Stock Analysis

Investors Don't See Light At End Of Transport Corporation of India Limited's (NSE:TCI) Tunnel

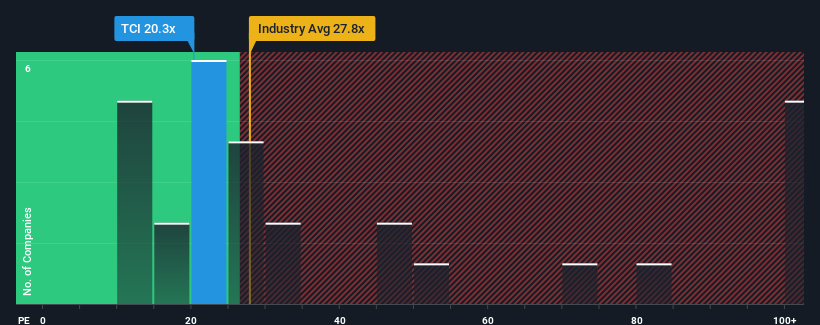

With a price-to-earnings (or "P/E") ratio of 20.3x Transport Corporation of India Limited (NSE:TCI) may be sending bullish signals at the moment, given that almost half of all companies in India have P/E ratios greater than 31x and even P/E's higher than 56x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times haven't been advantageous for Transport Corporation of India as its earnings have been rising slower than most other companies. It seems that many are expecting the uninspiring earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

View our latest analysis for Transport Corporation of India

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Transport Corporation of India's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 2.6% last year. Pleasingly, EPS has also lifted 175% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 14% during the coming year according to the eight analysts following the company. With the market predicted to deliver 24% growth , the company is positioned for a weaker earnings result.

In light of this, it's understandable that Transport Corporation of India's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Transport Corporation of India maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Transport Corporation of India that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're helping make it simple.

Find out whether Transport Corporation of India is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TCI

Transport Corporation of India

Transport Corporation of India Limited provides end to end integrated supply chain and logistics solutions in India.

Flawless balance sheet, good value and pays a dividend.