- India

- /

- Electric Utilities

- /

- NSEI:TATAPOWER

Should Tata Power (NSE:TATAPOWER) Be Disappointed With Their 25% Profit?

Buying a low-cost index fund will get you the average market return. But across the board there are plenty of stocks that underperform the market. Unfortunately for shareholders, while the The Tata Power Company Limited (NSE:TATAPOWER) share price is up 25% in the last three years, that falls short of the market return. Zooming in, the stock is actually down 8.6% in the last year.

Check out our latest analysis for Tata Power

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

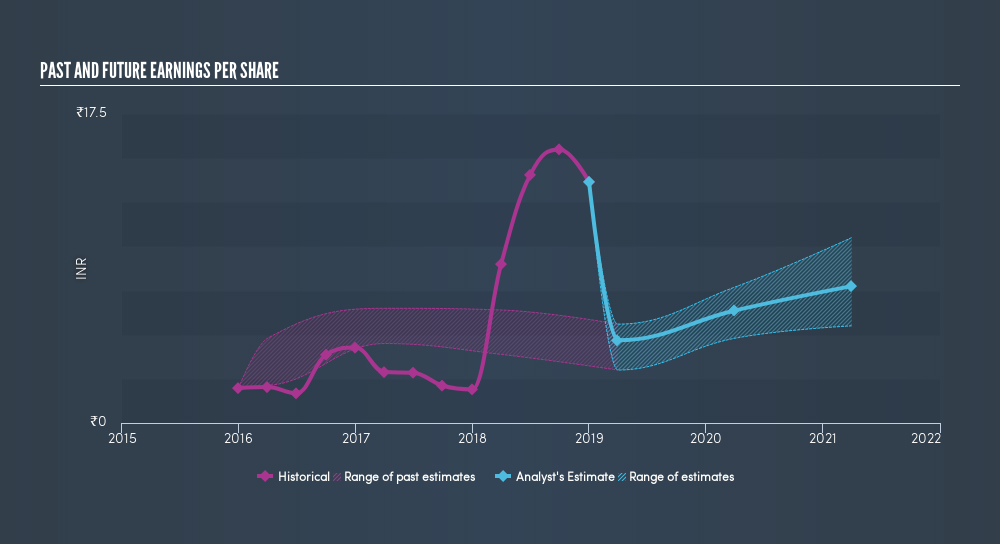

Tata Power was able to grow its EPS at 90% per year over three years, sending the share price higher. The average annual share price increase of 7.7% is actually lower than the EPS growth. Therefore, it seems the market has moderated its expectations for growth, somewhat. This cautious sentiment is reflected in its (fairly low) P/E ratio of 5.40.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Tata Power has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Tata Power's financial health with this freereport on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Tata Power's TSR for the last 3 years was 32%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Investors in Tata Power had a tough year, with a total loss of 7.0% (including dividends), against a market gain of about 0.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.2% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before deciding if you like the current share price, check how Tata Power scores on these 3 valuation metrics.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this freelist of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:TATAPOWER

Tata Power

Engages in the generation, transmission, distribution, and trading of electricity in India and internationally.

Average dividend payer with acceptable track record.