- India

- /

- Electronic Equipment and Components

- /

- NSEI:HONAUT

Investors in Honeywell Automation India (NSE:HONAUT) have unfortunately lost 28% over the last year

Honeywell Automation India Limited (NSE:HONAUT) shareholders should be happy to see the share price up 11% in the last quarter. But that doesn't change the reality of under-performance over the last twelve months. In fact the stock is down 28% in the last year, well below the market return.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

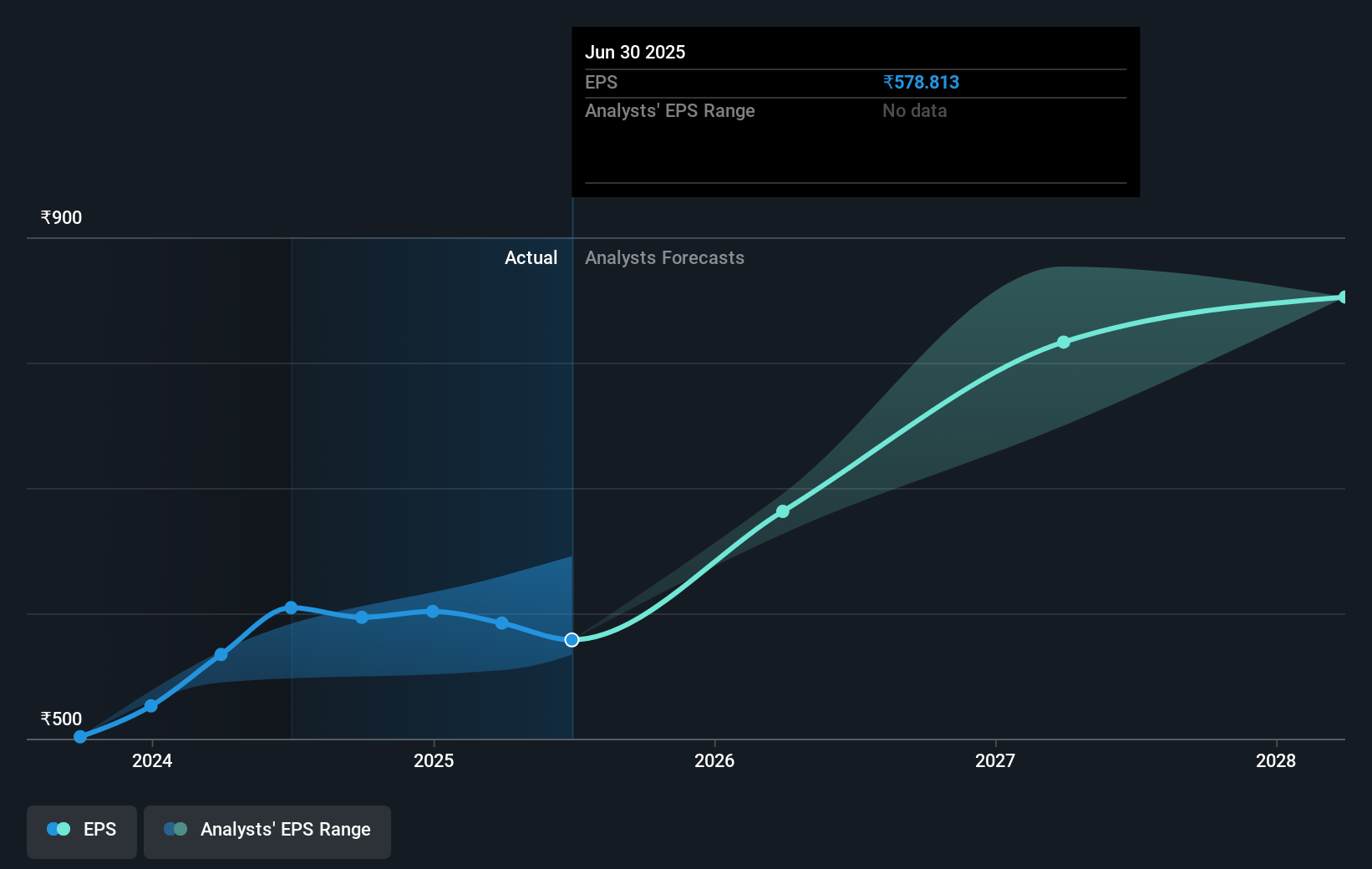

Unhappily, Honeywell Automation India had to report a 4.2% decline in EPS over the last year. The share price decline of 28% is actually more than the EPS drop. So it seems the market was too confident about the business, a year ago. Of course, with a P/E ratio of 67.42, the market remains optimistic.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Honeywell Automation India's key metrics by checking this interactive graph of Honeywell Automation India's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 4.8% in the twelve months, Honeywell Automation India shareholders did even worse, losing 28% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 5% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Is Honeywell Automation India cheap compared to other companies? These 3 valuation measures might help you decide.

But note: Honeywell Automation India may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Honeywell Automation India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HONAUT

Honeywell Automation India

Manufactures and sells industrial process control and automation systems in India and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives