Here's Why I Think Torrent Pharmaceuticals (NSE:TORNTPHARM) Is An Interesting Stock

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like Torrent Pharmaceuticals (NSE:TORNTPHARM), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Torrent Pharmaceuticals

How Fast Is Torrent Pharmaceuticals Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. It certainly is nice to see that Torrent Pharmaceuticals has managed to grow EPS by 26% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

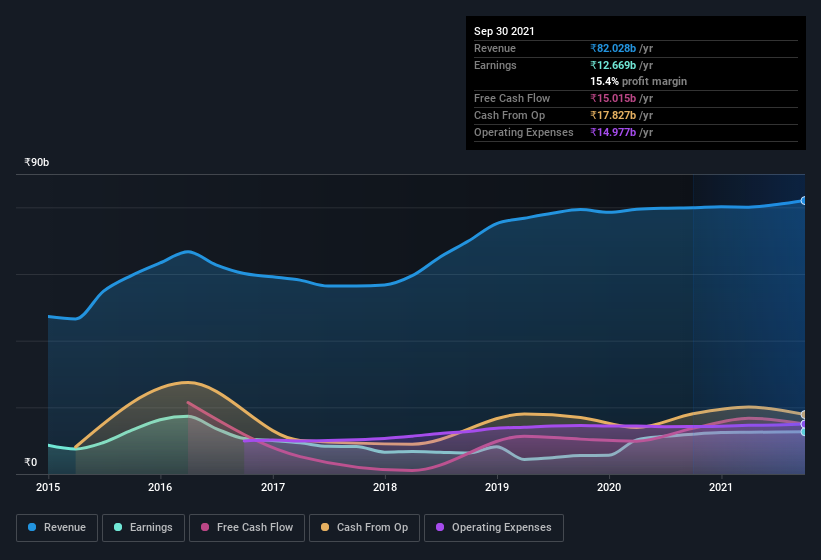

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Torrent Pharmaceuticals maintained stable EBIT margins over the last year, all while growing revenue 2.7% to ₹82b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Torrent Pharmaceuticals's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Torrent Pharmaceuticals Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While we did see insider selling of Torrent Pharmaceuticals stock in the last year, one single insider spent plenty more buying. Specifically the Independent Non Executive Director, Shailesh Haribhakti, spent ₹28m, paying about ₹2,862 per share. To me, that's probably a sign of conviction.

Along with the insider buying, another encouraging sign for Torrent Pharmaceuticals is that insiders, as a group, have a considerable shareholding. With a whopping ₹4.5b worth of shares as a group, insiders have plenty riding on the company's success. That's certainly enough to make me think that management will be very focussed on long term growth.

Is Torrent Pharmaceuticals Worth Keeping An Eye On?

For growth investors like me, Torrent Pharmaceuticals's raw rate of earnings growth is a beacon in the night. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So I do think this is one stock worth watching. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Torrent Pharmaceuticals , and understanding these should be part of your investment process.

As a growth investor I do like to see insider buying. But Torrent Pharmaceuticals isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Torrent Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TORNTPHARM

Torrent Pharmaceuticals

Engages in the research, development, manufacturing, and marketing of generic pharmaceutical formulations in India, the United States, Brazil, Germany, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.