Banco BPM And Two Other Top Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

In the wake of recent global market developments, U.S. stocks have rallied to record highs driven by expectations of economic growth and tax reforms following a significant political shift. As investors navigate these dynamic conditions, dividend stocks like Banco BPM can offer a reliable source of income, providing stability and potential for returns in an uncertain economic landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.21% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.81% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.52% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.15% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.47% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.43% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

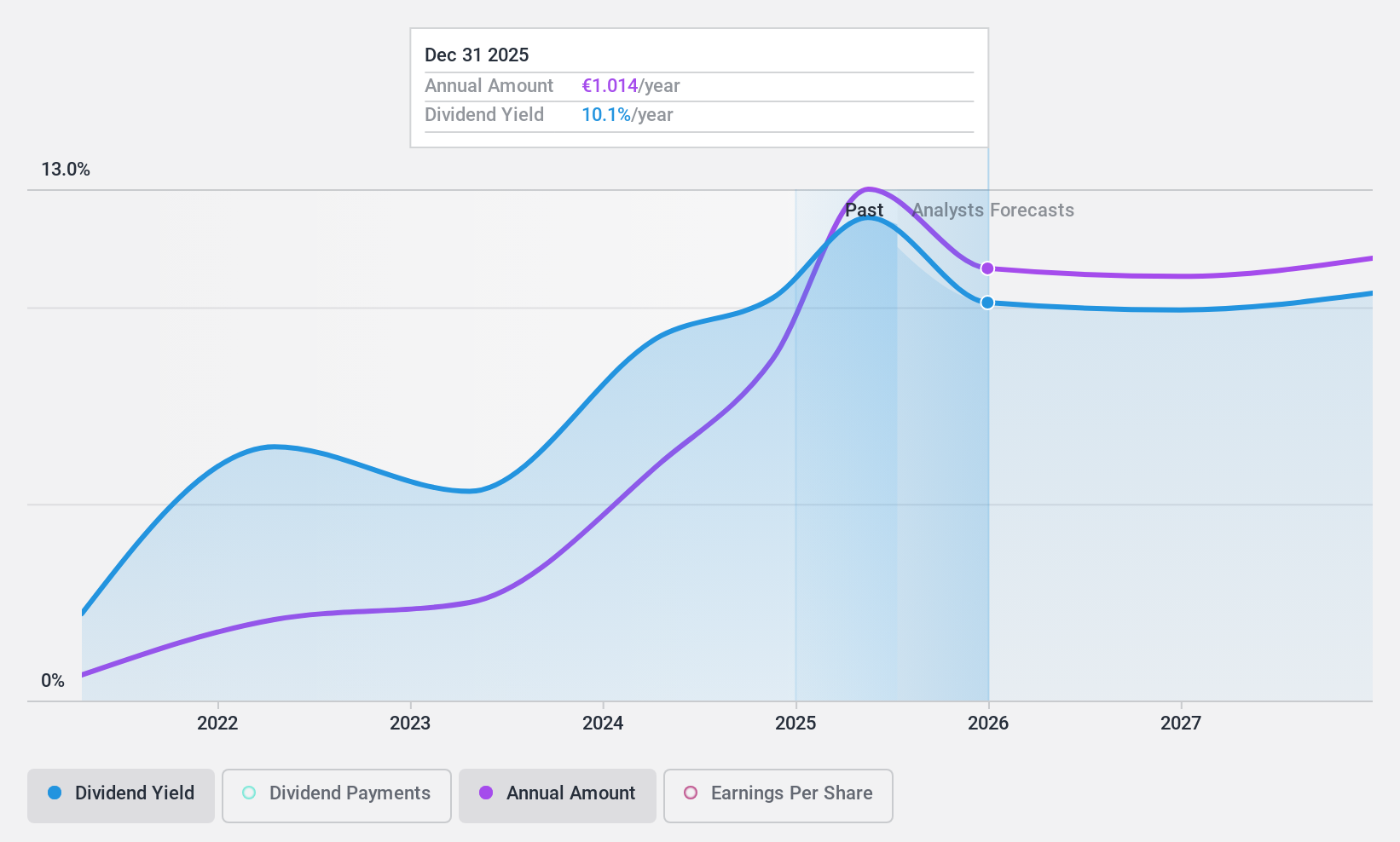

Banco BPM (BIT:BAMI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco BPM S.p.A. is an Italian bank offering a range of banking and financial services to individual, business, and corporate clients, with a market cap of €10.08 billion.

Operations: Banco BPM S.p.A. generates revenue through its diverse offerings of banking and financial products and services tailored to individual, business, and corporate customers in Italy.

Dividend Yield: 8.3%

Banco BPM offers an attractive dividend yield of 8.34%, placing it in the top 25% of Italian dividend payers, yet it has only a four-year history of payouts. The bank's dividends are currently covered by earnings with a payout ratio of 60.9%, expected to rise slightly to 69.7% in three years, suggesting sustainability despite forecasted earnings declines. Recent strong net income growth—EUR 945.7 million for Q3—supports its current financial position amidst high non-performing loans (3%).

- Take a closer look at Banco BPM's potential here in our dividend report.

- The analysis detailed in our Banco BPM valuation report hints at an deflated share price compared to its estimated value.

