Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SHSE:688539

High Growth Tech Stocks To Watch For Promising Expansion

Reviewed by Simply Wall St

As global markets respond to rising U.S. Treasury yields, with the S&P 500 Index experiencing a slight decline and the tech-heavy Nasdaq Composite Index showing resilience, investors are closely watching economic indicators that suggest a cautious monetary policy approach by central banks worldwide. In this environment, identifying high growth tech stocks that demonstrate robust potential for expansion involves looking at companies with innovative technologies and strong market positioning capable of navigating these macroeconomic challenges effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Alkami Technology | 21.90% | 101.89% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.21% | 70.72% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 28.78% | 72.86% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1280 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Datalogic (BIT:DAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Datalogic S.p.A. is a global company that specializes in the manufacturing and sale of automatic data capture and process automation products, with a market capitalization of €319.20 million.

Operations: With a revenue of €475.89 million, Datalogic focuses on automatic data capture and process automation products globally.

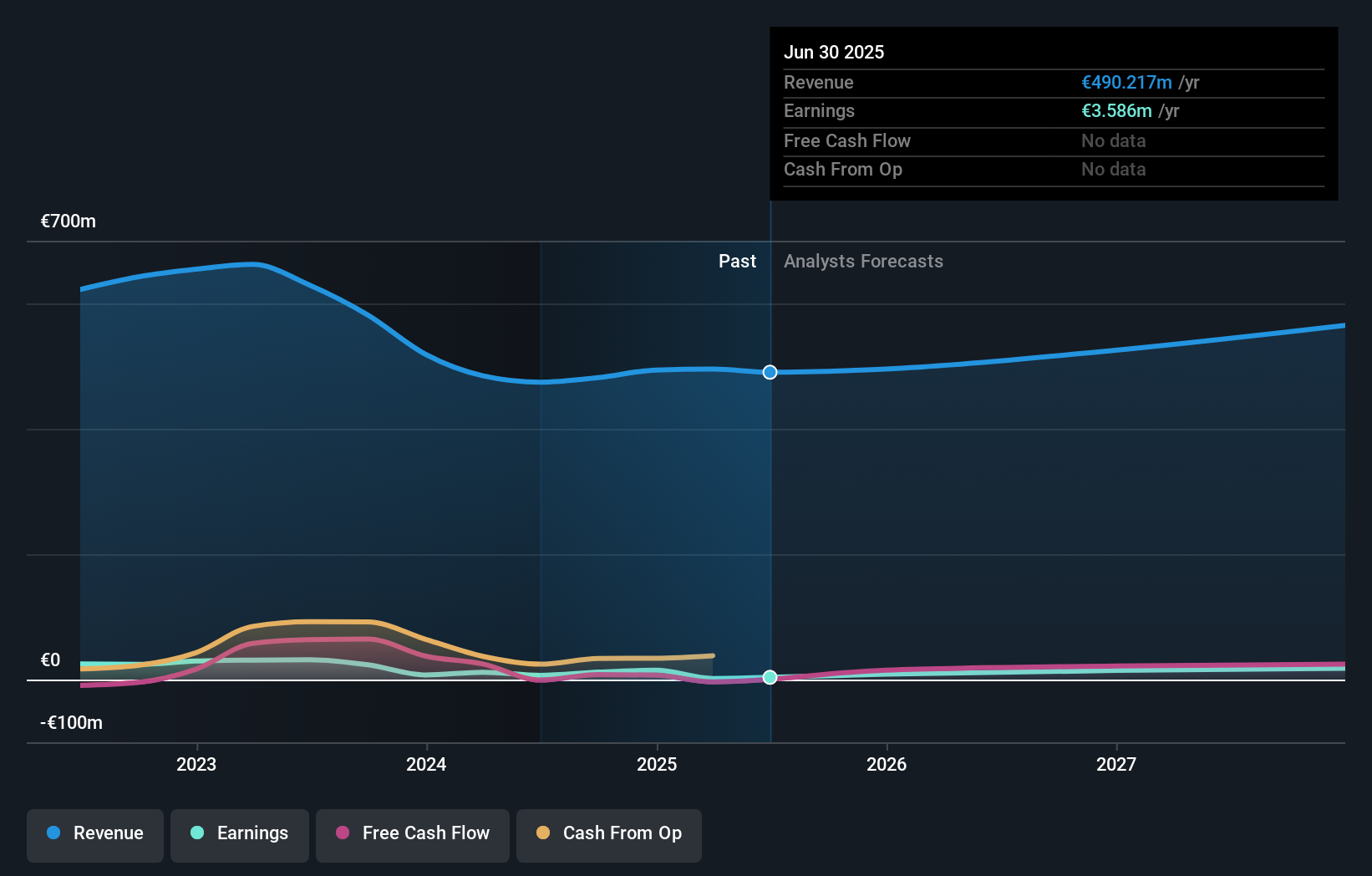

Datalogic S.p.A. has demonstrated resilience with a forecasted revenue growth of 7.1% per year, outpacing the Italian market's 4.1%. Despite a challenging past year where earnings fell by 71.8%, the company's commitment to innovation is evident in its R&D expenditures, which remain robust in comparison to industry norms. The recent earnings report highlighted a dip in net income from EUR 12.11 million to EUR 8.87 million year-over-year; however, Datalogic is poised for recovery with significant projected earnings growth of 41.74% annually, showcasing potential rebound and adaptation strategies within the tech sector. The firm's strategic focus on research and development is crucial for maintaining competitiveness, especially given its lower than average return on equity forecast at 7.8% in three years' time—a figure that underscores the need for continued investment in innovation to drive future performance enhancements and market share gains within high-tech industries.

