Shareholders Will Probably Hold Off On Increasing AAA Technologies Limited's (NSE:AAATECH) CEO Compensation For The Time Being

Key Insights

- AAA Technologies to hold its Annual General Meeting on 26th of September

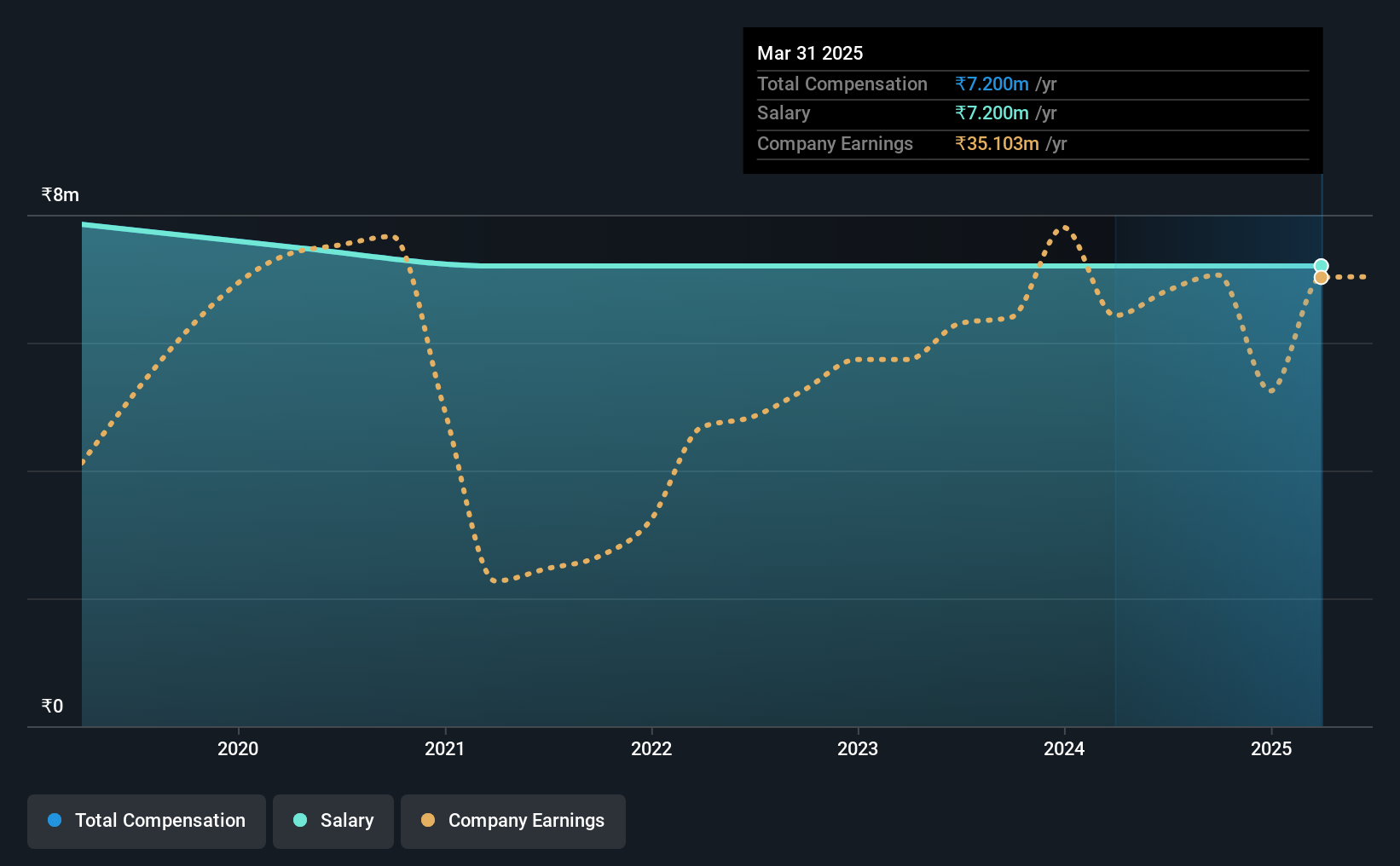

- Salary of ₹7.20m is part of CEO Anjay Agarwal's total remuneration

- The overall pay is 93% above the industry average

- AAA Technologies' EPS grew by 13% over the past three years while total shareholder return over the past three years was 17%

Performance at AAA Technologies Limited (NSE:AAATECH) has been reasonably good and CEO Anjay Agarwal has done a decent job of steering the company in the right direction. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 26th of September. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

Check out our latest analysis for AAA Technologies

Comparing AAA Technologies Limited's CEO Compensation With The Industry

Our data indicates that AAA Technologies Limited has a market capitalization of ₹1.0b, and total annual CEO compensation was reported as ₹7.2m for the year to March 2025. This was the same as last year. Notably, the salary of ₹7.2m is the entirety of the CEO compensation.

For comparison, other companies in the Indian IT industry with market capitalizations below ₹18b, reported a median total CEO compensation of ₹3.7m. Accordingly, our analysis reveals that AAA Technologies Limited pays Anjay Agarwal north of the industry median. What's more, Anjay Agarwal holds ₹225m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

On an industry level, around 89% of total compensation represents salary and 11% is other remuneration. At the company level, AAA Technologies pays Anjay Agarwal solely through a salary, preferring to go down a conventional route. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at AAA Technologies Limited's Growth Numbers

AAA Technologies Limited has seen its earnings per share (EPS) increase by 13% a year over the past three years. In the last year, its revenue is up 9.0%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has AAA Technologies Limited Been A Good Investment?

With a total shareholder return of 17% over three years, AAA Technologies Limited shareholders would, in general, be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

AAA Technologies pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 3 warning signs for AAA Technologies that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AAATECH

AAA Technologies

Engages in the provision of IS audit, information security audit, cyber security audit, IT assurance and compliance, and IT governance services in India.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

The Grid Modernizer: Leidos and the $2.4 Billion Bet on Sovereign AI and Energy

EU#6 - From Political Experiment to Global Aerospace Power

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.