Stock Analysis

- India

- /

- Specialty Stores

- /

- NSEI:PRAXIS

Shareholders in Praxis Home Retail (NSE:PRAXIS) are in the red if they invested five years ago

It is a pleasure to report that the Praxis Home Retail Limited (NSE:PRAXIS) is up 136% in the last quarter. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. Indeed, the share price is down 79% in the period. So we're hesitant to put much weight behind the short term increase. But it could be that the fall was overdone.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for Praxis Home Retail

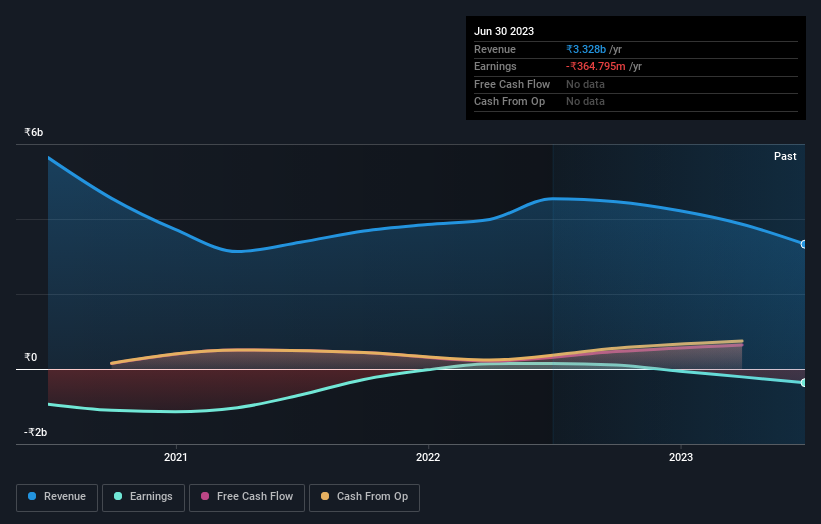

Given that Praxis Home Retail didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Praxis Home Retail saw its revenue shrink by 14% per year. That puts it in an unattractive cohort, to put it mildly. So it's not that strange that the share price dropped 12% per year in that period. This kind of price performance makes us very wary, especially when combined with falling revenue. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Praxis Home Retail's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that Praxis Home Retail's TSR, at -53% is higher than its share price return of -79%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's nice to see that Praxis Home Retail shareholders have received a total shareholder return of 39% over the last year. That certainly beats the loss of about 9% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Praxis Home Retail better, we need to consider many other factors. For instance, we've identified 3 warning signs for Praxis Home Retail (2 don't sit too well with us) that you should be aware of.

But note: Praxis Home Retail may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Praxis Home Retail is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PRAXIS

Praxis Home Retail

Praxis Home Retail Limited engages in the business of home retailing through departmental stores in India.

Mediocre balance sheet and slightly overvalued.