European Stocks Trading Below Estimated Value In November 2025

Reviewed by Simply Wall St

As the European market navigates a period of mixed performance, with the STOXX Europe 600 Index recently pulling back after reaching new highs, investors are keenly observing opportunities that may arise from fluctuating interest rate expectations and economic growth indicators. In this context, identifying stocks trading below their estimated value can be particularly appealing, as these investments might offer potential for appreciation when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| STEICO (XTRA:ST5) | €19.72 | €39.39 | 49.9% |

| Roche Bobois (ENXTPA:RBO) | €35.40 | €69.90 | 49.4% |

| Recupero Etico Sostenibile (BIT:RES) | €6.42 | €12.84 | 50% |

| PVA TePla (XTRA:TPE) | €24.02 | €47.55 | 49.5% |

| NEUCA (WSE:NEU) | PLN790.00 | PLN1553.92 | 49.2% |

| E-Globe (BIT:EGB) | €0.66 | €1.30 | 49.4% |

| doValue (BIT:DOV) | €2.64 | €5.20 | 49.3% |

| Daldrup & Söhne (XTRA:4DS) | €15.80 | €31.43 | 49.7% |

| B&S Group (ENXTAM:BSGR) | €5.94 | €11.83 | 49.8% |

| Atea (OB:ATEA) | NOK149.40 | NOK298.49 | 49.9% |

Let's dive into some prime choices out of the screener.

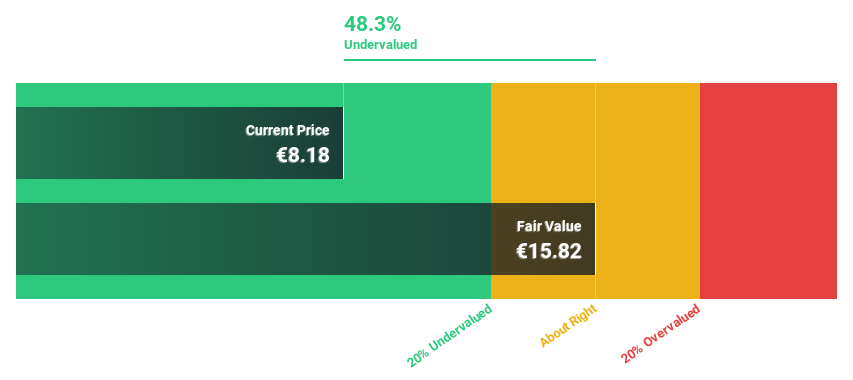

A.L.A. società per azioni (BIT:ALA)

Overview: A.L.A. società per azioni is a supply chain solutions provider serving the aerospace, defense, rail, and high-tech sectors with a market cap of €325.08 million.

Operations: The company's revenue is derived from several segments, including Production (€28.40 million), Distribution (€141.74 million), On Site Assembly (€3.14 million), and Service Providers (€144.00 million).

Estimated Discount To Fair Value: 32.8%

A.L.A. società per azioni appears undervalued based on cash flows, trading at €36 compared to a fair value estimate of €53.59. Despite a dividend not fully covered by free cash flow, revenue and earnings are forecasted to grow faster than the Italian market. Recent M&A activity includes H.I.G. Capital acquiring significant stakes with plans for delisting, highlighting strategic interest in the company amidst its financial growth trajectory and potential valuation gap closure.

- Our growth report here indicates A.L.A. società per azioni may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of A.L.A. società per azioni stock in this financial health report.

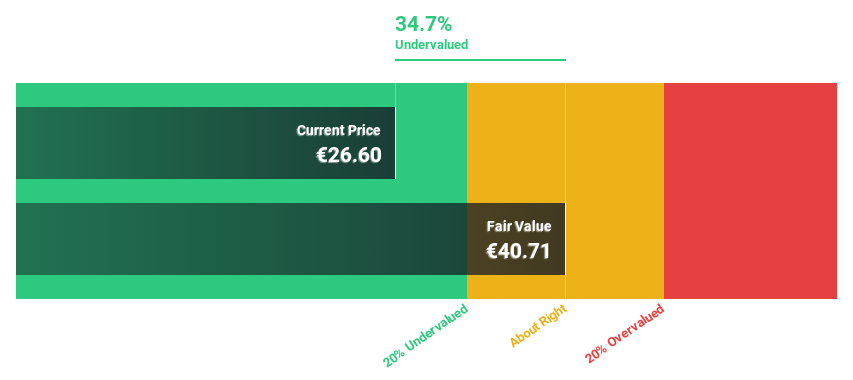

Tinexta (BIT:TNXT)

Overview: Tinexta S.p.A., along with its subsidiaries, offers digital trust, cybersecurity, and business innovation services across various regions including Italy, France, Spain, the rest of the EU, the United Kingdom, and the UAE; it has a market cap of €676.44 million.

Operations: The company's revenue is primarily derived from its Digital Trust segment at €212.13 million, followed by Business Innovation at €158.62 million and Cybersecurity at €127.16 million.

