- Italy

- /

- Other Utilities

- /

- BIT:ACE

Is ACEA (BIT:ACE) Undervalued? A Fresh Look at the Utility’s Investment Appeal

Reviewed by Simply Wall St

Most Popular Narrative: 12.9% Undervalued

According to the most widely followed narrative, ACEA’s shares are currently trading at a notable discount to analysts’ calculated fair value. This suggests the stock may be undervalued if base case assumptions are realized.

Ongoing and accelerated investment in renewable energy (notably solar and waste-to-energy), along with a clear commitment to circular economy infrastructure, are set to position ACEA to capture tailwinds from European decarbonization mandates and green infrastructure stimulus. These factors are likely to boost both revenue growth and EBITDA margins.

Curious how this outlook leads to a price target above today’s market price? The valuation rests on projected cash flows and profit margins that few expect from a typical utility. ACEA’s future earnings potential hinges on bold capital allocation plans and operational shifts. Want to see what specific assumptions are powering such an ambitious target? Discover the numbers and projections that have drawn so much attention.

Result: Fair Value of €22.8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, any adverse changes in Italian regulations or delays to key infrastructure projects could quickly undermine the current fair value outlook for ACEA.

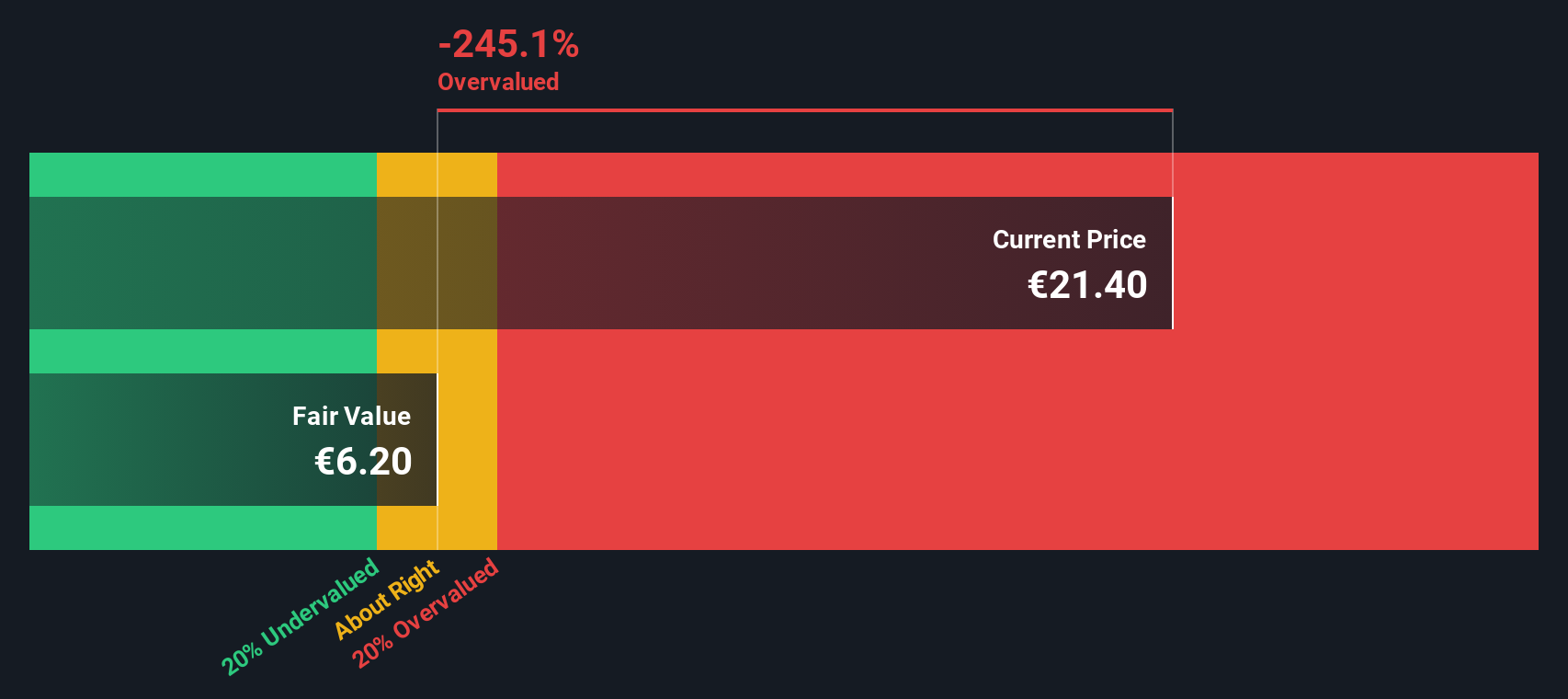

Find out about the key risks to this ACEA narrative.Another View: Our DCF Model

While analysts lean on future earnings and market ratios, a look through the lens of our DCF model offers a second opinion. This method also finds ACEA undervalued, but does it tell the whole story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ACEA for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ACEA Narrative

Not convinced by these perspectives or eager to dig into the details yourself? It takes just a few minutes to craft your own view, your way with Do it your way.

A great starting point for your ACEA research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

You’re just a click away from uncovering fresh opportunities beyond ACEA. Don’t let smart possibilities pass you by. These handpicked themes could help you spot your next winner:

- Uncover income potential by targeting companies with healthy payouts and track records of steady growth through dividend stocks with yields > 3%.

- Jump ahead of emerging disruption by following innovators at the forefront of artificial intelligence advances using AI penny stocks.

- Focus on strong fundamentals and compelling price tags with our curated list of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BIT:ACE

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives