- India

- /

- Electric Utilities

- /

- NSEI:ADANIENSOL

Does Adani Transmissions (NSE:ADANITRANS) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Adani Transmissions Limited (NSE:ADANITRANS) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Adani Transmissions

How Much Debt Does Adani Transmissions Carry?

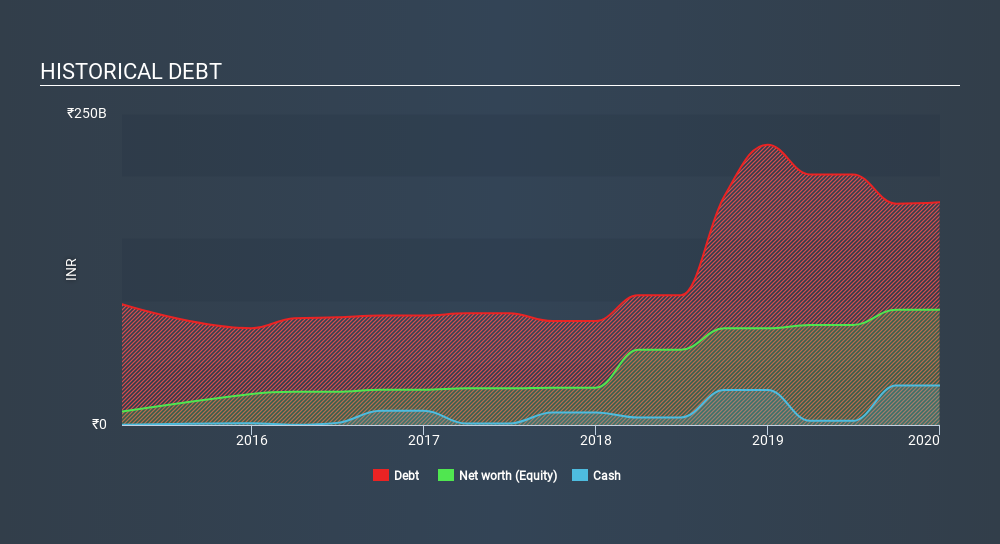

As you can see below, Adani Transmissions had ₹177.9b of debt at September 2019, down from ₹225.3b a year prior. On the flip side, it has ₹31.7b in cash leading to net debt of about ₹146.2b.

How Strong Is Adani Transmissions's Balance Sheet?

According to the last reported balance sheet, Adani Transmissions had liabilities of ₹56.2b due within 12 months, and liabilities of ₹187.6b due beyond 12 months. Offsetting this, it had ₹31.7b in cash and ₹14.0b in receivables that were due within 12 months. So its liabilities total ₹198.1b more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of ₹290.4b. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While we wouldn't worry about Adani Transmissions's net debt to EBITDA ratio of 3.5, we think its super-low interest cover of 2.0 times is a sign of high leverage. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Looking on the bright side, Adani Transmissions boosted its EBIT by a silky 76% in the last year. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Adani Transmissions's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Adani Transmissions generated free cash flow amounting to a very robust 81% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

Adani Transmissions's conversion of EBIT to free cash flow suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But the stark truth is that we are concerned by its interest cover. It's also worth noting that Adani Transmissions is in the Electric Utilities industry, which is often considered to be quite defensive. Looking at all the aforementioned factors together, it strikes us that Adani Transmissions can handle its debt fairly comfortably. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for Adani Transmissions (1 is potentially serious!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:ADANIENSOL

Adani Energy Solutions

Generates, transmits, and distributes power in India.

Moderate and good value.