Stock Analysis

- Italy

- /

- Healthtech

- /

- BIT:GPI

Exploring None High Growth Tech Stocks with Promising Potential

Reviewed by Simply Wall St

The global markets have recently experienced notable gains, with key indices such as the Dow Jones Industrial Average and the S&P 500 Index reaching record intraday highs, while small-cap stocks like those in the Russell 2000 Index have also joined this upward trend. In this environment of heightened market activity and geopolitical influences, identifying high-growth tech stocks with promising potential involves looking for companies that demonstrate robust innovation capabilities and resilience to economic shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.34% | ★★★★★★ |

Click here to see the full list of 1284 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

GPI (BIT:GPI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GPI S.p.A. provides social-healthcare IT and hi-tech services for healthcare markets both in Italy and internationally, with a market cap of approximately €314.03 million.

Operations: GPI S.p.A. generates revenue primarily from its Software and Care segments, with the Software segment contributing €283.27 million and the Care segment adding €161.11 million. The company focuses on delivering IT services and hi-tech solutions tailored to the healthcare industry across Italy and international markets.

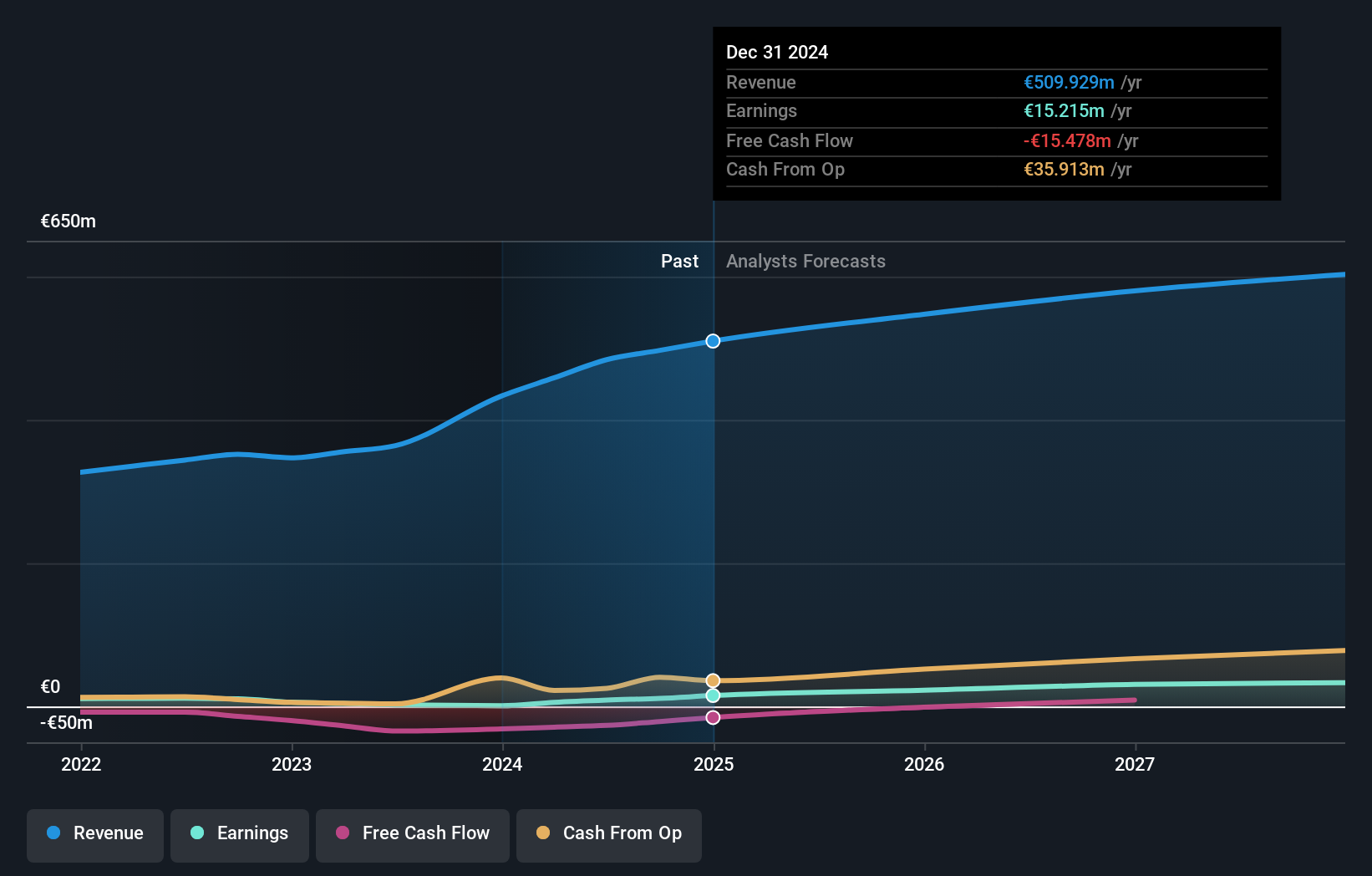

GPI S.p.A. recently showcased its robust financial recovery and strategic direction at various forums, including the CIC Market Solutions Forum in Paris. The company reported a significant turnaround with net income reaching €85.9 million for the first half of 2024, up from a net loss just a year prior, demonstrating effective operational adjustments and market adaptation. This resurgence is underpinned by an impressive 280.3% growth in earnings over the past year and forecasts suggest GPI's earnings will continue to grow by 35.2% annually, outpacing the Italian market's average of 7.1%. Despite challenges in covering interest payments with earnings, GPI’s commitment to innovation is evident in its R&D investments which are crucial for sustaining long-term growth in the competitive tech landscape. Moreover, GPI’s revenue growth projection stands at 6.4% per year, indicating a solid trajectory compared to Italy's overall market growth rate of 4.1%. This performance is especially notable given recent global economic pressures on tech sectors where continuous innovation plays a pivotal role; hence GPI’s focus on enhancing their R&D capabilities could significantly influence their future market position and stability within high-growth technology sectors.

- Navigate through the intricacies of GPI with our comprehensive health report here.

Gain insights into GPI's past trends and performance with our Past report.

Forth Corporation (SET:FORTH)

Simply Wall St Growth Rating: ★★★★★★

Overview: Forth Corporation Public Company Limited, along with its subsidiaries, is involved in the manufacture and distribution of electronic equipment both in Thailand and internationally, with a market cap of approximately THB10.29 billion.