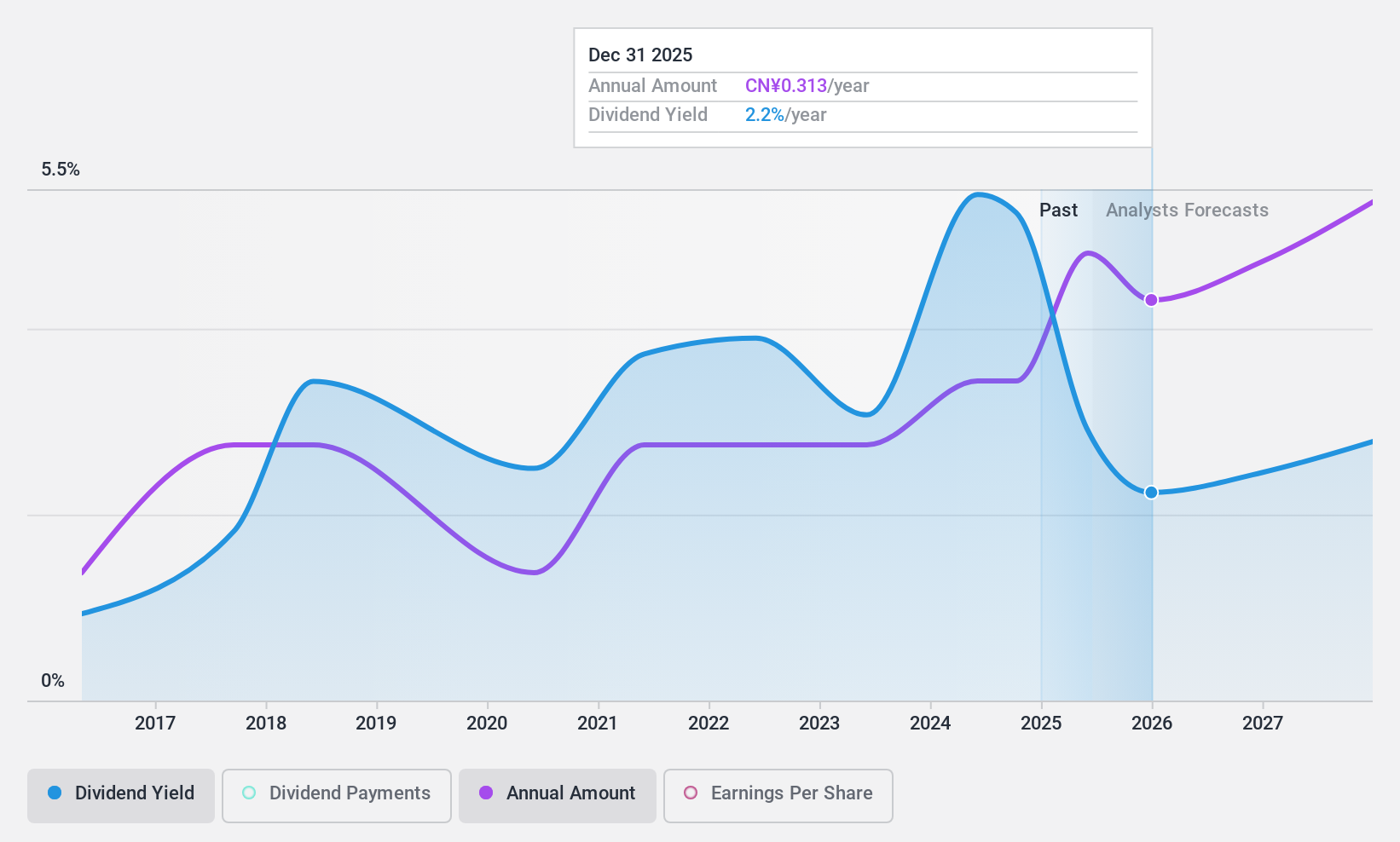

Guangdong Chj IndustryLtd (SZSE:002345)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Guangdong Chj Industry Co., Ltd. engages in the production and sale of jewelry and fashion consumer goods, with a market capitalization of CN¥4.53 billion.

Operations: Guangdong Chj Industry Co., Ltd. generates revenue primarily from the production and sale of jewelry and fashion consumer goods.

Dividend Yield: 3.9%

Guangdong Chj Industry Ltd. offers a dividend yield of 3.92%, ranking it among the top 25% of dividend payers in China, though its dividend history has been volatile over the past decade. Despite this instability, dividends are covered by both earnings and cash flows with payout ratios of 90% and 42.7%, respectively. Recent earnings for the nine months ended September 30, 2024, show modest growth in net income to CNY 315.91 million from CNY 312.94 million year-over-year, indicating stable financial performance amidst fluctuating dividends.

- Delve into the full analysis dividend report here for a deeper understanding of Guangdong Chj IndustryLtd.

- Insights from our recent valuation report point to the potential undervaluation of Guangdong Chj IndustryLtd shares in the market.

