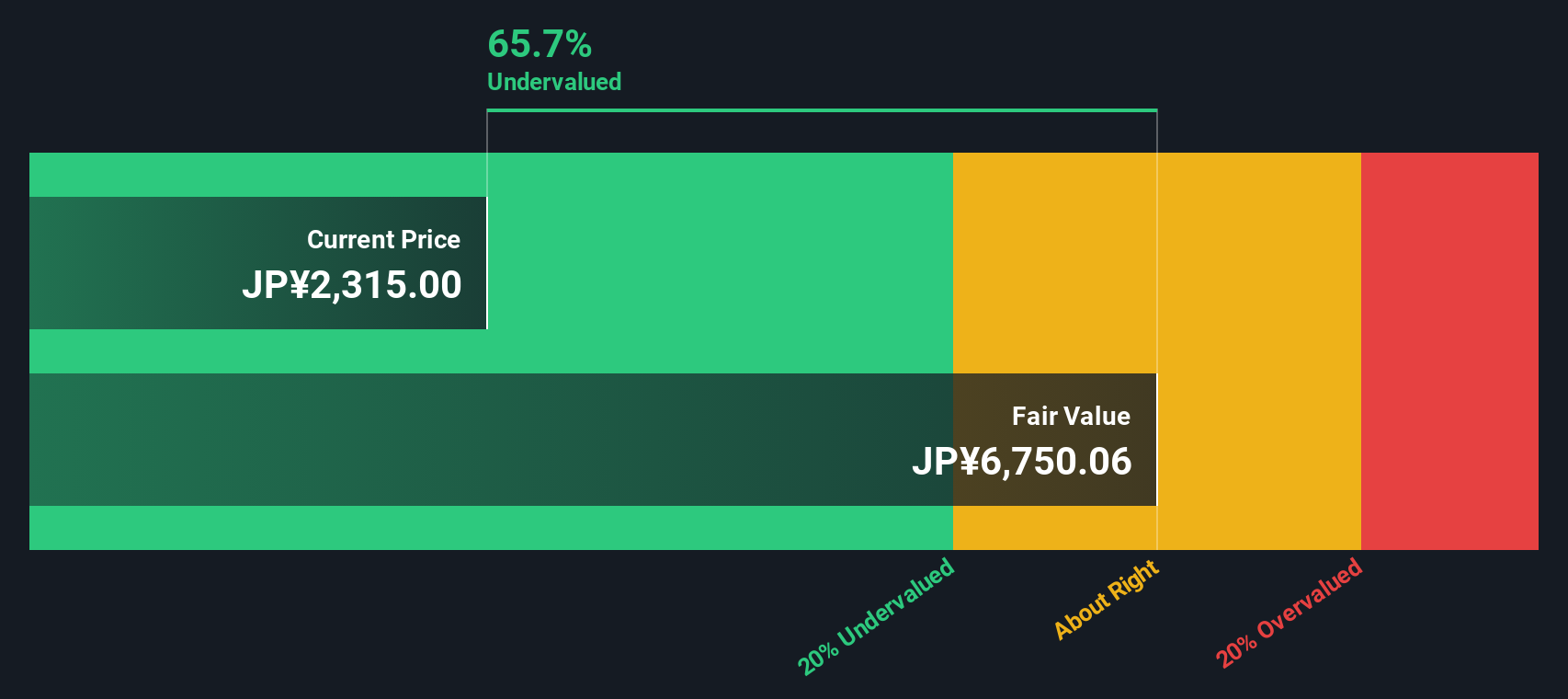

Another View: DCF Model Suggests a Different Story

While the P/E ratio paints Toyota Boshoku as fairly priced, our SWS DCF model tells a more optimistic tale. According to the DCF valuation, the current share price is significantly below estimated fair value, which suggests that the stock could be deeply undervalued. Does this gap signal a genuine opportunity, or is the market cautious for a reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toyota Boshoku for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 861 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toyota Boshoku Narrative

If you see things differently, or would rather investigate the figures for yourself, you can craft your own assessment in just a few minutes. Do it your way

A great starting point for your Toyota Boshoku research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more stock market opportunities?

Why stick with just one stock when there is a world of high-potential ideas to explore? Make your next smart move and choose what fits your strategy best.

- Tap into above-average yields and steady income streams by screening for these 17 dividend stocks with yields > 3% that offer generous dividend payouts and robust fundamentals.

- Pursue the next wave of technological breakthroughs by getting in early with these 25 AI penny stocks leading advancements in artificial intelligence and automation innovation.

- Seize significant potential with these 861 undervalued stocks based on cash flows trading below their intrinsic value, before the rest of the market recognizes the opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyota Boshoku might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3116

Toyota Boshoku

Develops, manufactures, and sells automotive interior systems in Japan, the United States, China, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives