- United States

- /

- Specialty Stores

- /

- NasdaqGS:WOOF

Distribution Solutions Group Leads These 3 Undervalued Small Caps With Insider Buying

Reviewed by Simply Wall St

As global markets show signs of recovery, with U.S. stocks posting solid gains and retail sales surging to their best in 18 months, the spotlight is turning to small-cap stocks. In this environment, identifying undervalued small caps with insider buying can be a promising strategy for investors looking to capitalize on market optimism and economic resilience. A good stock in today's market often combines strong fundamentals with favorable market conditions. Small-cap companies that exhibit insider buying can signal confidence from those closest to the business, making them compelling candidates for further consideration.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 24.8x | 5.6x | 11.64% | ★★★★★☆ |

| Essentra | 825.0x | 1.6x | 48.64% | ★★★★★☆ |

| Titan Machinery | 3.3x | 0.1x | 42.87% | ★★★★★☆ |

| Chatham Lodging Trust | NA | 1.3x | 30.65% | ★★★★★☆ |

| Trican Well Service | 8.1x | 1.0x | 6.05% | ★★★★☆☆ |

| ADENTRA | 16.3x | 0.3x | 10.97% | ★★★☆☆☆ |

| Sopharma AD | 11.6x | 0.6x | 2.88% | ★★★☆☆☆ |

| NSI | NA | 4.6x | 44.36% | ★★★☆☆☆ |

| Studsvik | 20.4x | 1.2x | 42.27% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Distribution Solutions Group (NasdaqGS:DSGR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Distribution Solutions Group operates in the distribution and supply chain solutions sector, providing a range of products and services through its subsidiaries Lawson, TestEquity, and Gexpro Services, with a market cap of $1.63 billion.

Operations: Distribution Solutions Group generates revenue primarily from Lawson ($463.59 million), Testequity ($782.97 million), and Gexpro Services ($402.23 million). The company saw its gross profit margin peak at 36.03% in Q1 2023, while net income margins have fluctuated, reaching a high of 1.68% in Q2 2023 before declining to -1.25% by mid-2024 due to rising costs of goods sold (COGS) and operating expenses.

PE: -78.6x

Distribution Solutions Group's recent activities highlight its potential as an undervalued small-cap stock. The company increased its borrowing capacity to US$1.06 billion, indicating strong financial maneuverability. Despite a net loss of US$3.33 million for the first half of 2024, sales grew to US$855.62 million from US$726.25 million year-over-year, showcasing revenue growth potential. Insider confidence is evident with share purchases totaling US$1.68 million in Q2 2024, suggesting belief in future prospects amidst active M&A pursuits and strategic capital allocation initiatives.

Petco Health and Wellness Company (NasdaqGS:WOOF)