Operations: Forth Corporation operates through three main revenue segments: Smart Service Business (THB3.73 billion), Enterprise Solutions Business (THB2.34 billion), and Electronics Manufacturing Service Business (THB3.56 billion). The company is focused on electronic equipment manufacturing and distribution in both domestic and international markets.

Despite a challenging year with net income down by 67.9%, Forth Corporation is poised for a significant rebound, with earnings expected to surge by 54.4% annually. This growth trajectory starkly contrasts the broader Electronic industry's average of just 7.1%. The company has also committed to substantial investments in R&D, which have historically represented a crucial percentage of revenue, underscoring its dedication to innovation and securing competitive advantages in rapidly evolving tech markets. Moreover, Forth's revenue is projected to grow at an impressive rate of 22.8% per year, outpacing the Thai market's forecasted growth rate of 6.5%, positioning it well for future expansions and market share gains in high-tech sectors.

- Dive into the specifics of Forth Corporation here with our thorough health report.

Assess Forth Corporation's past performance with our detailed historical performance reports.

Chenbro Micom (TWSE:8210)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chenbro Micom Co., Ltd. focuses on the research, development, design, manufacture, processing, and trading of computer peripherals and expendable systems across various international markets including the United States, China, Taiwan, and Singapore with a market cap of NT$35.27 billion.

Operations: Chenbro Micom generates revenue primarily from the computer peripherals segment, amounting to NT$15.38 billion. The company's operations span multiple international markets, contributing to its market cap of NT$35.27 billion.

Chenbro Micom has demonstrated a robust performance with its Q3 2024 earnings revealing a significant uptick in sales to TWD 4.27 billion, up from TWD 2.36 billion the previous year, and net income soaring to TWD 643.77 million from TWD 250.4 million. This surge is supported by an aggressive R&D strategy, with expenses tightly aligned with revenue growth, reflecting an innovative edge in server solutions for AI and cloud services showcased at the OCP Summit. Their strategic partnerships, notably expanding into AMD's next-generation platforms while maintaining strong ties with NVIDIA for advanced cooling technologies in data centers, underscore their adaptability and forward-thinking approach within the tech industry’s evolving landscape.

- Unlock comprehensive insights into our analysis of Chenbro Micom stock in this health report.

Examine Chenbro Micom's past performance report to understand how it has performed in the past.

Summing It All Up

- Navigate through the entire inventory of 1284 High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:GPI

GPI

Operates in the field of social-healthcare IT services and hi-tech services for healthcare markets in Italy and internationally.