Returns At TVS Supply Chain Solutions (NSE:TVSSCS) Are On The Way Up

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So on that note, TVS Supply Chain Solutions (NSE:TVSSCS) looks quite promising in regards to its trends of return on capital.

What Is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for TVS Supply Chain Solutions, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.046 = ₹1.4b ÷ (₹60b - ₹30b) (Based on the trailing twelve months to December 2024).

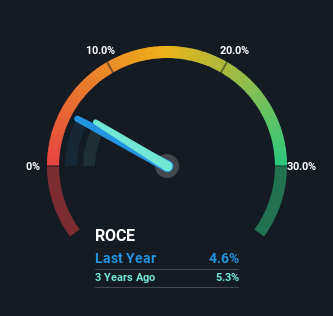

Thus, TVS Supply Chain Solutions has an ROCE of 4.6%. In absolute terms, that's a low return and it also under-performs the Logistics industry average of 15%.

Check out our latest analysis for TVS Supply Chain Solutions

In the above chart we have measured TVS Supply Chain Solutions' prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering TVS Supply Chain Solutions for free.

So How Is TVS Supply Chain Solutions' ROCE Trending?

TVS Supply Chain Solutions has broken into the black (profitability) and we're sure it's a sight for sore eyes. The company now earns 4.6% on its capital, because five years ago it was incurring losses. Interestingly, the capital employed by the business has remained relatively flat, so these higher returns are either from prior investments paying off or increased efficiencies. So while we're happy that the business is more efficient, just keep in mind that could mean that going forward the business is lacking areas to invest internally for growth. So if you're looking for high growth, you'll want to see a business's capital employed also increasing.

Another thing to note, TVS Supply Chain Solutions has a high ratio of current liabilities to total assets of 50%. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

The Bottom Line On TVS Supply Chain Solutions' ROCE

As discussed above, TVS Supply Chain Solutions appears to be getting more proficient at generating returns since capital employed has remained flat but earnings (before interest and tax) are up. And since the stock has fallen 27% over the last year, there might be an opportunity here. With that in mind, we believe the promising trends warrant this stock for further investigation.

Before jumping to any conclusions though, we need to know what value we're getting for the current share price. That's where you can check out our FREE intrinsic value estimation for TVSSCS that compares the share price and estimated value.

While TVS Supply Chain Solutions may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Valuation is complex, but we're here to simplify it.

Discover if TVS Supply Chain Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TVSSCS

TVS Supply Chain Solutions

Provides integrated supply chain solutions in India.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives