Zydus Lifesciences (NSEI:ZYDUSLIFE) Reports 20.2% Profit Margin and WHO Approval for ZyVac TCV

Reviewed by Simply Wall St

Zydus Lifesciences (NSEI:ZYDUSLIFE) has reported strong earnings growth, with a notable increase in revenue and net income for the second quarter of 2024, showcasing its financial health and strategic emphasis on product innovation. The company faces challenges such as relatively low return on equity and rising operational costs, which could impact future profitability. In the following discussion, we will explore Zydus's recent achievements, including the WHO approval of ZyVac TCV, and examine its strategic initiatives to address potential risks and capitalize on growth opportunities.

See the full analysis report here for a deeper understanding of Zydus Lifesciences.

Core Advantages Driving Sustained Success for Zydus Lifesciences

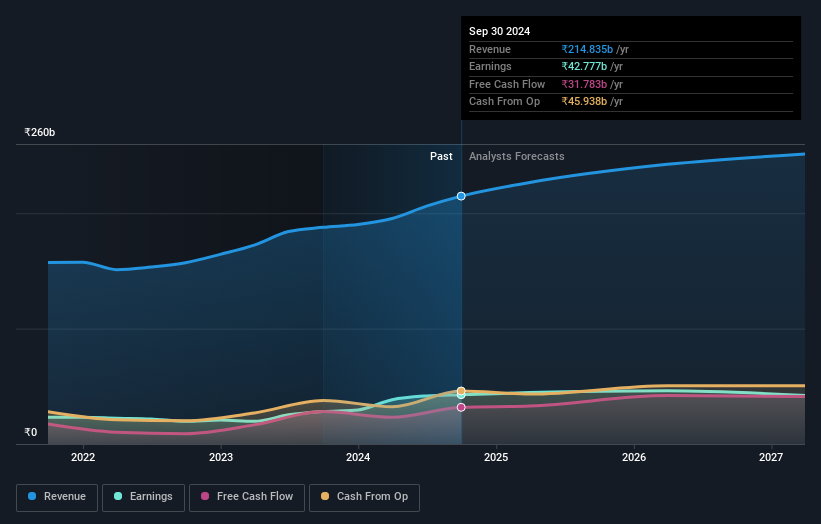

Strong earnings growth over the past year, with a remarkable 65% increase, positions Zydus Lifesciences as a leader in the pharmaceutical industry, far exceeding the industry average of 18.7%. The company's net profit margins have improved to 20.2%, showcasing financial health. This is further supported by a healthy balance sheet, where cash reserves surpass total debt, ensuring stability and financial flexibility. The strategic emphasis on product innovation, as highlighted by Sharvil Patel, Managing Director, underscores the company's commitment to maintaining a competitive edge through a rich pipeline of upcoming products. Furthermore, Zydus's valuation, with a Price-To-Earnings Ratio of 22.9x, is considered favorable compared to industry peers, suggesting strong market positioning.

Challenges Constraining Zydus Lifesciences's Potential

Despite impressive earnings growth, the company's Return on Equity at 19.4% is relatively low, indicating room for improvement in capital efficiency. The forecasted earnings growth of 3% annually lags behind the Indian market's average of 17.9%, posing a challenge for maintaining investor confidence. Additionally, the volatility and unreliability of dividend payments over the past decade could deter potential investors. Managing operational costs remains a concern, as noted by Sharvil Patel, due to rising raw material prices, which could pressure profit margins if not addressed effectively.

Growth Avenues Awaiting Zydus Lifesciences

Expansion into emerging markets presents significant growth opportunities, as emphasized by Ganesh Nayak, CEO. This strategic move aims to tap into new customer bases and diversify revenue streams. The company's investment in AI and digital health solutions is set to enhance operational efficiency, positioning Zydus for future growth. Recent product-related announcements, including the approval of ZyVac TCV by the World Health Organization, highlight Zydus's potential to capitalize on global health initiatives and expand its market reach.

External Factors Threatening Zydus Lifesciences

Economic headwinds, as cautioned by Ganesh Nayak, could impact healthcare spending, posing a risk to revenue growth. Regulatory challenges, particularly in navigating complex approval processes, may delay product launches and affect revenue projections. Additionally, supply chain vulnerabilities, as monitored closely by Kunal Randeria, CFO, could disrupt operations if not proactively managed. These factors highlight the need for Zydus to remain vigilant and adaptive in a dynamic global environment.

Conclusion

Zydus Lifesciences has demonstrated exceptional earnings growth, with a 65% increase, positioning it as a leader in the pharmaceutical industry. This strong performance is reflected in its improved net profit margins of 20.2% and a favorable Price-To-Earnings Ratio of 22.9x, suggesting a strong market position and potential for share price appreciation by over 20%. However, challenges such as a relatively low Return on Equity of 19.4% and forecasted earnings growth below the market average highlight areas needing strategic focus. The company's expansion into emerging markets and investment in AI and digital health solutions present significant growth opportunities, yet economic headwinds and regulatory challenges require careful navigation to sustain its competitive edge. Overall, while Zydus Lifesciences is well-positioned for future growth, addressing these challenges will be crucial to maintaining investor confidence and capitalizing on its favorable market valuation.

Summing It All Up

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Zydus Lifesciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NSEI:ZYDUSLIFE

Zydus Lifesciences

Engages in the research, development, production, marketing, distribution, and sale of pharmaceutical products in India, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.