Stock Analysis

- Italy

- /

- Construction

- /

- BIT:WBD

Investors might be losing patience for Webuild's (BIT:WBD) increasing losses, as stock sheds 3.0% over the past week

While Webuild S.p.A. (BIT:WBD) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 10% in the last quarter. But that shouldn't obscure the pleasing returns achieved by shareholders over the last three years. To wit, the share price did better than an index fund, climbing 75% during that period.

While the stock has fallen 3.0% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for Webuild

Webuild wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last three years Webuild has grown its revenue at 25% annually. That's well above most pre-profit companies. While the compound gain of 21% per year over three years is pretty good, you might argue it doesn't fully reflect the strong revenue growth. So now might be the perfect time to put Webuild on your radar. A window of opportunity may reveal itself with time, if the business can trend to profitability.

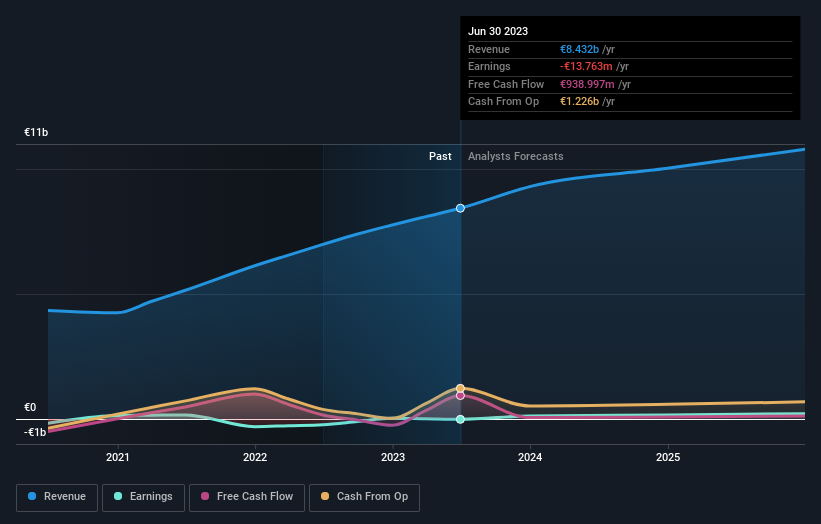

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Webuild's financial health with this free report on its balance sheet.

A Different Perspective

Webuild shareholders have received returns of 19% over twelve months (even including dividends), which isn't far from the general market return. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 3% over the last five years. While 'turnarounds seldom turn' there are green shoots for Webuild. It's always interesting to track share price performance over the longer term. But to understand Webuild better, we need to consider many other factors. Take risks, for example - Webuild has 1 warning sign we think you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Italian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Webuild is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:WBD

Flawless balance sheet with proven track record.