Stock Analysis

- India

- /

- Real Estate

- /

- NSEI:MAHLIFE

Despite the downward trend in earnings at Mahindra Lifespace Developers (NSE:MAHLIFE) the stock ascends 4.7%, bringing five-year gains to 433%

Buying shares in the best businesses can build meaningful wealth for you and your family. While not every stock performs well, when investors win, they can win big. For example, the Mahindra Lifespace Developers Limited (NSE:MAHLIFE) share price is up a whopping 420% in the last half decade, a handsome return for long term holders. This just goes to show the value creation that some businesses can achieve. It's also up 21% in about a month.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

Check out our latest analysis for Mahindra Lifespace Developers

We don't think that Mahindra Lifespace Developers' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 5 years Mahindra Lifespace Developers saw its revenue shrink by 4.9% per year. So it's pretty surprising to see that the share price is up 39% per year. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. I think it's fair to say there is probably a fair bit of excitement in the price.

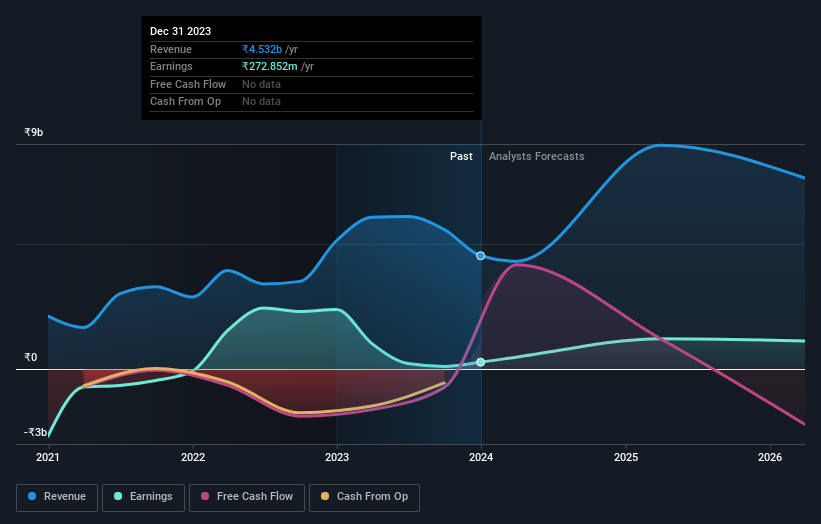

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Mahindra Lifespace Developers has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Mahindra Lifespace Developers' TSR for the last 5 years was 433%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Mahindra Lifespace Developers shareholders have received a total shareholder return of 78% over one year. That's including the dividend. That's better than the annualised return of 40% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Mahindra Lifespace Developers has 3 warning signs we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Mahindra Lifespace Developers is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MAHLIFE

Mahindra Lifespace Developers

Mahindra Lifespace Developers Limited, together with its subsidiaries, engages in the real estate and infrastructure development business in India.

High growth potential with mediocre balance sheet.