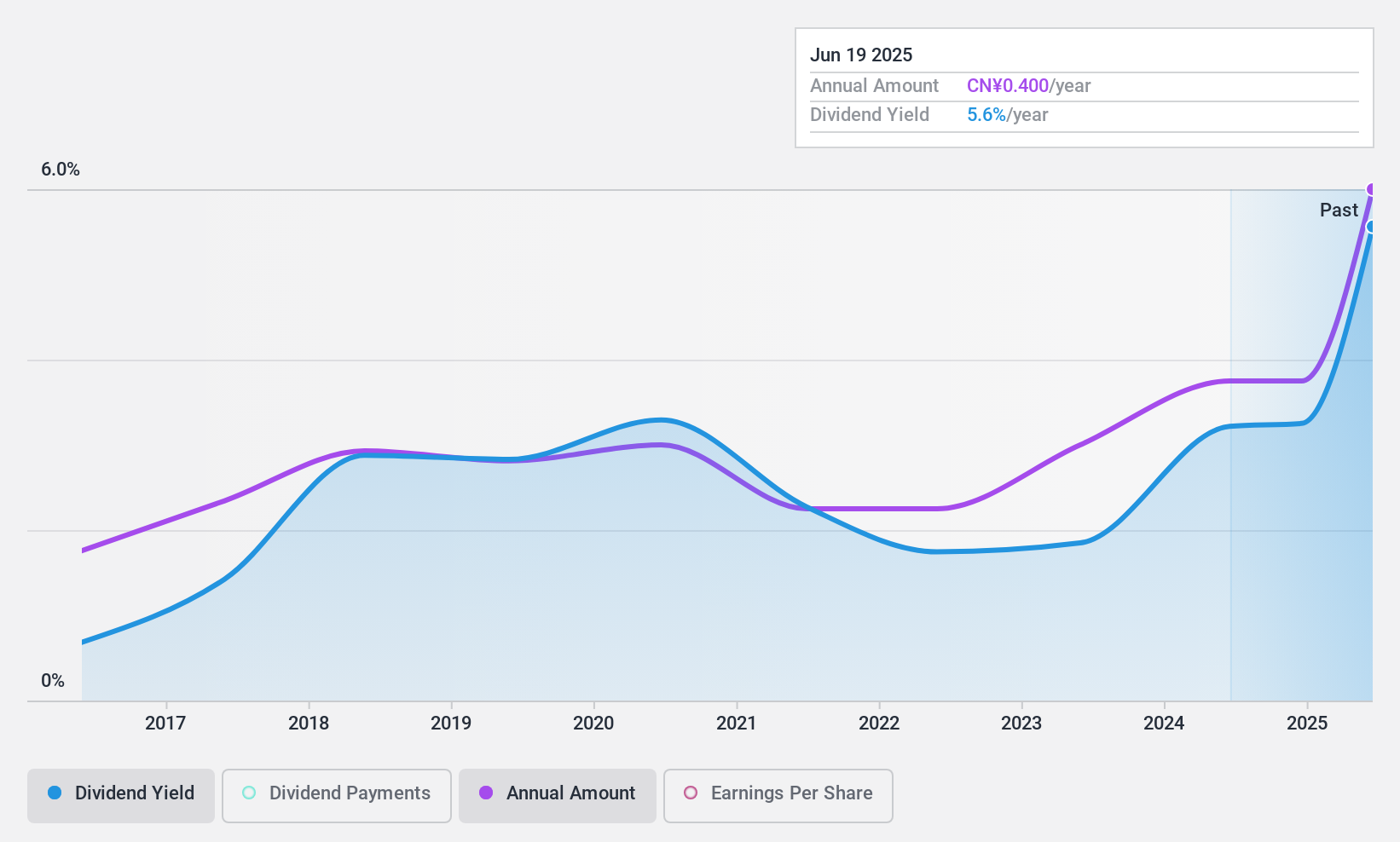

Xiamen R&T Plumbing TechnologyLtd (SZSE:002790)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xiamen R&T Plumbing Technology Co., Ltd. is involved in the research, development, production, and sale of bathroom products and accessories globally, with a market cap of CN¥3.39 billion.

Operations: Xiamen R&T Plumbing Technology Co., Ltd. generates its revenue primarily from the research, development, production, and sale of bathroom products and accessories on a global scale.

Dividend Yield: 3.1%

Xiamen R&T Plumbing Technology Ltd. offers a dividend yield of 3.08%, placing it in the top 25% of Chinese dividend payers, though its eight-year history shows volatility. Dividends are covered by earnings and cash flows with payout ratios of 61% and 78.9%. Recent results for nine months ending September 30, 2024, show revenue growth to CNY 1.71 billion from CNY 1.55 billion year-over-year, but net income declined to CNY 126.34 million from CNY 175.85 million.

- Click here and access our complete dividend analysis report to understand the dynamics of Xiamen R&T Plumbing TechnologyLtd.

- In light of our recent valuation report, it seems possible that Xiamen R&T Plumbing TechnologyLtd is trading behind its estimated value.

Next Steps

- Navigate through the entire inventory of 1940 Top Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco BPM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BAMI

Banco BPM

Provides banking and financial products and services to individual, business, and corporate customers in Italy.

Undervalued with solid track record and pays a dividend.