Slammed 26% Askoll EVA SpA (BIT:EVA) Screens Well Here But There Might Be A Catch

Askoll EVA SpA (BIT:EVA) shares have had a horrible month, losing 26% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 48% share price drop.

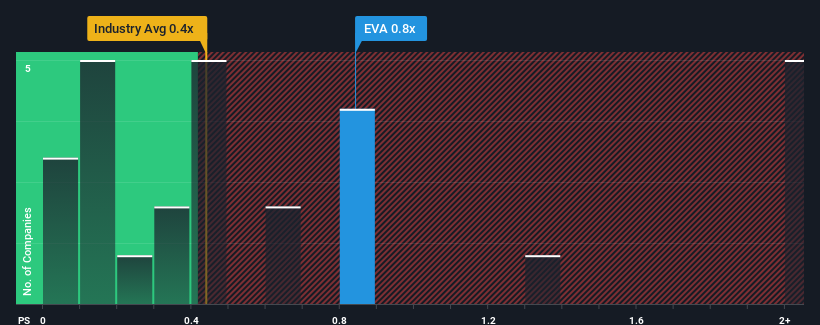

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Askoll EVA's P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Auto industry in Italy is also close to 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Askoll EVA

What Does Askoll EVA's P/S Mean For Shareholders?

Askoll EVA hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Askoll EVA.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Askoll EVA would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 40% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 25% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 50% per annum as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 3.9% each year, which is noticeably less attractive.

With this information, we find it interesting that Askoll EVA is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Askoll EVA's P/S?

Following Askoll EVA's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at Askoll EVA's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 5 warning signs for Askoll EVA (2 are concerning!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:EVA

Askoll EVA

Askoll Eva SpA manufactures and sells electric vehicles in Italy.

Moderate with imperfect balance sheet.

Market Insights

Community Narratives