- Click to explore a detailed breakdown of our findings in Datalogic's health report.

Assess Datalogic's past performance with our detailed historical performance reports.

Perfect Presentation for Commercial Services (SASE:7204)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Perfect Presentation for Commercial Services Company is an ICT services and technology solutions provider based in the Kingdom of Saudi Arabia, with a market cap of SAR4.34 billion.

Operations: The company generates revenue primarily through Software Licenses and Development Services (SAR398.64 million), Operation and Maintenance Services (SAR376.09 million), Call Centre Services, and Management Services. A significant portion of its business is driven by the ICT services sector within Saudi Arabia.

Perfect Presentation for Commercial Services has shown a robust growth trajectory, with its revenue surging by 17.7% annually, outpacing the Saudi market's average of just 1.3%. This growth is underpinned by significant R&D investments, reflecting a strategic emphasis on innovation to maintain competitiveness in the tech sector. The company's earnings have also seen an impressive increase, with a forecasted annual growth rate of 20.3%, suggesting strong future prospects despite not leading the high-growth tech category outright. Recent financials reveal a solid performance with second-quarter sales reaching SAR 287.14 million and net income climbing to SAR 58.77 million, demonstrating effective operational execution and market adaptation amidst evolving industry dynamics.

- Take a closer look at Perfect Presentation for Commercial Services' potential here in our health report.

Understand Perfect Presentation for Commercial Services' track record by examining our Past report.

NanJing GOVA Technology (SHSE:688539)