Estimated Discount To Fair Value: 12.8%

Tinexta is trading at €14.74, below its fair value estimate of €16.91, indicating it may be undervalued based on cash flows despite a high debt level and unstable dividend track record. Earnings are projected to grow significantly at 36% annually, outpacing the Italian market's growth rate and supporting its valuation potential. However, large one-off items have impacted financial results, and revenue growth is expected to be moderate at 7% per year.

- According our earnings growth report, there's an indication that Tinexta might be ready to expand.

- Click to explore a detailed breakdown of our findings in Tinexta's balance sheet health report.

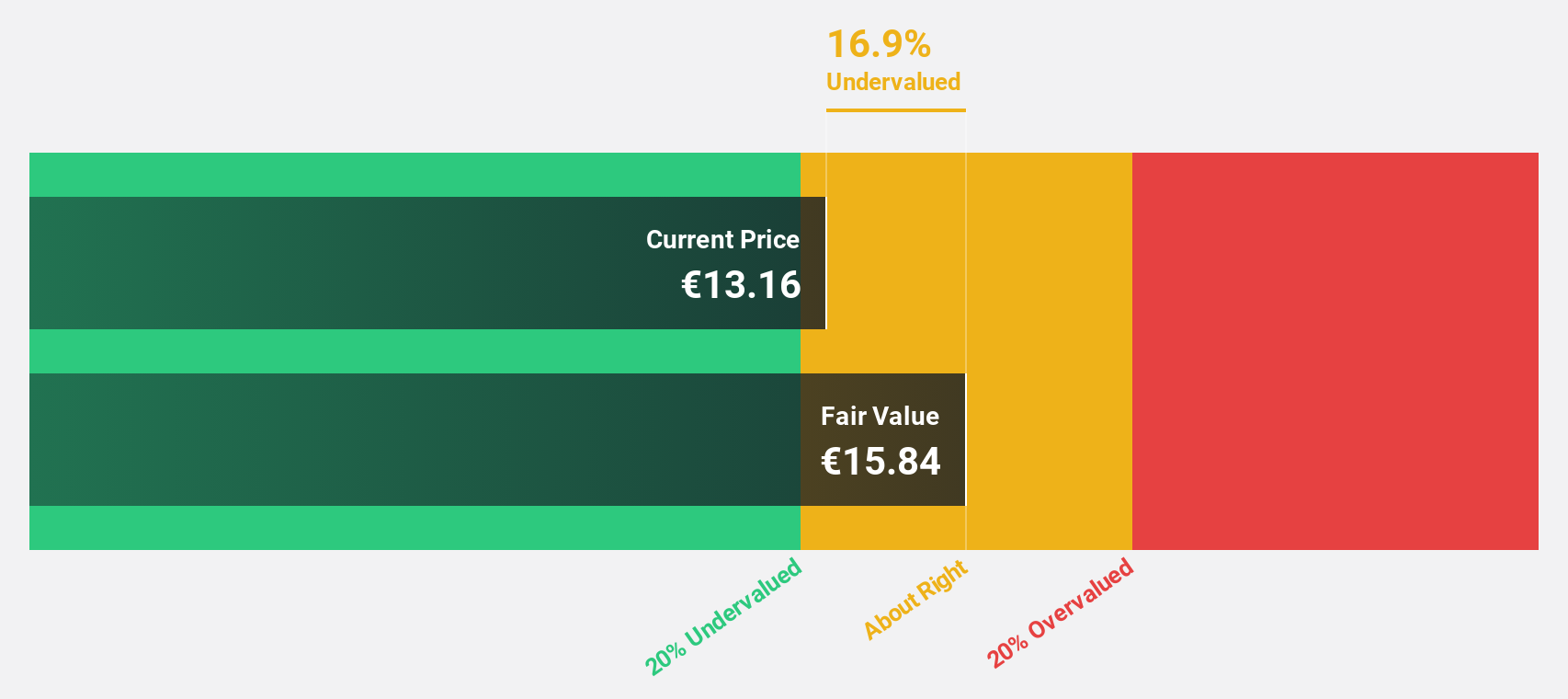

Semperit Holding (WBAG:SEM)

Overview: Semperit Holding is a global company that develops, produces, and sells rubber products for the medical and industrial sectors, with a market cap of €263.34 million.

Operations: The company's revenue is generated from its Semperit Engineered Applications segment, contributing €364.57 million, and its Semperit Industrial Applications segment, which accounts for €287.20 million.

Estimated Discount To Fair Value: 13.8%

Semperit Holding, trading at €12.8, is below its fair value estimate of €14.84 and offers good relative value compared to peers. Despite recent index exclusion and a net loss of €4 million in Q2 2025, the company is forecasted to achieve profitability within three years with earnings growing at 98.86% annually. However, its dividend yield of 3.91% lacks coverage by earnings, and revenue growth remains modest at 7.6% per year against market averages.

- The growth report we've compiled suggests that Semperit Holding's future prospects could be on the up.

- Dive into the specifics of Semperit Holding here with our thorough financial health report.

Summing It All Up

- Investigate our full lineup of 186 Undervalued European Stocks Based On Cash Flows right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:SEM

Semperit Holding

Develops, produces, and sells rubber products for the medical and industrial sectors worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives