- Italy

- /

- Healthcare Services

- /

- BIT:SRI

Servizi Italia's (BIT:SRI) one-year earnings growth trails the respectable shareholder returns

Passive investing in index funds can generate returns that roughly match the overall market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Servizi Italia S.p.A. (BIT:SRI) share price is up 55% in the last 1 year, clearly besting the market return of around 14% (not including dividends). That's a solid performance by our standards! Zooming out, the stock is actually down 14% in the last three years.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

See our latest analysis for Servizi Italia

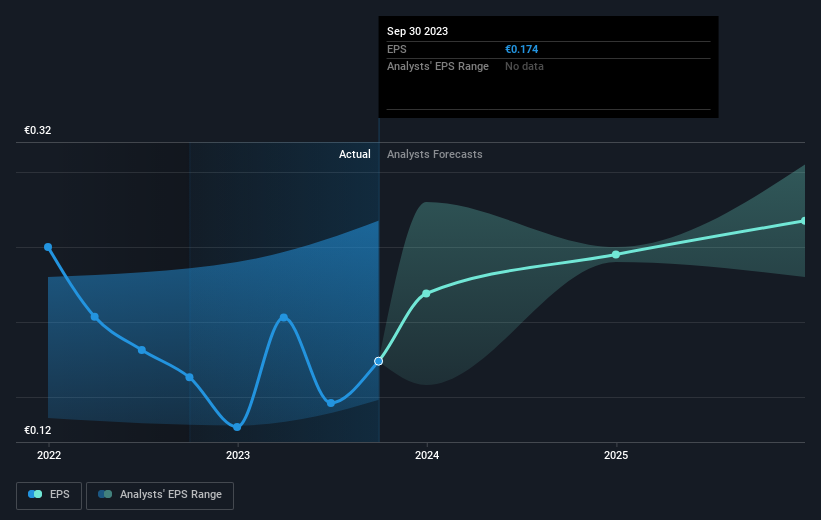

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Servizi Italia grew its earnings per share (EPS) by 6.6%. The share price gain of 55% certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Servizi Italia has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that Servizi Italia shareholders have received a total shareholder return of 55% over one year. That certainly beats the loss of about 7% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Servizi Italia (2 shouldn't be ignored) that you should be aware of.

Of course Servizi Italia may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Italian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:SRI

Servizi Italia

Provides wash-hire and sterilization services in Italy, Turkey, and Brazil.

Proven track record and fair value.