Stock Analysis

Morepen Laboratories Limited's (NSE:MOREPENLAB) Popularity With Investors Is Under Threat From Overpricing

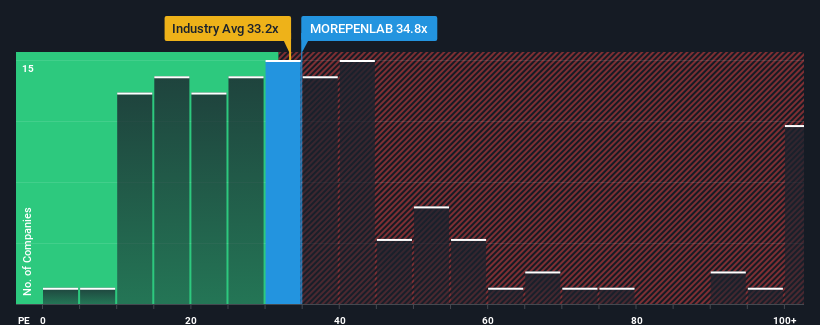

With a price-to-earnings (or "P/E") ratio of 34.8x Morepen Laboratories Limited (NSE:MOREPENLAB) may be sending bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 30x and even P/E's lower than 17x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With earnings growth that's exceedingly strong of late, Morepen Laboratories has been doing very well. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Morepen Laboratories

How Is Morepen Laboratories' Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Morepen Laboratories' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 74% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 18% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's an unpleasant look.

With this information, we find it concerning that Morepen Laboratories is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Morepen Laboratories currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Morepen Laboratories with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than Morepen Laboratories. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Morepen Laboratories is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MOREPENLAB

Morepen Laboratories

Morepen Laboratories Limited develops, manufactures, markets, and sells active pharmaceutical ingredients (APIs), formulations, and home health products in India, the United States, and internationally.

Flawless balance sheet with solid track record.