Do These 3 Checks Before Buying Wiit S.p.A. (BIT:WIIT) For Its Upcoming Dividend

Wiit S.p.A. (BIT:WIIT) stock is about to trade ex-dividend in three days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Therefore, if you purchase Wiit's shares on or after the 25th of April, you won't be eligible to receive the dividend, when it is paid on the 27th of April.

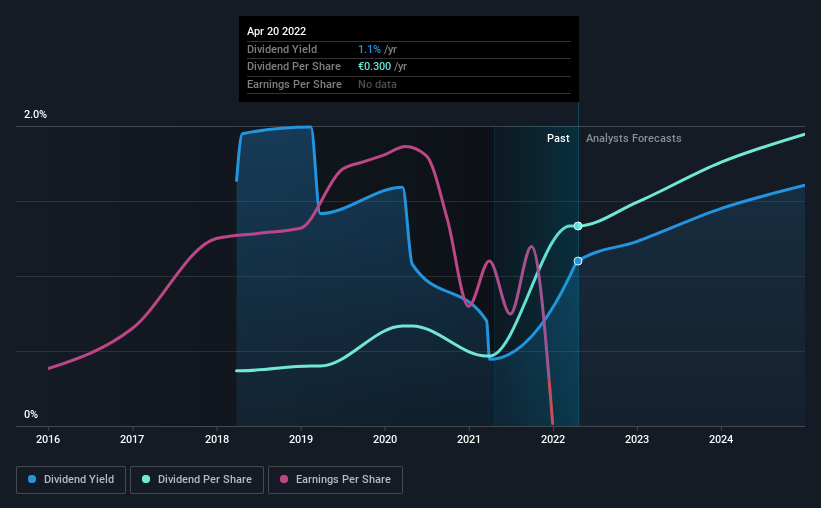

The company's next dividend payment will be €0.30 per share, and in the last 12 months, the company paid a total of €0.30 per share. Last year's total dividend payments show that Wiit has a trailing yield of 1.1% on the current share price of €27.28. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for Wiit

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Wiit lost money last year, so the fact that it's paying a dividend is certainly disconcerting. There might be a good reason for this, but we'd want to look into it further before getting comfortable. Considering the lack of profitability, we also need to check if the company generated enough cash flow to cover the dividend payment. If cash earnings don't cover the dividend, the company would have to pay dividends out of cash in the bank, or by borrowing money, neither of which is long-term sustainable. It paid out 21% of its free cash flow as dividends last year, which is conservatively low.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Wiit was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last five years, making us wonder if the dividend is sustainable at all.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Wiit has delivered an average of 38% per year annual increase in its dividend, based on the past four years of dividend payments.

Remember, you can always get a snapshot of Wiit's financial health, by checking our visualisation of its financial health, here.

Final Takeaway

Is Wiit worth buying for its dividend? It's hard to get used to Wiit paying a dividend despite reporting a loss over the past year. At least the dividend was covered by free cash flow, however. Bottom line: Wiit has some unfortunate characteristics that we think could lead to sub-optimal outcomes for dividend investors.

So if you're still interested in Wiit despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. To that end, you should learn about the 3 warning signs we've spotted with Wiit (including 1 which is a bit unpleasant).

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Wiit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:WIIT

Wiit

Provides cloud services for various businesses in Italy and internationally.

High growth potential with questionable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026