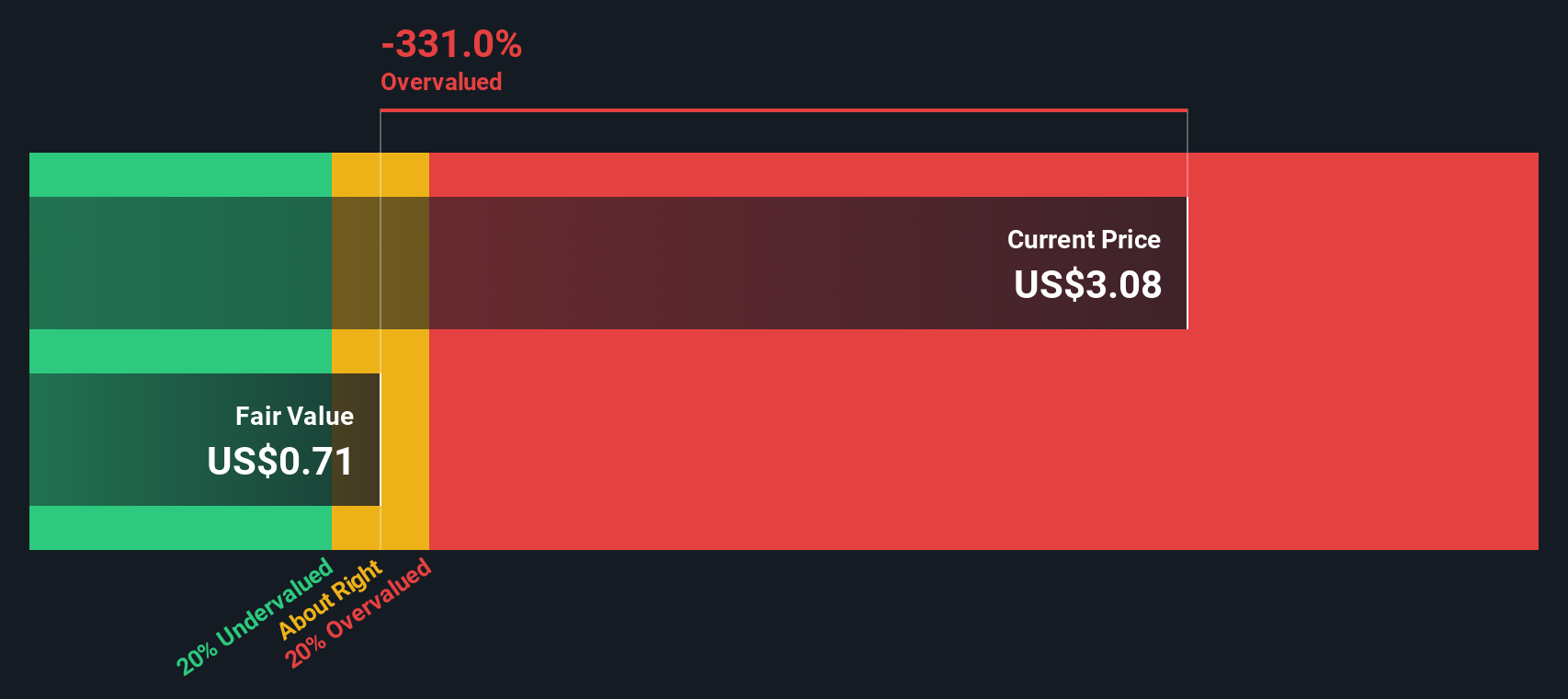

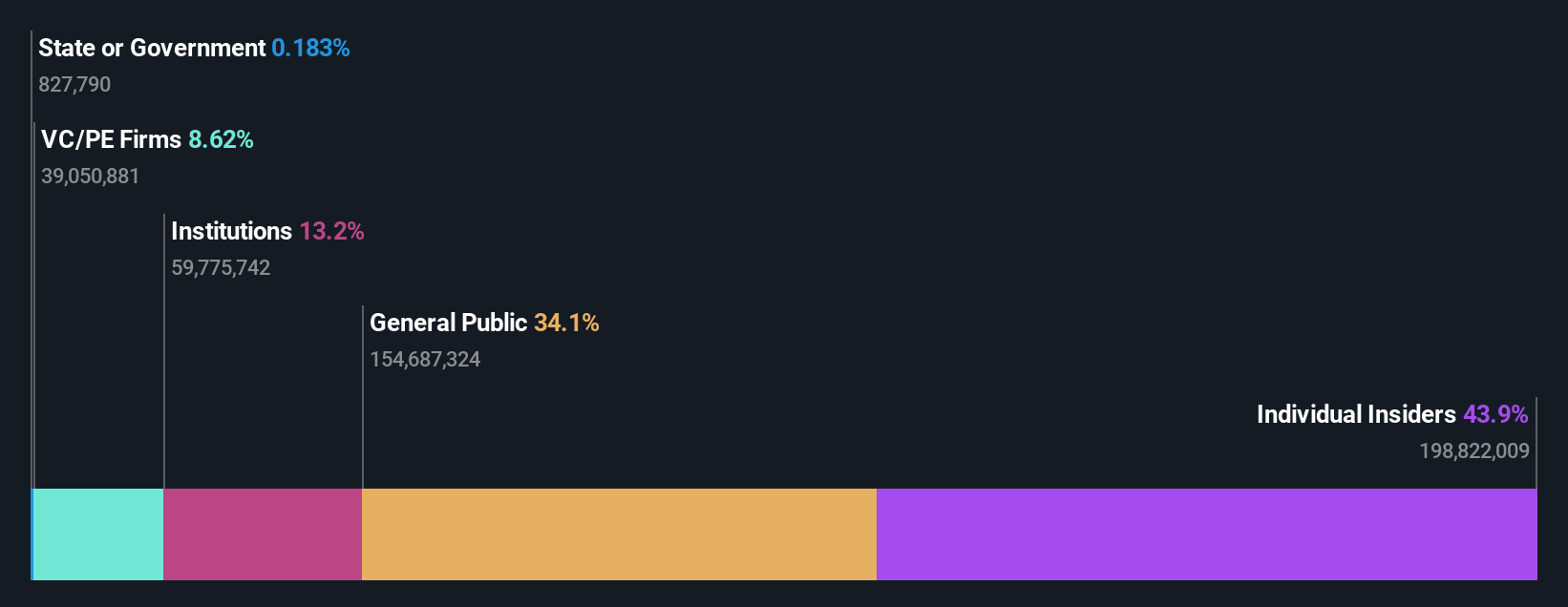

Simply Wall St Value Rating: ★★★★★☆

Overview: Petco Health and Wellness Company operates a network of pet care centers offering products, services, and veterinary care with a market cap of approximately $2.13 billion.

Operations: Petco Health and Wellness Company generates revenue primarily from its retail specialty segment, amounting to $6.23 billion. The company's gross profit margin has shown a decline from 43.37% in February 2019 to 37.38% in August 2024, while net income margins have fluctuated significantly, reaching -21.27% in the latest period.

PE: -0.6x

Petco Health and Wellness Company, a small cap stock, has been experiencing significant changes and developments. The company recently announced its Halloween Bootique and fall collections, featuring over 300 items with 90% priced under US$15, catering to various pet needs. Joel D. Anderson was appointed CEO on July 29, 2024, bringing extensive retail leadership experience from Five Below and Walmart.com. Despite being dropped from several Russell indices in July 2024, Petco was added to the Russell 2000 Value Index. Earnings forecasts indicate a projected annual growth of 128.84%.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Marksans Pharma is a pharmaceutical company engaged in the development, manufacturing, and marketing of generic pharmaceutical formulations with a market cap of approximately ₹45.32 billion.

Operations: Marksans Pharma's revenue primarily comes from its pharmaceuticals segment, which generated ₹22.68 billion in the most recent period. The company's gross profit margin has shown an upward trend, reaching 53.39% as of June 2024.

PE: 29.9x

Marksans Pharma has shown promising financial growth, with Q1 2025 revenue rising to INR 6.06 billion from INR 5.10 billion in the same period last year, and net income increasing to INR 887.52 million from INR 686.58 million. The company is actively seeking M&A opportunities to expand in Europe, indicating strategic growth plans. Insider confidence is reflected by recent share purchases within the past six months, suggesting optimism about future performance. Additionally, a recent USFDA inspection of its Goa facility concluded successfully with a Voluntary Action Indicated (VAI) classification, supporting operational credibility and compliance standards.

- Click here and access our complete valuation analysis report to understand the dynamics of Marksans Pharma.

Evaluate Marksans Pharma's historical performance by accessing our past performance report.

Taking Advantage

- Discover the full array of 200 Undervalued Small Caps With Insider Buying right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WOOF

Petco Health and Wellness Company

Operates as a health and wellness company, focuses on enhancing the lives of pets, pet parents, and its Petco partners in the United States, Mexico, and Puerto Rico.

Undervalued with moderate growth potential.