- Italy

- /

- Consumer Finance

- /

- BIT:MOL

Is Consistent Growth in Sales and Net Income Altering the Investment Case for Moltiply Group (BIT:MOL)?

Reviewed by Simply Wall St

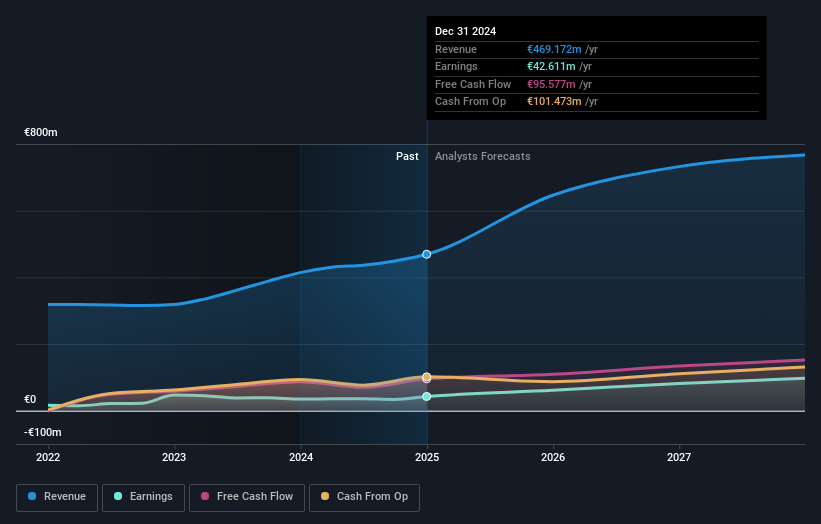

- Moltiply Group S.p.A. recently announced its earnings results for the half year ended June 30, 2025, reporting sales of €311.65 million and net income of €21.16 million, both up from the previous year.

- This consistent growth in both revenue and net income highlights Moltiply Group's ability to expand its market presence while improving profitability across its business divisions.

- Let's examine how Moltiply Group's improved sales and net income might influence its investment narrative and long-term growth expectations.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Moltiply Group Investment Narrative Recap

To be a Moltiply Group shareholder, you need to believe in its ability to deliver sustained earnings growth, driven by scale and diversification across digital financial services. The recent jump in sales and net income affirms near-term momentum, but does not materially change the biggest short-term catalyst: gains from new product launches and acquisitions in the Mavriq Division. The key risk remains exposure to rising Google-related costs affecting E-Commerce Price Comparison margins, which continues to warrant close monitoring.

Among recent announcements, the potential acquisition of Verivox GmbH stands out, given its relevance to Moltiply’s growth-through-acquisition strategy and alignment with the revenue expansion seen in the latest earnings. This deal, if concluded, could become a catalyst for broadening Moltiply's international reach and further strengthening its online comparison offerings, areas highlighted as key for future growth. Still, integration risks and execution will play a role in how much value is ultimately created.

In contrast, investors should be aware that Moltiply’s continued reliance on Google for traffic acquisition puts its earnings at risk if cost trends worsen...

Read the full narrative on Moltiply Group (it's free!)

Moltiply Group's narrative projects €879.6 million in revenue and €112.8 million in earnings by 2028. This requires 21.0% yearly revenue growth and an increase in earnings of €69.4 million from the current earnings of €43.4 million.

Uncover how Moltiply Group's forecasts yield a €57.33 fair value, a 35% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members currently converge on a single fair value estimate at €57.33, showing no range in opinions. While forecasts highlight potential benefits from new product launches, risks around platform dependency and cost pressures add critical context for the company's future trajectory.

Explore another fair value estimate on Moltiply Group - why the stock might be worth as much as 35% more than the current price!

Build Your Own Moltiply Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Moltiply Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Moltiply Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Moltiply Group's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:MOL

Moltiply Group

A holding company that operates in the financial services industry.

High growth potential with questionable track record.

Market Insights

Community Narratives