Simply Wall St Growth Rating: ★★★★★☆

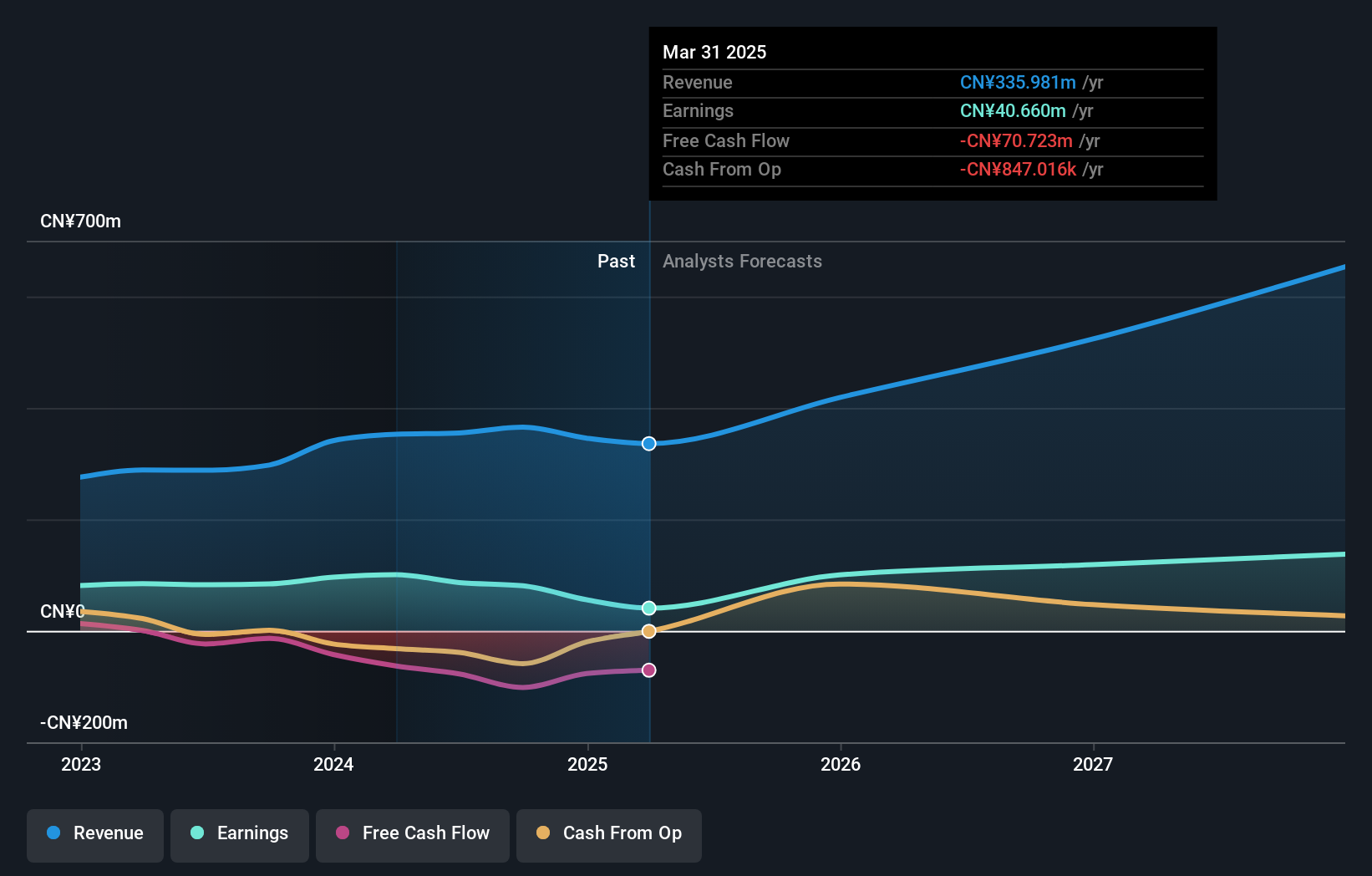

Overview: NanJing GOVA Technology Co., Ltd. focuses on the research, design, development, production, and sale of sensors and sensor network systems in China with a market capitalization of CN¥4.54 billion.

Operations: The company generates revenue primarily from its Electronic Test & Measurement Instruments segment, contributing CN¥355.15 million.

NanJing GOVA Technology, amidst a competitive tech landscape, has demonstrated a robust growth pattern, with revenue projections rising by 26.6% annually and earnings expected to surge by 32.6%. This performance outstrips the broader Chinese market's averages significantly. The company's commitment to innovation is evident in its R&D spending trends, which are strategically aligned with its growth trajectory—ensuring it remains at the forefront of technological advancements despite not being the top player in high-growth tech sectors. Recent buyback activities underscore confidence in their strategic direction, with 479,123 shares repurchased for CNY 10.27 million as part of an ongoing effort to enhance shareholder value through careful capital management practices.

Turning Ideas Into Actions

- Unlock our comprehensive list of 1280 High Growth Tech and AI Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NanJing GOVA Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688539

NanJing GOVA Technology

Engages in the research, design, development, production, and sale of sensors and sensor network systems in China.