- India

- /

- Telecom Services and Carriers

- /

- NSEI:GTLINFRA

GTL Infrastructure (NSE:GTLINFRA) shareholders are still up 340% over 5 years despite pulling back 23% in the past week

The GTL Infrastructure Limited (NSE:GTLINFRA) share price has had a bad week, falling 23%. But that does not change the realty that the stock's performance has been terrific, over five years. In fact, during that period, the share price climbed 340%. Impressive! Arguably, the recent fall is to be expected after such a strong rise. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain.

Since the long term performance has been good but there's been a recent pullback of 23%, let's check if the fundamentals match the share price.

View our latest analysis for GTL Infrastructure

Given that GTL Infrastructure didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years GTL Infrastructure saw its revenue shrink by 0.2% per year. So it's pretty surprising to see that the share price is up 34% per year. Obviously, whatever the market is excited about, it's not a track record of revenue growth. I think it's fair to say there is probably a fair bit of excitement in the price.

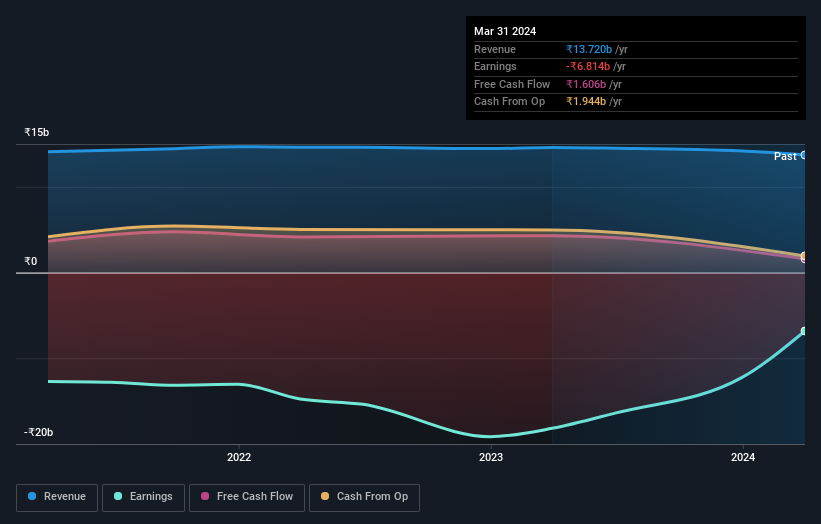

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on GTL Infrastructure's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that GTL Infrastructure shareholders have received a total shareholder return of 258% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 34% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand GTL Infrastructure better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with GTL Infrastructure (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

Of course GTL Infrastructure may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:GTLINFRA

GTL Infrastructure

An independent and neutral telecom tower company, owns, builds, operates, and maintains shared passive telecom infrastructure sites primarily in India.

Good value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives