- Italy

- /

- Oil and Gas

- /

- BIT:ENI

Energy Transition Push in Southeast Asia Might Change The Case For Investing In Eni (BIT:ENI)

Reviewed by Sasha Jovanovic

- In recent weeks, Eni has announced progress on major energy transition initiatives, including the groundbreaking for a biorefinery joint venture in Malaysia and expanding upstream gas projects via a $15 billion partnership with Petronas in Southeast Asia, alongside upgraded 2025 production guidance after strong quarterly results.

- This series of developments highlights Eni's dual-track focus on growing both renewables and natural gas production, while leveraging international partnerships and operational momentum to support its energy transition strategy.

- We'll explore how Eni's intensified investment in Southeast Asian gas assets may shape its investment outlook going forward.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Eni Investment Narrative Recap

To be an Eni shareholder today, you need to believe the company can balance its ambitious transition to cleaner energy while maintaining operational momentum in oil and gas production. The recent production guidance upgrade after strong Q3 results gives weight to the company’s near-term growth plans, providing reassurance on execution, although core risks tied to legacy business drag and emerging market exposure remain largely unchanged for now.

Among the latest announcements, the expanded $15 billion gas-focused joint venture with Petronas in Southeast Asia stands out in context of Eni’s production outlook. This development aligns directly with the company’s strategy to strengthen near-term output and diversify future cash flows by tapping new reserves, although it does not directly resolve longer-term concerns tied to renewables scaling or market volatility.

But even with these positive signals, investors should not ignore the persistent risk posed by Eni’s slow path to cash flow neutrality in Plenitude, as...

Read the full narrative on Eni (it's free!)

Eni's outlook anticipates €88.8 billion in revenue and €5.1 billion in earnings by 2028. This projection reflects a 0.7% annual revenue decline and a €2.8 billion increase in earnings from the current level of €2.3 billion.

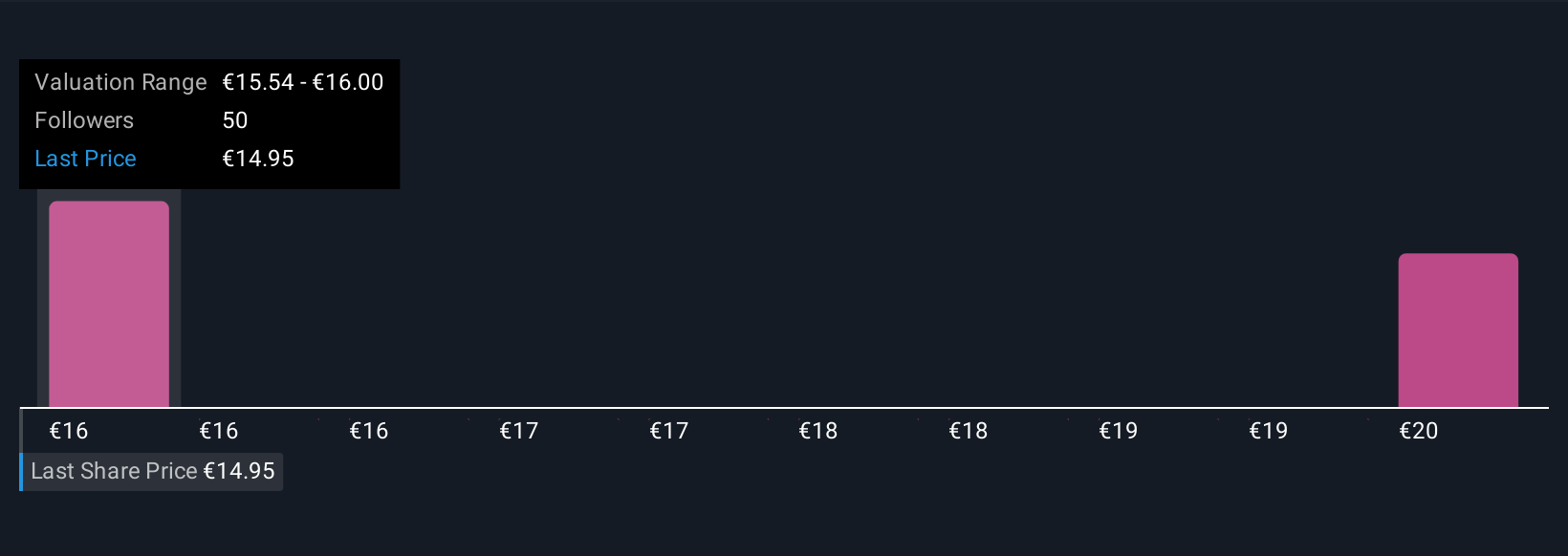

Uncover how Eni's forecasts yield a €16.12 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates for Eni from 3 Simply Wall St Community members range widely from €15.95 to €23.29 per share. In light of the company’s expanded Southeast Asian gas production plans, expectations for future growth, and the associated operational risks, warrant a closer look at differing assumptions across the market.

Explore 3 other fair value estimates on Eni - why the stock might be worth as much as 41% more than the current price!

Build Your Own Eni Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eni research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eni research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eni's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eni might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ENI

Eni

Operates as an integrated energy company in Italy, Other European Union, Rest of Europe, the United States, Asia, Africa, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives