Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies NLC India Limited (NSE:NLCINDIA) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for NLC India

What Is NLC India's Net Debt?

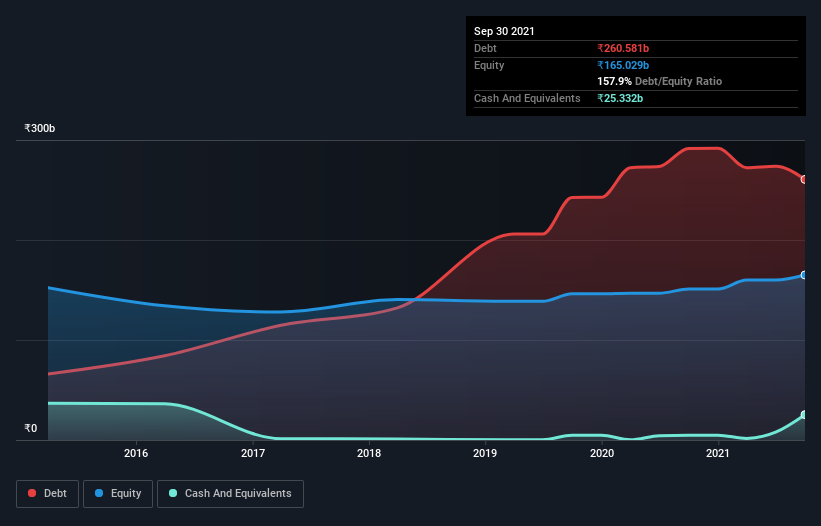

You can click the graphic below for the historical numbers, but it shows that NLC India had ₹260.6b of debt in September 2021, down from ₹291.6b, one year before. However, because it has a cash reserve of ₹25.3b, its net debt is less, at about ₹235.2b.

How Strong Is NLC India's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that NLC India had liabilities of ₹103.6b due within 12 months and liabilities of ₹260.9b due beyond that. Offsetting this, it had ₹25.3b in cash and ₹48.6b in receivables that were due within 12 months. So its liabilities total ₹290.5b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the ₹87.4b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, NLC India would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

NLC India's debt is 4.7 times its EBITDA, and its EBIT cover its interest expense 3.2 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Even more troubling is the fact that NLC India actually let its EBIT decrease by 6.1% over the last year. If it keeps going like that paying off its debt will be like running on a treadmill -- a lot of effort for not much advancement. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since NLC India will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, NLC India reported free cash flow worth 7.5% of its EBIT, which is really quite low. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

Mulling over NLC India's attempt at staying on top of its total liabilities, we're certainly not enthusiastic. And even its interest cover fails to inspire much confidence. Taking into account all the aforementioned factors, it looks like NLC India has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for NLC India (of which 1 can't be ignored!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if NLC India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NLCINDIA

Established dividend payer with adequate balance sheet.